The Australian dollar is almost unchanged on Friday, as the pair trades slightly above the 0.72 line. On the release front, The US will release two key indicators – Preliminary GDP and UoM Consumer Sentiment. As well, Fed chair Janet Yellen will deliver remarks at an event in Boston. There are no Australian releases on Friday. Traders should be prepared for possible volatility from AUD/USD in the North American session.

First quarter numbers out of the US have been mixed, so Preliminary GDP, which can be treated viewed as an economic report card, will be closely monitored on Friday. Final GDP for the fourth quarter came in at 0.5%, shy of the estimate of 0.7%. The estimate for Preliminary GDP stands at 0.8%, and if the indicator matches or beats this reading, the US dollar could push upwards. The markets also have strong expectations for the UoM Consumer Sentiment report, with an estimate of 95.7 points. In April, this key consumer confidence indicator dipped to 89.0 points, marking the first reading below the symbolic 90 level since November 2014.

Australian releases have been struggling this week, but the Australian dollar has managed to hold its own, trading at the 0.72 level. Construction Work Done, an important construction indicator, declined 2.6% in the first quarter, marking a third consecutive quarter of contraction. This was followed by a very soft Private Capital Expenditure, which is also published every quarter. The indicator came in at -5.2%, compared to an estimate of -3.2%. With the RBA holding a policy meeting on June 7, key economic data will play an important role as to whether the RBA cuts rates for a second straight month or remains on the sidelines.

The Fed minutes have renewed speculation that the Fed may press the rate trigger in June, and this has bolstered the US dollar. The minutes were more hawkish than expected, resulting in strong volatility in the currency markets. Odds of a rate hike in June increased to 40% earlier this week, compared to just 4% one week ago. Still, the Fed will be hard-pressed to raise rates if key indicators don’t show improvement, particularly inflation numbers.

On Monday, FOMC member John Williams reiterated that he expected the Fed to raise rates two or three times in 2016. However, there appears to be a gap between the hawkish message some FOMC members are sending out and market sentiment, as many analysts are projecting only one rate hike this year. The guessing game as to what the Fed has in mind is likely to continue into June, but it’s safe to say that another rate move will be data-dependent, so stronger US numbers will increase the likelihood of a quarter-point hike at the June policy meeting.

Janet Yellen’s speech on Friday will be closely watched. Will she reinforce the hawkish tone of her FOMC colleagues, or well she dampen growing enthusiasm about a June move?

AUD/USD Fundamentals

Friday (May 27)

- Day 2 – G7 Meetings

- 8:30 US Preliminary GDP. Estimate 0.8%

- 8:30 US Preliminary GDP Price Index. Estimate 0.7%

- 10:00 US Revised UoM Consumer Sentiment. Estimate 95.7

- 10:00 US Revised UoM Inflation Expectations

- 13:15 US Fed Chair Janet Yellen Speaks

*Key releases are highlighted in bold

*All release times are EDT

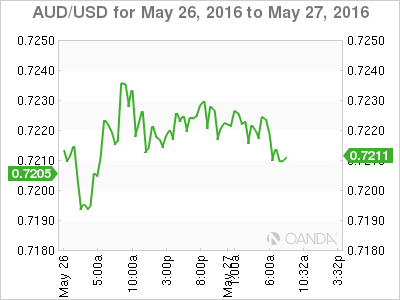

AUD/USD for Friday, May 27, 2016

AUD/USD May 27 at 9:15 EDT

Open: 0.7225 Low: 0.7207 High: 0.7235 Close: 0.7210

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6916 | 0.7049 | 0.7160 | 0.7251 | 0.7339 | 0.7472 |

- AUD/USD posted limited movement in the Asian and European sessions

- 0.7160 is providing support

- There is resistance at 0.7251

- Current range: 0.7160 to 0.7251

Further levels in both directions:

- Below: 0.7160, 0.7049, 0.6916 and 0.6843

- Above: 0.7251, 0.7339 and 0.7472

OANDA’s Open Positions Ratio

AUD/USD ratio is almost unchanged on Friday, consistent with the lack of movement from AUD/USD. Long positions have a strong majority (64%), indicative of trader bias towards AUD/USD breaking out and moving higher.