Both the RBA and RBNZ will be announcing interest rates in the coming fortnight and speculation is mounting over what the two central banks will do. Whilst both governors have expressed a willingness to ease, NZ’s Graeme Wheeler will likely be the first and only governor to move on rates. A number of factors will be influencing Wheeler’s decision, key amongst them will be the RBA’s response to a lower NZ OCR.

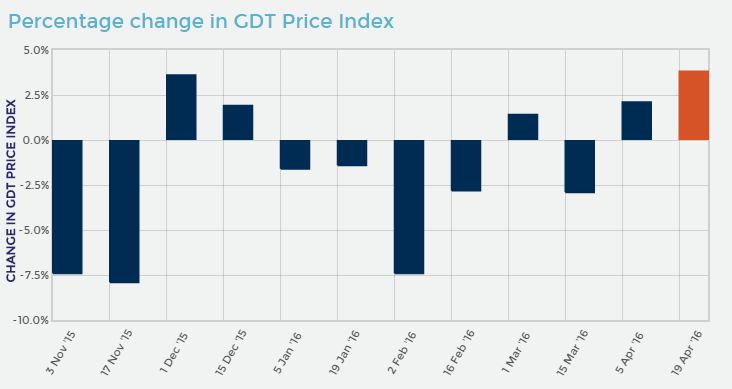

Firstly, it is important to understand why there is such a high probability of Wheeler cutting the OCR below the current 2.25% rate. One major factor is the poor global dairy trade (GDT) prices index results that have been predominating for the past few months. As a result of this year’s net reduction in the NZ milk powder price, the nation’s primary export sector has been struggling to stay afloat. Consequently, depreciating the NZD dollar to help support the economy’s main export sector remains a potent policy tool which the RBNZ is sure to be eyeing. Moreover, Wheeler has already patently stated that the country can expect to see the historically low OCR rate drop further in the coming year. Additionally, NZ inflation is currently well below the required 1-3% target level. As a result, the central bank should be dropping rates anyway in an attempt to fulfil its mandate, in addition to buoying the struggling dairy sector.

Whilst a rate cut to stimulate NZ exports remains likely, it could ultimately be undone by a subsequent cut across the Tasman. Consequently, Wheeler will be cautious of lowering the OCR if the RBA looks likely to drop rates. Recently, RBA governor Stevens has been questioning the strong Aussie Dollar and cites falling commodity prices as a reason for caution. However, unlike New Zealand, Australia’s major export has been making significant price gains this year. Specifically, iron ore has shot up almost 45% since January which could soften Stevens’ scrutiny of the higher AUD. As a result of Stevens’ reduced incentive to cut rates, The RBNZ may want to capitalise on pushing the AUD/NZD pair higher to maximise Australian importing power.

Maximising Australian purchasing power is especially important for New Zealand dairy and the economy as a whole. Australia represents New Zealand’s largest export market, having a total two-way trade value of $23,467M AUD in 2014. Consequently, pushing the AUD/NZD higher generates a significant increase in demand for New Zealand dairy exports. This makes monetary intervention an especially powerful tool to stimulate export demand for the country. Given the potency of intervention, it would appear a rate cut is almost certain in the coming announcement.

However, some might argue that cutting rates in New Zealand will incentivise the RBA to follow suit and cut its own rates to protect exporting sectors. Fortunately for Wheeler, NZ is a minor blip for Australian exporters as the small nation represents the sixth largest export market for the Aussies. The AUD23,467M New Zealand trade relationship pales in comparison to the AUD152,468M relationship with China. Consequently, the RBA is unlikely to take a reactionary rate cut following an NZ OCR change. In addition, as China maintains a managed peg for the yuan, the changing of Australian interest rates has a muted effect in stimulating export demand.

Ultimately, New Zealand needs a cut to the OCR and it is likely to occur in the coming announcement. The combination of low global dairy prices and low inflation are forcing the hand of the RBNZ and there seems little doubt that the central bank will intervene. Additionally, Australia is unlikely to follow the NZ example and as a result, Graeme Wheeler can discount any effect a reactionary RBA rate cut might have. Going forward, we can expect to see the AUD/NZD push past the 1.1371 zone of resistance as the RBNZ seeks to bail out the dairy industry once again.