The AUD/USD has edged lower and is trading slightly above the 0.94 line in Monday trading. It’s a very quiet start to the new trading week, with just one minor release out of the US. There are no Australian releases today. In the US, the government shutdown continues into its sixth day, with no end in sight to the crisis.

The US government shutdown will be a week old on Tuesday, and there is no progress to report out of Washington. Democrats and Republicans continue to play the blame game as the government remains paralyzed without funds to operate. Republicans had demanded that the Democrats delay implementation of the 2010 health care act, known as Obamacare, before agreeing to pass a budget. The Democrats have refused, saying the budget must first be passed before any discussions can be held. There are increasing concerns that a prolonged shutdown will hurt the US economy. If the shutdown does continue, we could see some instability in the markets this week and the US dollar, which is already under strong pressure, could lose ground.

The media and markets continue to focus on the shutdown, which has paralyzed the US government for close to a week. However, a potentially devastating crisis is creeping up – the debt ceiling. The US has a debt worth $16.7 trillion, and will run out of funds to service the debt by October 17, unless Congress authorizes raising the debt ceiling. Otherwise, the US could potentially default on its obligations, which could cause chaos in the domestic and international markets. Over the weekend, Republican House Speaker John Boehner seems to have hardened his position, saying that the Republicans would not raise the debt ceiling without a “serious conversation” about what is driving the debt to such high levels. This statement (threat?) has irked the Democrats and will do little to soothe jittery markets.

There was a lot of expectation that the Federal Reserve would taper QE in September, and the markets were caught by surprise when the Fed balked and maintained the levels of the bond-buying program at $85 billion/mth. However, things have changed dramatically in the past few weeks, with the budget deadlock in Washington, as well as growing fears about a debt ceiling crisis. Even if both of these issues were to be resolved quickly, the distortions and delays in key economic data will make it difficult for the Fed to have an accurate, up-to-date picture of the US economy. This will likely rule out any decision to taper QE before the end of the year. AUD/USD" border="0" height="300" width="400">

AUD/USD" border="0" height="300" width="400">

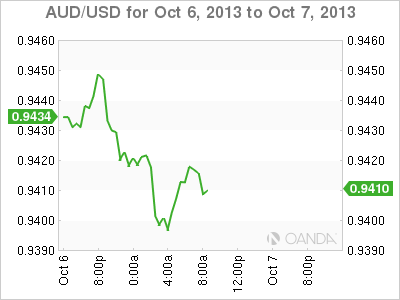

AUD/USD October 7 at 11:50 GMT

AUD/USD 0.9416 H: 0.9450 L: 0.9388

AUD/USD Technical" title="AUD/USD Technical" src="https://d1-invdn-com.akamaized.net/content/pic3c09d4bbd464efcee8cf54e8e12adfee.png" height="73" width="591">

- AUD/USD is trading quietly on Monday, slightly above the 0.94 line.

- The pair faces resistance at 0.9508. This is followed by a resistance line at 0.9613.

- On the downside, the pair continues to receive support at the round number of 0.9400. This is a weak line which could face pressure if the Australian dollar loses ground. There is stronger support at 0.9328.

- Current range: 0.9328 to 0.9400

Further levels in both directions:

- Below: 0.9400, 0.9328, 0.9221, 0.9135 and 0.9089

- Above: 0.9508, 0.9613, 0.9700 and 0.9821

OANDA’s Open Positions Ratio

The AUD/USD is pointing to movement towards long positions in Monday trading. This is not reflective of the pair’s current movement, as the US dollar has edged higher against the Aussie.

The pair has edged lower and is trading slightly above the 0.94 line. With no major economic releases on Monday, we can expect an uneventful North American session.

AUD/USD Fundamentals

- 19:00 US Consumer Credit. Estimate 12.6B

*Key releases are highlighted in bold

*All release times are GMT

Original post