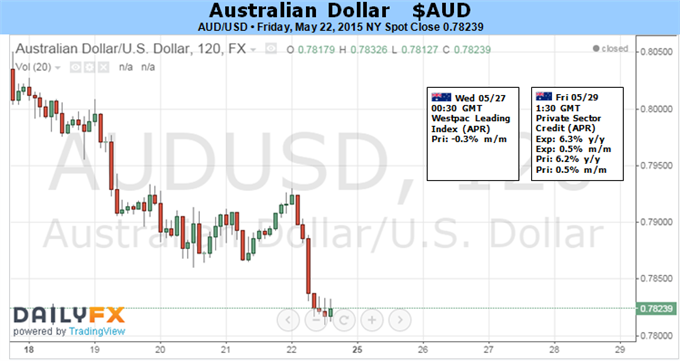

Fundamental Forecast for the Australian Dollar: Neutral

- Jitters Ahead of Key US News Undermined Aussie Recovery Last Week

- Fading RBA Rate Cut Bets, US GDP Revision May Reboot AUD Gains

- Find Key Inflection Points for the Australian Dollar with DailyFX SSI

The Australian Dollar turned lower last week, breaking the win streak against its US counterpart established in early April. As we suspected, the move appeared to reflect repositioning ahead of the release of minutes from last month’s FOMC meeting and April’s CPI report.

Tellingly, supportive comments from RBA Deputy Governor Lowe as well as minutes from May’s RBA meeting failed to underpin the Aussie despite implying that the central bank is in no hurry to cut interest rates further. Meanwhile, the greenback launched a broad-based recovery against all of its top counterparts including AUD, presumably amid bargain-hunting after five consecutive weeks of losses on the off-chance that either FOMC rhetoric or a pop in price growth might fuel rebuilding Fed rate hike speculation.

As it happened, the greenback lost momentum once event risk passed. The Fed minutes’ explicit unwillingness to dismiss the June FOMC meeting as a possible time to raise rates sounded hawkish compared with priced-in market expectations pointing toward tightening late in the fourth quarter. Still, the markets cut short the greenback’s recovery once the coast cleared for continued profit-taking on pro-USD positions that began after speculative net-long exposure hit a record high in March.

The stock of formative event risk looks relatively thin in the week ahead. Australia’s data docket doesn’t seem to feature anything capable of meaningfully derailing the evolution of RBA policy bets, where the path of least resistance favors a shift from dovish end of the spectrum toward a more neutral setting. Similarly, a US calendar shortened by the Memorial Day holiday is populated with primarily second-tier releases.

A revised set of first-quarter US GDP figures expected to bring a sharp downward revision marks a break in the monotony. The report is expected to show that output shrank 0.9 percent in the first three months of the year, marking a stark contrast with the already sub-par 0.2 percent increase initially reported. While the BEA last week acknowledged a “residual seasonality” distortion that has produced unduly soft first-quarter GDP readings for some years, the admission won’t mean dismal readings boost Fed tightening (it will perhaps just limit negative fallout for USD).

On balance, this seems to suggest that after last week’s respite, the broad-based counter trend reversal playing out across the G10 FX space in the second quarter may resume. The Aussie is set to resume its recovery in such a scenario as the range of anti-USD majors retrace, waiting for Janet Yellen and company to signal the onset of stimulus withdrawal so explicitly as to reboot the benchmark currency’s long-term advance. The mid-June meeting still seems like the time to do so, but there is ample time left in the interim.