AUD/USD Weekly" title="AUD/USD Weekly" height="452" width="1000">

AUD/USD Weekly" title="AUD/USD Weekly" height="452" width="1000">

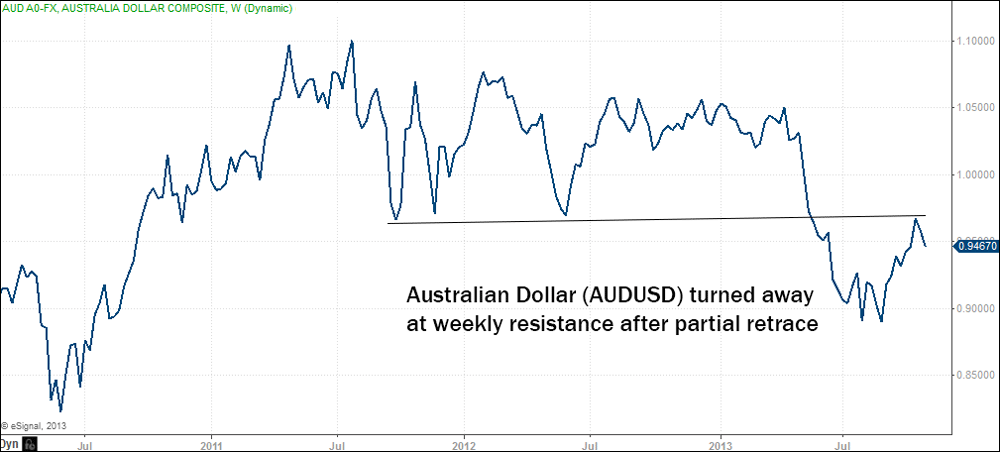

Whither the Australian dollar? After a multi-month rally on improved China sentiment and a sharply declining US dollar, the Aussie has been turned away at weekly resistance levels.

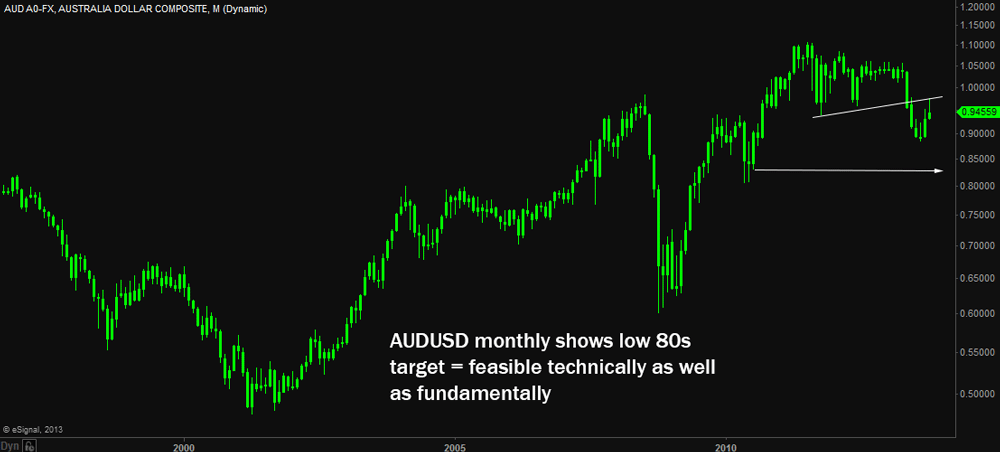

Fresh prospects for a China growth slowdown, a mean reversion strengthening of the US dollar, and continued problems within the Australian economy could all point to a continuation of a new long-term downtrend, visible on the AUD/USD monthly chart (below). AUD/USD Monthly" title="AUD/USD Monthly" height="452" width="1000">

AUD/USD Monthly" title="AUD/USD Monthly" height="452" width="1000">

For Reserve Bank of Australia (RBA) governor Glenn Stevens, the only thing separating the Aussie dollar from a “materially lower” exchange rate is the Fed’s enactment of “tapering” (a tightening of stimulus measures long since hinted at, but not yet enacted).

Given China’s increasingly volatile (and questionable) demand for Australian iron ore and coal, and the RBA’s willingness to take cash rates to all-time lows, “significantly lower” could mean the Aussie settling out at 2010 lows around 0.82, far below Thursday’s 0.95.

If you want a reason for the Aussie dollar’s strength over the last five years, look no further than Chinese demand for Australian iron and coal. More so than any other country, Australia has been the big winner in China’s booming demand for commodities.

Earlier this year, however, China’s shift to what the IMF expects to be permanently lower growth rates finally weighed on Australian miners’ profits and dragged the Aussie dollar lower, to the 0.90 area, after trading above parity with the US dollar for the better part of the last two years.

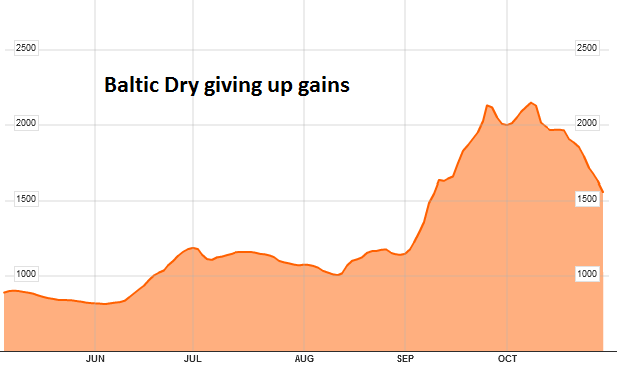

Rumblings of renewed Chinese growth helped push the Aussie dollar back up to 0.98 this fall. But China’s renewed demand for commodities has a great deal more to do with a rush to restock port inventories at low commodity prices than a true turnaround in industrial production.

As of this writing, dry bulk freight rates have been declining for nine days straight, as Chinese iron ore importers sit on cheap inventory they had rushed to buy during the last two months.

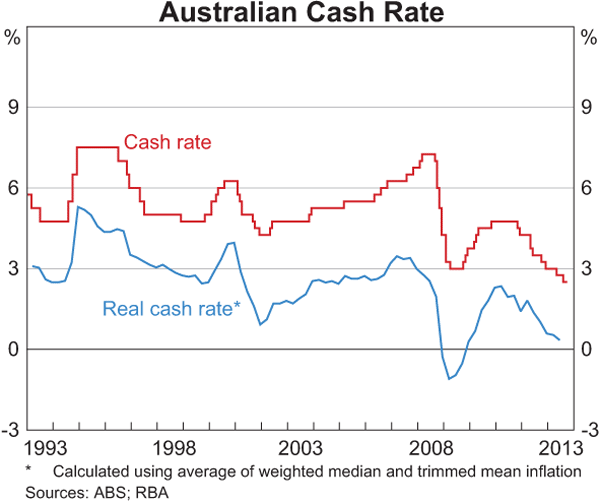

The RBA’s response to Chinese slowdown has been textbook monetary easing. Governor Stevens has cut the RBA’s cash rate to all-time lows of 2.5% in response to growing concerns. Low interest rates are sending already frothy housing prices in Sydney and Melbourne to even riskier levels, however, and the RBA has expressed reluctance to cut interest rates further.

Still, Governor Stevens has moved to talk the Aussie dollar down, saying in essence “surely the taper will come” — a reference to US monetary policy — with the implication that the strong Aussie will find some relief in declining from “unusually high” levels once the greenback strengthens.

While the RBA is well aware it cannot fight the Fed any more than other financial players can, the Fed’s effective decision to taper (when it comes) should mark the “beginning of a return to something resembling more normal conditions” according to Governor Stevens. A tapering Fed will likely make US yields more competitive vs Australian yields, weigh on commodity prices, and give the RBA more or less what it wants: a “materially lower” Aussie dollar, with trajectory potential into the low 80s.

As properly functioning markets act as forward discounting mechanisms, it is also possible the Aussie resumes its big picture downtrend well before any actual “tapering” occurs. The extent of concern over China’s rebound — quite possibly more artificial than real — could further weigh on AUDUSD independent of Federal Reserve actions. Last but not least, economic fallout from an imploding Australian housing bubble, once it pops in earnest, could lead the RBA to get more aggressive in its easing stance.

A multi-month Australian dollar short was one of our strongest trades of the year thus far, as we caught the bulk of the move from $1.02 to the $0.90 level. We are now watching and waiting for potential fresh entry points as the big picture (monthly) Aussie trend looks set to continue.

Disclosure: This content is general info only, not to be taken as investment advice. Click here for disclaimer

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Australian Dollar Could Be Headed For Low 80s

Published 11/01/2013, 03:14 AM

Updated 07/09/2023, 06:31 AM

Australian Dollar Could Be Headed For Low 80s

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.