AUD/USD has edged lower on Tuesday, as the pair trades at 0.7550. On the release front, Australian Building Approvals posted a sharp gain of 11.3%. In the US, today’s highlight is CB Consumer Confidence. The indicator is expected to remain steady, with a forecast of 97.2 points. On Wednesday, the US will release two key events – ADP Nonfarm Employment Change and Pending Home Sales.

Australian Building Approvals were red-hot in July, surging 11.3 percent. This crushed the forecast of 1.2 percent and marked the strongest gain since December 2013. However, the Australian dollar has failed to gain ground on the greenback on Tuesday. The strong release was welcome news from the construction sector, which had posted some weak numbers recently. On Sunday, HIA Home Sales plunged 9.7% in July, more than offsetting a gain of 8.2% a month earlier. Last week, Construction Work Done came in at -3.7% in the second quarter, compared to an estimate of -1.9%. The indicator has managed just one gain in the past nine quarters, pointing to ongoing weakness in the construction industry. The RBA will be in the spotlight next week, as the bank holds its monthly policy meeting on September 7. The markets are expecting the benchmark interest rate to remain unchanged at 1.50%.

The Aussie is trading close to 4-week lows, courtesy of Janet Yellen’s speech at the Jackson Hole on Friday. The Fed chair’s message to the markets was clearly upbeat, as she stated the case for a rate increase had “strengthened in recent months”. Yellen noted that the economy was close to maximum employment, inflation was steady, and consumer spending remained solid. At the same time, Yellen did not provide any timeline on a rate hike nor did she spell out what the Fed wants to see before pressing the rate trigger. On Friday, Fed members Dennis Lockhart and Stanley Fischer both came out in favor of two rate hikes in 2016, and these comments helped the dollar record broad gains on Friday. The Fed’s stance has raised the odds of a rate move according to the CME FedWatch tool, with a September hike priced at 30% in September and 57% for a December hike. However, given that any move by the Fed will be data-dependent, US numbers ahead of the Fed policy meeting on September 21 could significantly change the rate outlook.

AUD/USD Fundamentals

Monday (August 29)

- 21:30 Australian Building Approvals. Estimate 1.2%. Actual 11.3%

Tuesday (August 30)

- 9:00 US S&P/CS Composite-20 HPI. Estimate 5.1%

- 10:00 US CB Consumer Confidence. Estimate 97.2

- 21:00 RBA Assistant Governor Guy Debelle Speaks

- 21:30 Australian Private Sector Credit. Estimate 0.4%

Wednesday (August 31)

- 8:15 US ADP Non-Farm Employment Change. Estimate 173K

- 10:00 US Pending Home Sales. Estimate 0.7%

- 19:30 Australian AIG Manufacturing Index

- 21:30 Australian Private Capital Expenditure. Estimate -4.0%

- 21:30 Australian Retail Sales. Estimate 0.3%

*All release times are EDT

* Key events are in bold

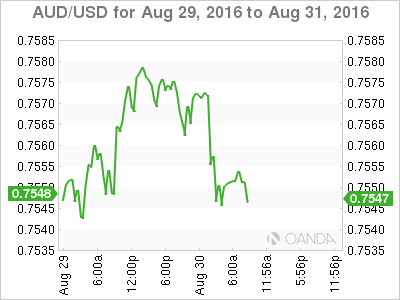

AUD/USD for Tuesday, August 30, 2016

AUD/USD August 30 at 8:10 EDT

Open: 0.7575 High: 0.7580 Low: 0.7542 Close: 0.7553

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.7200 | 0.7339 | 0.7440 | 0.7560 | 0.7701 | 0.7835 |

- AUD/USD was flat in the Asian session and has posted slight losses in European trade

- 0.7440 is a strong resistance line

- 0.7560 remains fluid and is currently a weak resistance line

- Current range: 0.7440 to 0.7560

Further levels in both directions:

- Below: 0.7440, 0.7339 and 0.7200

- Above: 0.7560, 0.7701, 0.7835 and 0.7938

OANDA’s Open Positions Ratio

AUD/USD ratio is unchanged on Tuesday, current with a lack of significant movement from AUD/USD. Long positions have a small majority (52%), indicative of slight trader towards AUD/USD reversing directions and moving higher.