The Australian dollar is almost unchanged on Monday, as the pair trades slightly below the 0.72 line. On the release front, Australian HIA Home Sales and Company Operating Profits both posted sharp declines of 4.7%.

US markets are closed for Memorial Day, so there are no US releases. Due to the holiday, we can expect light trade on Monday. On Tuesday, the US releases CB Consumer Confidence and Australia will release GDP.

Australian releases started off the week on a sour note. HIA Home Sales declined 4.7% in April, compared to a sharp gain of 8.9% in the previous month. Company Operating Profits, an important business indicator, also slipped 4.7% in the first quarter, well of the estimate of +0.5%. This marked the indicator’s third decline in the past four releases.

The Aussie hasn’t reacted to the dismal numbers, as it trades close to the 0.72 level.

Australia will release GDP on Tuesday, with the estimate for the first quarter report standing at 0.6%. With the RBA making a rate announcement on June 7, the GDP report could have a strong impact as to whether the RBA lowers interest rates next week.

On Friday, the US released Preliminary GDP for the first quarter. The key indicator, which can be viewed as an economic report card, posted a gain of 0.8%, matching the forecast. This was an improvement above Advanced GDP, which came in at 0.5%.

Still, the economy slowed down considerably compared to the fourth quarter of 2015. The export sector has been hurt by the strong US dollar and weak global demand. Oil prices remain low, which has taken a sharp toll on the oil industry.

Elsewhere, the UoM Consumer Sentiment report improved in April, climbing to 94.7 points. This marked the indicator’s highest level in 11 months, although it was short of the estimate of 95.7 points. The US dollar responded positively to these releases and posted gains against the Aussie.

The Fed minutes and comments from Fed chair Janet Yellen have renewed speculation that the Fed may press the rate trigger this summer, and this has bolstered the US dollar. The minutes were more hawkish than expected, resulting in strong volatility in the currency markets. Odds of a rate hike in June have sharply increased, but the Fed will be hard-pressed to raise rates if key indicators don’t show improvement, particularly inflation numbers.

On Monday, FOMC member John Williams reiterated that he expected the Fed to raise rates two or three times in 2016. However, there appears to be a gap between the hawkish message some FOMC members are sending out and market sentiment, as many analysts are projecting only one rate hike this year.

The guessing game as to what the Fed has in mind is likely to continue into June, but it’s safe to say that another rate move will be data-dependent, so stronger US numbers will increase the likelihood of a quarter-point hike at the June policy meeting.

AUD/USD Fundamentals

Sunday (May 29)

- 21:00 Australian HIA New Home Sales. Actual -4.7%

- 21:30 Australian Company Operating Profits. Estimate 0.5%. Actual -4.7%

Monday (May 30)

- 21:30 Australian Building Approvals. Estimate -2.8%

- 21:30 Australian Current Account. Estimate -19.3B

- 21:30 Australian Private Sector Credit. Estimate 0.5%

Tuesday (May 31)

- 10:00 US CB Consumer Confidence. Estimate 96.1

- 21:30 Australian GDP. Estimate 0.6%

*Key releases are highlighted in bold

*All release times are EDT

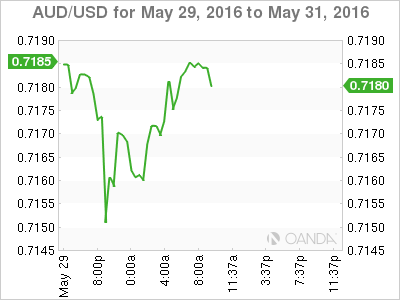

AUD/USD for Monday, May 30, 2016

AUD/USD May 30 at 9:00 EDT

Open: 0.7178 Low: 0.7148 High: 0.7187 Close: 0.7182

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.6916 | 0.7049 | 0.7160 | 0.7251 | 0.7339 | 0.7472 |

- AUD/USD posted small losses in the Asian session but has recovered in European trade

- 0.7160 was tested in support earlier and could break during the North American session

- There is resistance at 0.7251

- Current range: 0.7160 to 0.7251

Further levels in both directions:

- Below: 0.7160, 0.7049, 0.6916 and 0.6843

- Above: 0.7251, 0.7339 and 0.7472

OANDA’s Open Positions Ratio

AUD/USD ratio is unchanged on Monday, consistent with the lack of movement from AUD/USD. Long positions have a strong majority (64%), indicative of trader bias towards AUD/USD breaking out and moving higher.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.