Earnings season in the biotech sector started on a positive note with Amgen (NASDAQ:AMGN) (AMGN - Analyst Report) reporting better-than-expected first quarter 2015 results. Meanwhile, The Medicines Co. (MDCO - Analyst Report) received some good news with an FDA advisory panel backing its antiplatelet agent. However, companies like Athersys (ATHX - Snapshot Report) and Ampio suffered setbacks on the pipeline front.

Recap of the Week’s Most Important Stories

1. Amgen kicked off 2015 on a strong note with both earnings and revenues surpassing expectations. Earnings were driven by higher revenues and lower operating expenses. The strong first quarter 2015 results led to the company to raise its earnings guidance for the year significantly.

We are positive on the company’s restructuring plan, which should make it leaner and more cost-efficient. This will be an important year on the pipeline and regulatory front as well. However, the company does have some competitive challenges in store for 2015, including the entry of biosimilar competition for Neupogen.

2. The FDA’s advisory panel voted in favor of approving The Medicines Co.’s intravenous antiplatelet agent, Kengreal. With the panel giving a positive vote, chances of Kengreal getting approved by Jun 23 look high. The product is already approved in the EU (Read more: The Medicines Co.'s Kengreal Backed for FDA Approval).

3. Athersys suffered a pipeline setback with its stem cell treatment failing to fare better than placebo in in a mid-stage study conducted in patients who suffered an ischemic stroke. Shares were down on the interim results (Read more: Athersys Slumps as MultiStem Fails in Mid-Stage Study).

4. Another company that suffered a pipeline setback is Ampio - the company’s experimental pain treatment, Ampion, failed to achieve the primary endpoint in a late-stage study (STRIDE study AP008). Shares were down significantly on the news (Read more: Ampio Plunges as STRIDE Study on Ampion Fails).

5. Alnylam (ALNY - Analyst Report) presented promising 12-month data from an ongoing mid-stage study on patisiran. Patisiran is being evaluated for the treatment of transthyretin (TTR)-mediated amyloidosis (ATTR amyloidosis) in patients with familial amyloidotic polyneuropathy (FAP). Results showed a decrease (2.5 point) in modified Neuropathy Impairment Score as well as a sustained knockdown in mean serum TTR at the 80% target level. According to the company, the results support the hypothesis that neuropathy progression in patients with FAP can be halted with TTR knockdown.

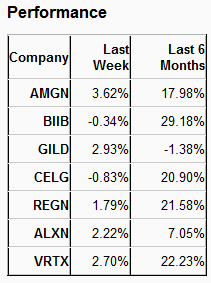

Over the last five trading days, Amgen was the highest gainer (3.62%) among major biotechs, while Celgene (NASDAQ:CELG) declined 0.83%. Biogen (NASDAQ:BIIB) was the highest gainer (29.18%) over the last six months. Gilead (GILD - Analyst Report) lost 1.38% during this period.

The NASDAQ Biotechnology Index was up 2.1% over the last five trading days (See the last biotech stock roundup here: Favorable Briefing Documents for MDCO's Kengreal, Alexion Soliris Label Update).

What's Next in the Biotech World?

Later this week, companies like AbbVie (ABBV - Analyst Report) and Biogen (BIIB - Analyst Report) will be reporting first quarter results. Amgen also has an important regulatory event coming up with an FDA advisory panel expected to review its regulatory application for its experimental melanoma talimogene laherparepvec on Apr 29.