As I mentioned in my last post, there is a disturbing possibility that gold's intermediate cycle has topped, and done so in a left translated manner. For clarification, left translated cycles often lead to lower lows. In this case if gold did top on week 9 and the intermediate cycle is now in decline, then the odds are high we are going to see the June low of $1179 tested and broken before the next intermediate bottom.

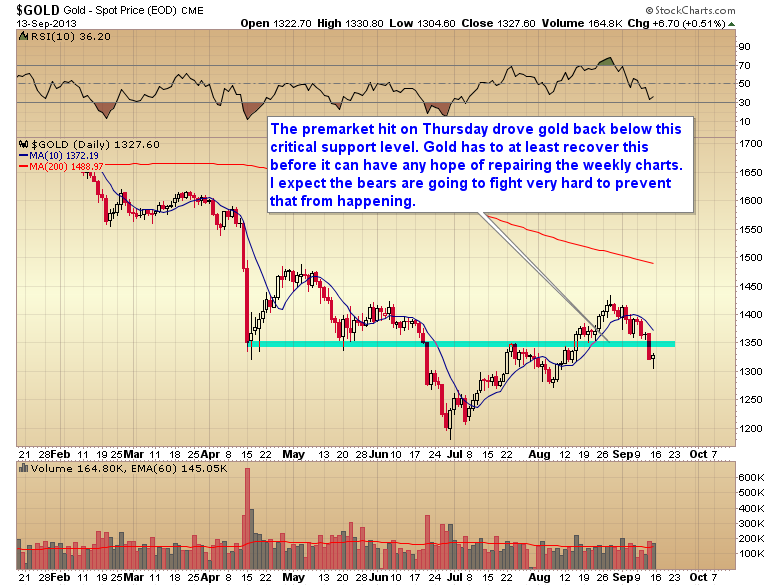

Whenever I'm not sure about direction the first thing I do is go to the weekly charts. You can see in the three charts below that the Thursday premarket hit did serious damage to the entire sector.

Just based on those three charts the sector is screaming that an intermediate top has formed. At the very least I think one has to wait until these three weekly charts are repaired before risking further long exposure to the sector. Keep in mind I'm not recommending selling short, the daily cycle is due to bounce soon, probably on the FOMC statement. But there is a strong possibility that bounce will be a fake-out to draw in another round of buyers only to reverse and head back down again.

I continue to think this is a high stakes game where big money insiders are trying to lower the starting point before the bubble phase of the gold bull begins. As I've noted before, if one can artificially lower the beginning of the bubble phase to let's say $1000 instead of where it naturally occurred last summer at $1550, then the profit potential once the bubble phase begins is dramatically magnified.

I'm convinced the force behind this is trying to drive gold back down to the prior C-wave top at $1030 before reversing course and riding the bubble phase of gold into a top somewhere above $5000. It remains to be seen if they will accomplish their goal, but they did succeed in forcing gold back below the critical $1350 support level on Thursday's premarket hit.

At this point the bulls are back on the defensive. They have to--at the very least--recover that $1350 level before they have any chance at repairing those weekly charts.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Beware, A Gold Intermediate Top Has Formed

Latest comments

Penentuan arah gold ke 1274.75 bahkan ke 1253.10 ada di 1305.25(daily stronger support) jika harga ini tembus maka mas berada di area 1200 lagi...good luck.

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.