The Jerome Levy Forecasting Center generated media attention recently with a new forecast of a 65% probability of a global recession next year, a contraction that will lead to a US downturn by the end of 2015. “Clearly the direction of most of the recent global economic news suggests movement toward a 2015 downturn,” the center’s chairman advised on Oct. 23 via Bloomberg. The reasoning is that balance-sheet excesses in the developed world threaten to drum up another financial crisis—a crisis that central banks will be hard-pressed to address because monetary stimulus is already in high gear and so there’s minimal capacity for juicing the economy with new liquidity.

Levy’s dark outlook is plausible, but it could easily be wrong. The old game of looking for demons by assuming that x will lead to y, which will trigger z at some unknown point down the road is a mug’s game. Considering what could happen can be useful, of course, but mostly as an intellectual exercise. You can’t squeeze blood out of a stone, however, and even brilliant models can’t see around corners.

Warning that a global recession is coming sometime next year, which will push the US off the business-cycle cliff soon after, is sure to create a buzz among the usual suspects. And maybe that’s the point. The problem, of course, is that this is still just guesswork in no trivial degree. Sophisticated guessing, perhaps, but any economic forecast much beyond two or three months moves into the realm of argumentum ad ignorantiam.

History doesn’t look kindly on long-range macro predictions for an obvious reason: there are too many moving and uncertain parts that drive the economic trend to paint a clear picture of what may happen six or 12 months down the road. That doesn’t seem to discourage anyone from dispensing a regular stream of bold claims. But modeling economic activity beyond the immediate future is an exercise in futility. That doesn’t mean you shouldn’t make informed guesses about what could happen, but such efforts deserve the proper labeling, along the lines of: Warning, the enclosed forecast is really our warm and fuzzy best-guess and the prediction may be harmful to your financial health.

What’s the alternative? Analyzing the data in hand and estimating the implied trend for the very near future – nowcasting. If reliability, at least in relative terms, is your goal, there’s really no choice other than to spend a lot of time with the published numbers and modeling the implications for, say, the next month or two. If you’re also looking for timely signals (who isn’t?), it’s essential to re-rerun the analysis as new data arrives. A daily frequency may be overkill at times, but weekly is prudent.

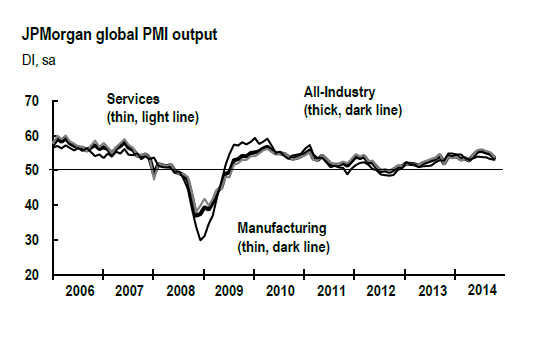

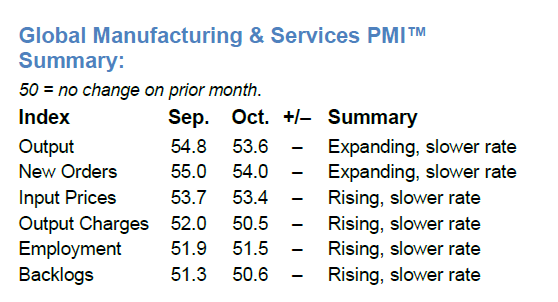

On that note, what does the data tell us these days about the global economy? “The start of the final quarter saw global economic growth slow for the third straight month,” noted last week’s press release for the October update of the J.P.Morgan Global Manufacturing & Services Purchasing Managers Index (PMI).

Digging into the PMI numbers shows a mixed bag of growth rates, although it’s still clear that an expansionary bias remains intact.

The US, by the way, is expanding at a stronger rate vs. the global economy, according to last month’s manufacturing and services PMIs. The US trend also looks encouraging across a broad set of economic indicators.

Is there a risk that the global economy could stumble and take a toll on the US? Yes, of course. But that’s a risk that’s been around for a while. Arguably it’s a risk that’s on the rise, but it’s far from clear that this goose is cooked. The soft global trend could turn out to be noise… again. It wouldn’t be the first time that growth withered only to speed up. Will this time be different? Maybe. But until the numbers tell us so, in a clear and convincing degree, warning that there’s a new recession brewing—sometime next year—is little more than a guess based on assumptions of far-off events that are beyond the grasp of mere mortals in the here and now.