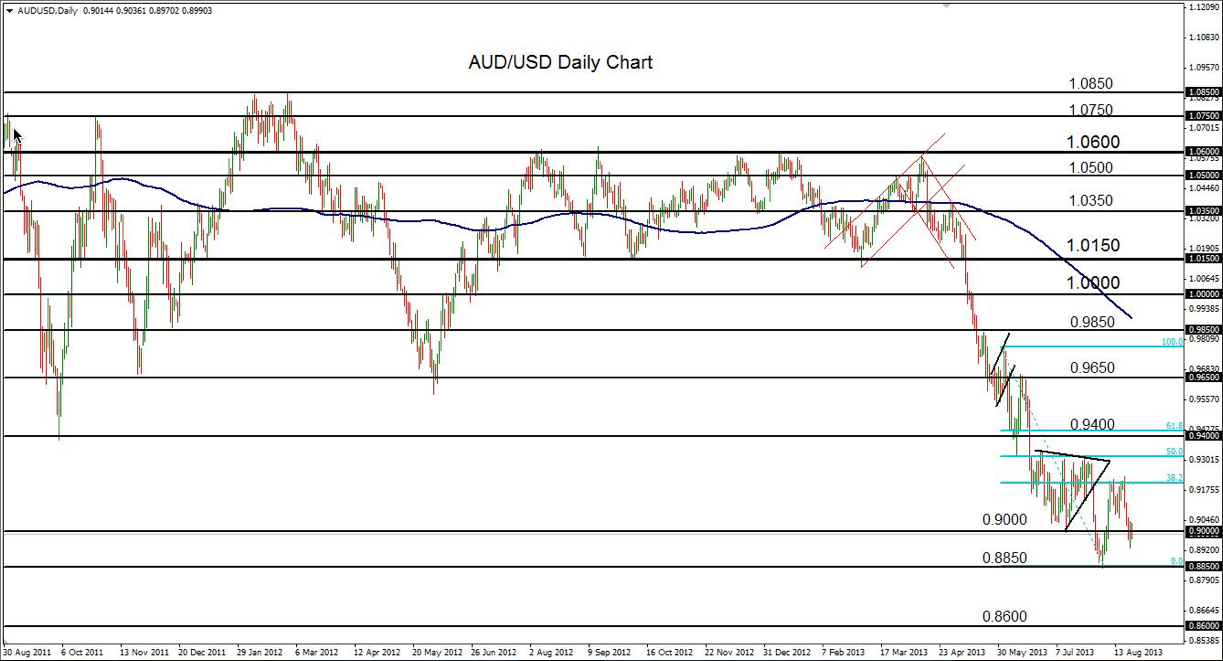

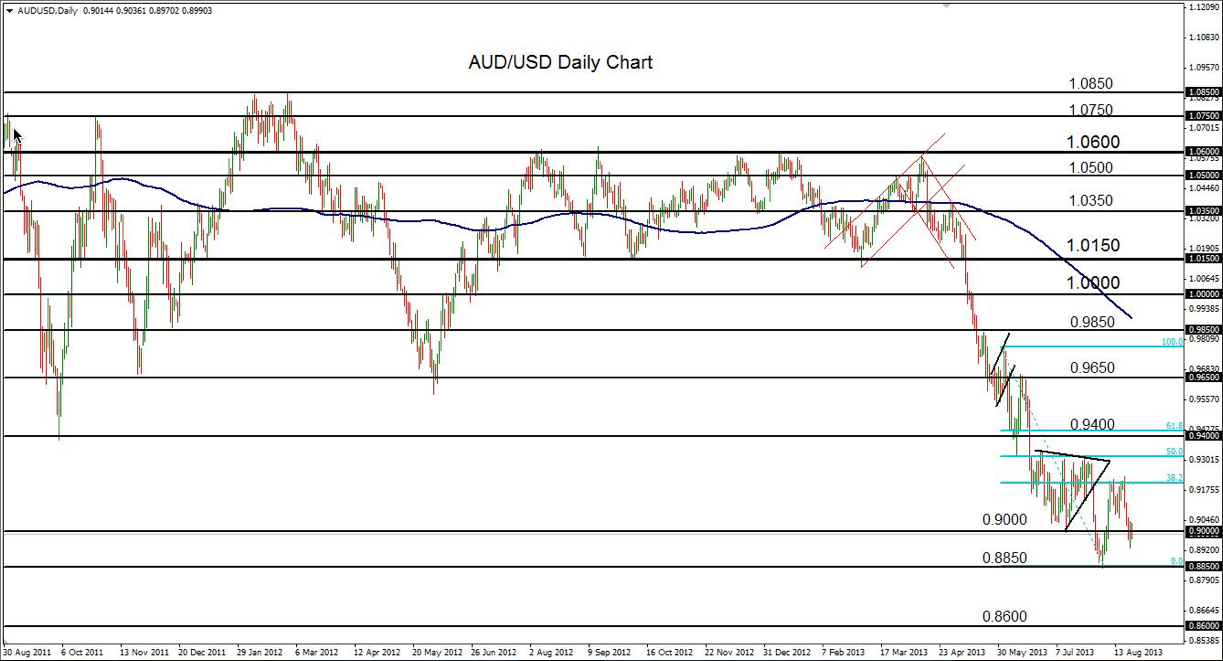

The AUD/USD (daily chart) has sustained its slide of the past several days to dip below the key 0.9000 psychological level and approach a resumption of the strong bearish trend that has been in place since the April high near 1.0600. The past several weeks have seen an upside correction that hit a high of 0.9232, but that correction was rather minor and short-lived within the context of the much larger bearish trend. The key downside level to watch continues to be major support at 0.8850, which is not only a strong historical support/resistance level but is also the pivotal long-term low that was hit in early August before the upside correction. A breakdown below 0.8850 would confirm a continuation of the four-month plunging trend. In this event, a key intermediate support objective to the downside resides around the 0.8600 level.

AUD/USD: Daily" width="1223" height="661" />

AUD/USD: Daily" width="1223" height="661" />

AUD/USD: Daily" width="1223" height="661" />

AUD/USD: Daily" width="1223" height="661" />