Chances are you don’t think about the commodity markets when you swing by your local café and order your regular, but perhaps you should. Both coffee and milk prices have falling significantly over the past several months thanks to oversupply and a lack of demand in both commodities. The bottom line is: things are going to get better for the consumer.

Coffee saw a spike in prices last year as the fear of a drought wiping out the Brazilian crop sent coffee buyers scrambling to secure their future supply. That pushed coffee prices as high as $2.25 per pound, but prices have fallen to their current level ($1.27 per pound for September futures) thanks to conditions in Brazil proving to be more optimal this season. There has been plenty of rain in the right places in Brazil which is forecast to increase production as high as 52.4m 60kg bags.

The slide in the Brazilian Real (BRL) has also helped to keep coffee futures down thanks to Brazil producing the world’s largest coffee crop. Prices are quoted in US dollar and farmers are paid in Reals making Brazilian exports more competitive.

The demand side of coffee has quite a bit to do with it too. Some analysts are concerned that roasters are working their way through the stockpiles bought up last year during the drought. The economic troubles in Europe and China are also having an effect on demand and things could get worse for China especially. Demand in the US has also tailed off as many people buy machines for their homes that use coffee more efficiently for one cup rather than filtering a whole pot.

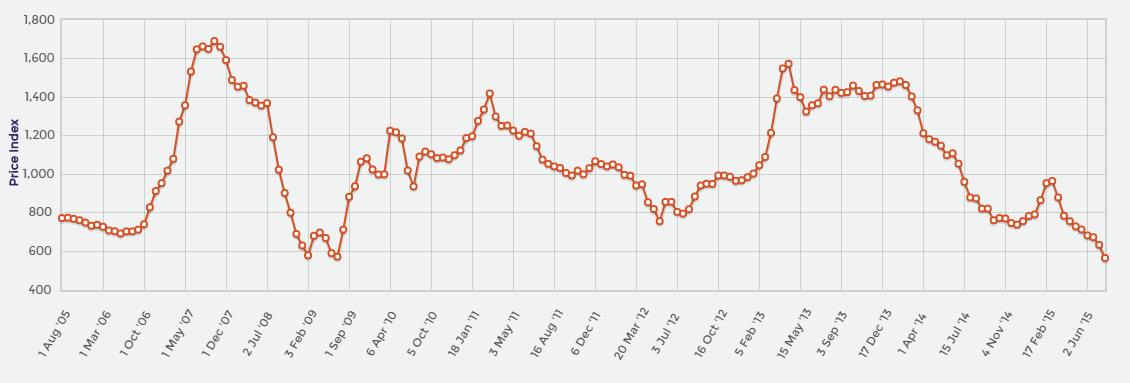

Milk, the other main ingredient in your morning latte, has taken a pummelling over the course of the year, falling to a five year low. Excess supply, especially out of New Zealand, which is the world’s largest producer and dairy accounts for over 30% of exports, has been met head on with a lack of demand. The ramp up in prices over the last five years led many farmers to turn to dairy for better returns. There are even reports of dairies in the US dumping milk because of a record supply this year.

China is New Zealand’s largest export market and buys the majority of its whole milk powder. The economic wobbles in China have seen stocks of milk powder piling up leading to a lack of demand in the dairy auctions.Demand is unlikely to pick up any time soon in China, leading many to forecast low dairy prices until the end of the year.

The two main ingredients in your morning coffee have seen some large price falls over the course of 2015. The fundamental oversupply in both markets will reduce the input costs in your cup, so maybe it’s time to negotiate a better deal with your barista.