Fundamental Forecast for the Australian Dollar: Neutral

- Aussie Dollar at Risk on Rebuilding 2015 Fed Rate Hike Speculation

- RBA to Hold Rates But Dovish Rhetoric May Signal Rate Cuts Ahead

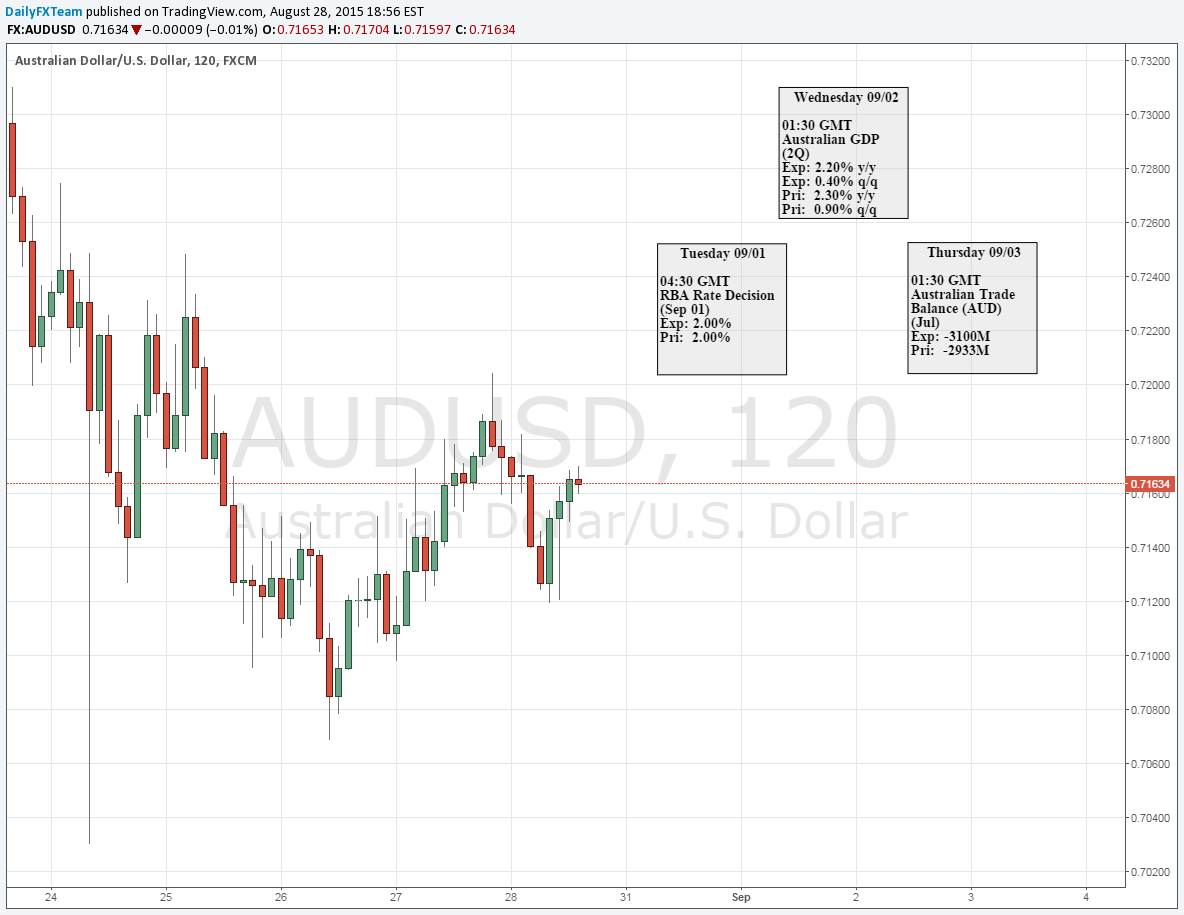

Domestic and overseas monetary policy expectations will be firmly in focus for the Australian dollar in the week ahead. News-flow from the central bank symposium at Jackson Hole, Wyoming over the weekend will set the tone before the weekly trading open. A much-anticipated speech from Federal Reserve Vice Chair Stanley Fischer will help shape speculation about the likelihood of an interest rate hike at next month’s meeting of the FOMC policy-setting committee.

Speaking in an interview with CNBC on Friday, Fischer pushed back against the notion that recent market volatility has conclusively taken a hike at next month’s sit-down off the table. While he acknowledged that the central bank is mindful of external developments, Fischer downplayed spillover risk from stress in China while talking up US employment and inflation trends. The Vice Chair added that while a final decision will depend on incoming data over the next two weeks – seemingly nodding to next week’s payrolls figures – the case for September liftoff had been “pretty strong” if not “conclusive” before the latest round of risk aversion.

The markets took notice, with priced-in bets on the timing of the first step toward tightening soaring into the weekend. Fed funds futures once again reflect expectations of an increase in October having shown investors abandoning faith in a hike at any point in 2015 as recently as Monday of last week. A hawkish speech from Mr Fischer over the weekend coupled with a firm result on Augusts’ US jobs report may shift the timeline further forward. Consensus forecasts call for a 220,000 payrolls increase, marking a slight pickup from July. Leading survey data reinforces the likelihood of a supportive outcome, pointing to strong hiring trends in the service sector, which accounts for three quarters of the US labor force.

Meanwhile on the home front, the RBA will deliver its monitory policy announcement. As with the Fed, the downturn in market sentiment over recent weeks has rekindled speculation that Governor Glenn Stevens and company will cut rates at least once over the coming 12 months. The priced-in probability of a move at this meeting is at 31 percent however, suggesting the baseline scenario favors standstill. This means traders will look for a directional catalyst in the text of the policy statement and the extent to which it telegraphs a dovish shift in officials’ outlook.

On balance, the reintroduction of near-term Fed tightening risk poses a two-pronged threat to the Aussie dollar, first on the basis of an adverse shift in expected yield differentials and second via sentiment trends in the event that nearing stimulus withdrawal fuels risk aversion. An accommodative turn in RBA rhetoric stands to compound selling pressure. Needless to say, a surprise interest rate cut would only make matters worse. The currency stalled after spiking to a six-year low against its US counterpart early last week, but downside follow-through may be just around the corner.