GROWTHACES.COM Trading Positions:

- USD/JPY: long at 104.90, target 108.00, stop-loss 106.50

- GBP/USD: long at 1.6220, target 1.6400, stop-loss 1.6130

- EUR/USD: long at 1.2920, target 1.3100, stop-loss 1.2830

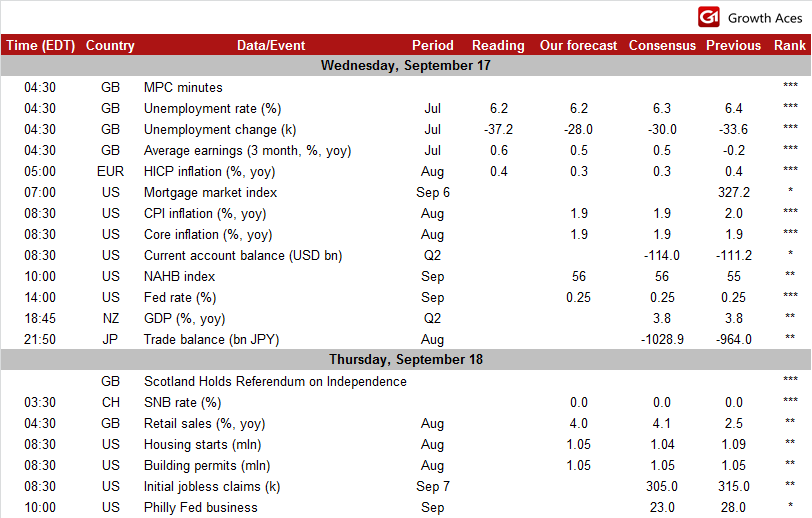

ECONOMIC CALENDAR

EUR/USD: Fed in the limelight

(bullish in the medium term)

- Investors are focused on the Fed meeting today. The Fed needs to decide whether to maintain a pledge to keep near-zero rates in place for a "considerable time" after its bond-buying stimulus program ends. With the central bank set to reduce its monthly purchases to USD 15 bn this month, the program will likely end in October. The Fed will release an update of its economic projections, which, for the first time, will include the FOMC members’ projections for 2017.

- The USD came under pressure on Tuesday after the Wall Street Journal said the Fed may keep the words "considerable time" in its policy statement. As we said yesterday the market had largely priced in a more hawkish statement suggesting shorter period between the end of quantitative easing and the start of tightening cycle.

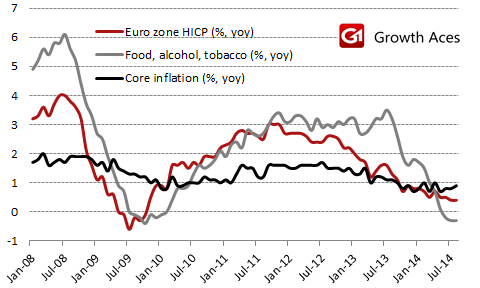

- Euro zone inflation in August was higher than initially estimated and amounted to 0.1% mom and 0.4% yoy (initial estimate of 0.3% yoy). Rises in prices in restaurants and cafes, rents and more costly car repairs had the biggest upward impact on the yoy inflation, while cheaper fuel, fruit and phone calls exerted the biggest downward pull.

- French Prime Minister Manuel Valls headed off a revolt against his government on Tuesday, winning a confidence vote .The vote tally showed 269 deputies backed Valls with 244 against. As expected, 32 in his Socialist Party abstained in protest at plans to make EUR 50 bn of public spending cuts in the next three years while easing taxes for business.

- The EUR/USD raised yesterday to 1.2995 on dovish turn in Fed expectations but then eased back in the area of 1.2660. The EUR/USD is likely to consolidate ahead of the FOMC decision. If the Fed decides not to change its dovish language the USD will likely depreciate strongly. We should watch also Fed forecasts. We keep our long position and stay bullish in the medium term.

Significant technical analysis' levels:

Resistance: 1.2966 (hourly high Sep 16), 1.2995 (high Sep 16), 1.3030 (recovery high Sep 4)

Support: 1.2922 (low Sep 16), 1.2908 (low Sep 15), 1.2897 (low Sep 11)

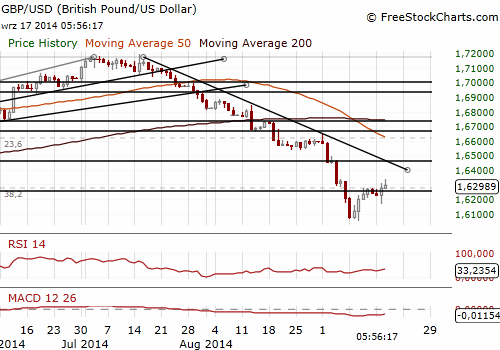

GBP/USD: Higher volatility ahead of Scottish referendum

(still long, looking to raise the target)

- Minutes of the BoE Monetary Policy Committee's September 3-4 meeting showed that external members Martin Weale and Ian McCafferty voted to raise interest rates by 25 bps, but the rest of their colleagues remained firmly against tighter policy. The MPC said that it was concerned that temporary weakness in the euro zone could turn into a prolonged period, and revive worries about the solvency of some euro zone governments.

- The MPC also took increased interest in the growth of unit labour costs rather than official wage growth figures. In the opinion of the MPC unit labour costs are important for the inflation outlook, but for now, unit labour cost growth was well below rates that could trigger inflation pressure. The September minutes revealed that the key difference between the hawks and doves in the MPC was the assessment of wage growth.

- The BoE's staff revised up their forecast for Q3 growth to 0.9% but saw early signs of possible slowdown in Q4.

- Office for National Statistics released the data for unemployment and average earnings. The number of unemployed fell in August by 37.2k vs. a fall by 37.4k in July and the median forecast of 30k. Unemployment rate in the May-July period went down to 6.2%, in line with the forecast of GrowthAces.com and slightly below the market consensus of 6.3%. Growth in average weekly earnings was slightly higher than expected (0.6% 3-month yoy through July vs. forecast of 0.5% yoy and a fall by 0.1% in the previous month).

- Three surveys - from pollsters ICM, Opinium and Survation - showed support for Scottish independence at 48% compared to 52% backing union. The fact that supporters of the union were ahead in the polls prompted investors to buy the GBP.

- The GBP/USD recovered from Tuesday’s low of 1.6162. The GBP rally became considerably more rapid after the Wall Street Journal said the Fed may keep the words "considerable time" in its policy statement (which means a more dovish statement than expected). The GBP/USD hit its highest since September 5 today at 1.6337 shortly after monthly unemployment and wages figures came in better than expected but then retreated.

- GrowthAces.com keeps its long position on the GBP/USD. We do not exclude raising the target in case of further GBP appreciation.

Significant technical analysis' levels:

Resistance: 1.6340 (high Sep 5), 1.6349 (50% of 1.6645-1.6052), 1.6358 (recovery high Sep 4)

Support: 1.6244 (10-dma), 1.6162 (low Sep 16), 1.6052 (low Sep 10)

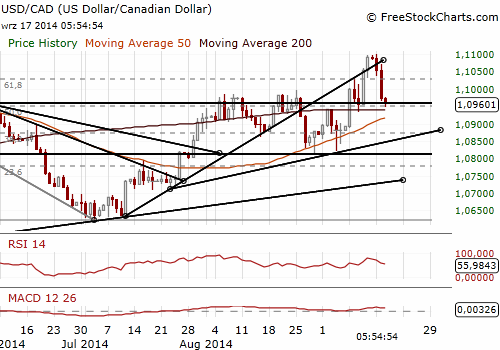

USD/CAD fell strongly despite dovish comments from BOC

(USD/CAD reached our stop-loss at 1.0980 yesterday)

- Bank of Canada Governor Stephen Poloz said recent Canadian economic data had been encouraging, particularly on exports. He pointed to a substantial amount of slack in the job market.

- His remarks followed a speech in which he said the central bank does not try to manipulate the value of the Canadian dollar or even guide currency markets. He said: “The interest rates in Canada are already 1%, that's already quite a bit above what the U.S. rate is. So there is some room to talk about where we should be going when the time is right and when the rest of the macro story is coming together.” He made clear the Bank of Canada would not feel compelled to match eventual US rate hikes if the Canadian economy is not ready for such moves.

- In our opinion the speech was dovish and left the impression that the central bank is in no hurry to shift out of its officially neutral policy, which means its next interest-rate move could be either a hike or a cut.

- Canadian factory sales rose by a higher-than-expected 2.5% in July from June (the median forecast was 1.0%). Motor vehicle sales increased by 11.6%, and aerospace by 12.2%. The inventory-to-sales ratio was the lowest also since June 2012 and amounted to 1.33 in July vs. 1.36 in June.

- The CAD strengthened against the USD on Tuesday after data showed factory sales rose strongly in July. Despite dovish speech from Bank of Canada Governor Stephen Poloz the CAD continued its rally against the greenback.

- GrowthAces.com went long yesterday on the USD/CAD at 1.1040 but the rate broke below the 10-dma, reached our stop-loss at 1.0980 and is falling further during today’s session. The USD/CAD is going to test another significant support level at 1.0938 (30-dma).

Significant technical analysis' levels:

Resistance: 1.1072 (high Sep 16), 1.1100 (high Sep 15), 1.1106 (high Mar 27)

Support: 1.0938 (30-dma), 1.0934 (low Sep 10), 1.0881 (low Sep 8)