Is Silver Ready For Liftoff?

As Janet Yellen’s dollar continues its show of relative strength, precious metals have suffered. As of yesterday morning, Silver was teetering at $17.33 an ounce. Gold slowly climbed to $1,211.80 an ounce and Platinum to over $1,258 an ounce.

Traditionally, precious metals perform with strength when global events shake equity and currency markets. In January 2000, the price of silver was $5.30 an ounce. At the close on February 14, 2012, silver was at $33.60 an ounce, a healthy return over the 12-year cycle of 534 percent, a slightly greater return than either gold or platinum. In other words, if an investor had acquired $10,000 worth of silver in January, 2000, and sold it on February 14, 2012, the investor would have collected an impressive $53,400. All this while, stocks gained an average about 18 percent.

During these years, the US dollar was rocked by the housing crisis, other economic events and the toll of the prolonged wars in Iraq and Afghanistan. US debt was steadily escalating. The dollar was laboring. Today, equity markets are still adjusting to life without Bernanke. The world is facing another Middle East conflict that could last years. The US dollar is strengthening against other currencies but if the US takes on more debt, how long can the dollar maintain current levels?

Traditionally, gold has been the standard “flight to safety” as a precious metal but silver just might be the better opportunity. Demand for silver is strong and outweighs supply. As a super conductive metal, silver has a broad base of commercial and industrial uses, much broader than gold. Silver plays an important role in many commercial and technological applications and in electronics. Investors in silver enjoy the luxury of a precious but are fully aware that there is more commercial and industrial demand than as jewelry or bullion.

Yet, with the rising dollar, silver continues to fall in value. Some investors, including myself, feel that in this $17.00 range, silver is nearing the bottom and marks a solid play. There are a number of ways to purchase silver.

- Commodity EFTs

- Stocks and Mutual Funds

- Futures and Options

- Bullion

- Certificates

If we expect the amount of US debt to rise and if the possibility of a long-term conflict lies ahead, we are building a strong case for diversification and we must consider our asset allocations. At the same time, we must acknowledge that precious metal strategies have changed as silver, platinum and palladium become more functional in manufacturing processes. These developments have seen gold, the standard flight to safety, lose some of its glitter.

Of today’s precious metals, silver is the most attractive. In 2013, the US experienced a shortage of American Silver Eagles from the mint as well as shortages in the availability of junk silver. Indeed, many investors are actually holding their silver the way some investor hold gold.

Meanwhile, commercial demand continues to rise. This increases the value of gold when and if the economy ever fully recovers from the recession. At that time, silver will be in greater demand than ever as more technology and electronic advances will rely on the super conducting metal for an even wider number of manufactured goods.

Today, approximately $1 billion of silver is used by industry annually. This does not include silver used in technology or as jewelry. Dentists and nanotechnology help to build a case for silver, even if there is not a global crisis ahead. To this equation, add the price of silver, which looks to be near its bottom. Investing in silver looks to have sustainable potential.

ProShares UltraShort Silver

ProShares UltraShort Silver (ARCA:ZSL) is a pro-active and aggressive ETF that has performed well over the last 52 weeks. With a 52-week low of 65.93 and a 52-week high of 111.81, ZSL has been the most successful silver ETF over the last year. As CapitalCube’s ETF profile indicates, “ProShares UltraShort Silver seeks daily investment results before fees and expenses that correspond to twice (200) the inverse (opposite) of the daily performance of silver bullion as measured by the U.S. Dollar fixing price for delivery in London,” ProShares UltraShort Silver has prospered with the recent downtrend in silver prices.

Interestingly, most silver ETFs are now holding more silver than at any time in history even as some analysts project price declines to around $15.00.

The decline is silver prices has served ZSL well. As other silver ETFs have struggled, ZSL is up 37.549 percent this year and gained a hefty 22.006 percent in the last month. ZSL is leveraged 2 to 1 against silver and with the tightening of the dollar against the yen and the euro, silver prices have slipped, making ZSL a winner. But, will the dollar stay strong?

iShares Silver Trust

Investors who think not might prefer iShares Silver Trust (ARCA:SLV), whose performance mirrors recent declines in silver prices. Down 20.688 percent this year and off 9.881 percent over the last 30 days, SLV represents an opportunity for those investors who think the dollar will weaken in the face of world events. As CapitalCube notes, the price of SLV shares is a direct representation of the value of silver held by the trust, which continues to acquire the precious metal.

Interestingly, when the US began its renewed bombing campaign in Syria on September 23rd, silver began to show signs of recovery from a prolonged, multi-year slump. If you believe there is a correlation between US military action and silver prices, then SLV might be your silver investment.

Silver Wheaton Corporation

Following the same trajectory as SLV are mining shares like Silver Wheaton Corporation (NYSE:SLW). Closing at 21.79 Monday, SLW is off 16.99 percent in the last 30 days. Over 52 weeks, shares have fluctuated between $20 and $30. One benefit of this issue is that Capital Cube shows a high quality dividend of 1.62 percent at the current share price.

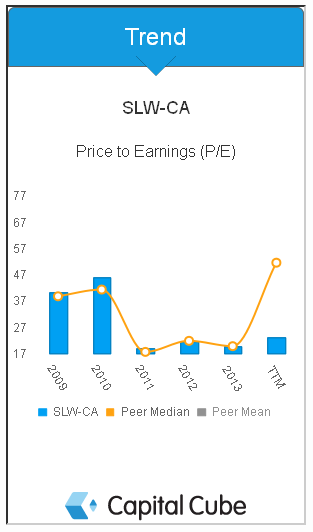

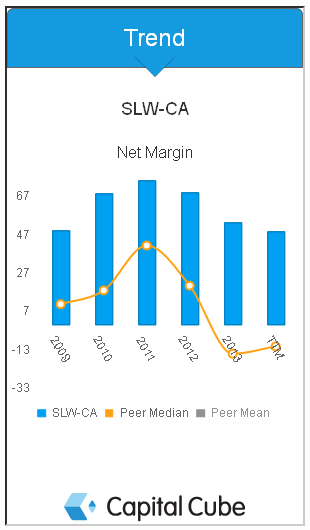

SLW has other interesting trends. Current PE is well below peer median (54.39). Both gross and net margins are exemplary compared to peers.

The same is true for the company’s operating and pre-tax margins. SLW’s ROE and ROA figures are also encouraging. The company is well positioned to profit with a rise in silver prices.

If owning shares of a silver mining company has more appeal than investing in a silver ETF, SLW runs a tight ship. With any silver investment, your bet is that the dollar will weaken and that the US is headed for a mid to long term conflict. If you are like me, you agree this seems to be where we are headed and silver is a commodity asset that we should own.

Disclosure: The views and opinions expressed above are those of the author and do not necessarily reflect the views of CapitalCube.com, AnalytixInsight, Inc., its affiliates, or its employees. Disclaimer