AUD/USD has posted slight losses on Thursday, as the pair trades in the low-0.94 range early in the North American session. Looking at today's releases, US Unemployment Claims sparkled, dropping to their lowest level in over eight years. However, New Home Sales dropped sharply in June, well shy of the forecast. There are no Australian releases on Thursday.

Unemployment Claims tumbled last week, as the key indicator fell to 298 thousand, its lowest level since February 2008. This surprised the markets, which had expected a reading of 301 thousand. The strong release continues a string of solid employment data, and the dollar could get a boost from the good news. As well, good news on the employment front is bound to increase speculation about a rate increase by the Federal Reserve.

US housing data was dismal on Thursday, as New Home Sales slumped to a three-month low. The key indicator fell to 406 thousand, compared to 504 thousand in the previous release. The markets were way off in their forecast, with an estimate of 485 thousand. There was much better news earlier in the week, as Existing Home Sales jumped to 5.04 million, surpassing the estimate of 4.94 million. This was the best showing we've seen since October,

The Australian dollar continues to trade at high levels and received a boost on Wednesday as CPI posted a gain of 0.5% in Q2, matching the estimate. However, there is room for concern as CPI gains continue to decrease, dating back to Q3 of 2013, when the index jumped 1.2%. There was good news from Trimmed CPI, which excludes volatile items that are included in CPI. The index posted a strong gain of 0.8% in Q2, also matching the forecast.

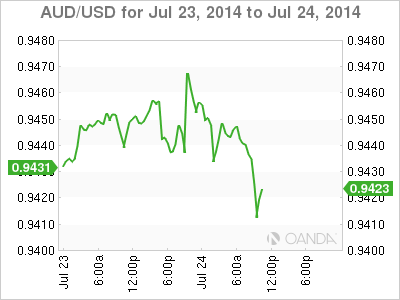

AUD/USD July 24 at 14:15 GMT

- AUD/USD 0.9425 H: 0.9470 L: 0.9412

AUD/USD Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.9119 | 0.9229 | 0.9361 | 0.9446 | 0.9617 | 0.9757 |

- AUD/USD touched a high of 0.9479 in the Asian session, but was unable to consolidate at that level and has lost ground in the European and North American sessions.

- 0.9361 continues to provide strong support for the pair.

- 0.9446 remains a weak resistance line and saw action earlier in the day. This is followed by strong resistance at 0.9617.

Further levels in both directions:

- Below: 0.9361, 0.9229, 0.9119 and 0.9000

- Above: 0.9446, 0.9617, 0.9757 and 0.9842

OANDA's Open Positions Ratio

AUD/USD ratio is pointing to gains in short positions on Thursday, continuing the trend which has marked the ratio for most of the week. This is consistent with the movement of the pair, as the Australian dollar has posted slight losses. The ratio has a majority of short positions, indicative of trader bias towards the US dollar continuing to move to higher ground.

AUD/USD Fundamentals

- 12:30 US Unemployment Claims. Estimate 310K. Actual 298K.

- 13:45 US Flash Manufacturing PMI. Estimate 57.5 points.

- 14:00 US New Home Sales. Estimate 485K. Actual 406K.

- 14:30 US Natural Gas Storage. Estimate 95B. Actual 90B.

* Key releases are highlighted in bold

*All release times are GMT