We are not too perturbed by the decline in stock prices of almost all the major carriers over the past week. We believe that this is part of the year-end market correction. The NYSE ARCA Airline index was down 5.7% over the period.

We believe that fundamentals of the industry remain strong and stocks in the airline space should gain over the long-term. We expect oil prices to remain weak as we enter into 2015, thereby benefiting carriers. Notably, fuel costs account for a major chunk of an airline's operating expenses.

Delta Air Lines (Delta Air Lines Inc (NYSE:DAL)) attracted attention during the past week with the encouraging long-term outlook, driven by collapsing oil prices, at its investor day. The carrier was also in the news when it announced a new five-tiered seating scheme to further improve its top line.

Apart from that, headlines were dominated by Southwest Airlines Co.’s (NYSE:LUV)) decision to expand internationally. To attain this objective, the low-cost carrier has sought approval from the U.S. Department of Transportation to fly to six Latin American destinations from Houston’s Hobby airport.

Senator Charles Schumer’s demand for a federal investigation into expensive ticket prices despite weak oil prices also grabbed headlines. He has also asked for an investigation whether mergers have contributed to the high prices by limiting competition.

Recap of the Week’s Most Important Stories

1. In a bid to boost its top line, improve customer satisfaction and convenience and counter competition, Delta Air Lines has announced that it will introduce a new five-tiered seating plan from Mar 1, 2015. This will replace the existing basic first class and coach seating schemes.

The carrier also announced at its investor day that it expects a net benefit of $1.7 billion in 2015 from falling fuel prices. Delta expects to grow system capacity by about 2% in 2015. The carrier projects a pretax profit in excess of $5 billion in 2015, up from the $4.5 billion forecasted in 2014. Pretax income was only $1.9 billion in 2013. Additionally operating margin in the range of 11.5% to 12.5% is projected for the fourth quarter of 2014.

Furthermore the carrier expects earnings per share to grow in the range of 10% to 15% after 2014 (long term growth). Operating margin over the long-term is projected in the range of 11%-14%.

Moreover, Delta extended its credit card deal with American Express Company (AXP). Following the extension, Delta will continue as the card-accepting merchant and a participant in the Membership Rewards program with American Express.

2. In a bid to expand international operations and improve customer convenience, U.S.-based low cost carrier Southwest Airlines has sought approval from the U.S. Department of Transportation to fly to six Latin American destinations from Houston’s Hobby airport. The news impacted the stock positively (read more: Southwest Airlines Up on Big International Expansion Plans).

3. United Airlines – the wholly owned subsidiary of United Continental Holdings, Inc. (NYSE:UAL) – intends to launch additional flights to Shanghai and Chengdu in China. The expansion can be seen as a move intended to meet air-travel demand which shoots up during the summer travel season (read more: United Airlines to Add More Flights to China for Summer 2015).

4. Senator Charles Schumer has questioned the logic behind air tickets being expensive despite plummeting crude prices. The senator has asked the Department of Justice and the Department of Transportation to investigate into this apparent abnormality as fuel costs account for a significant chunk of an airline's operating expense.

5. Republic Airways Holdings Inc. (NASDAQ:RJET) was also in the news during the week when it amended its Capacity Purchase Agreement with Delta Air Lines to operate nine more 69-seat E170 aircraft. The planes under the amended agreement will become operational between the third quarter of 2015 and the second quarter of 2016. Each plane will operate for six years. Moreover, the carriers extended the terms of the deal pertaining to 14 E170 aircraft by four years (through Oct 2021) and the 16 E175 aircraft by five years (through Feb 2024).

Performance

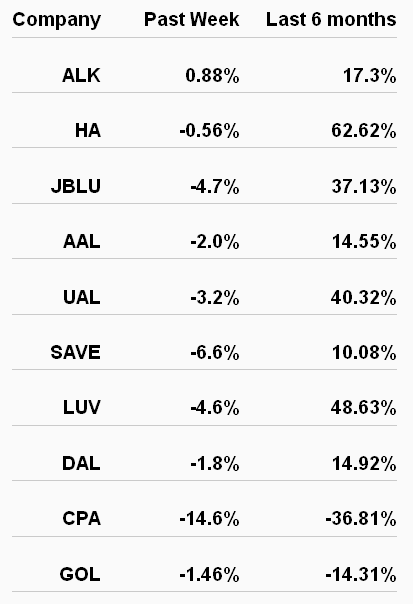

The following table shows the price movement of the major airline players over the past week and during the last 6 months.

The share prices of all the carriers baring Alaska Air Group (NYSE:ALK) declined during the past week which we believe is due to overall market contraction as a part of the year-end correction. Latin American carrier Copa Holdings SA (NYSE:CPA) was the biggest loser in the period with its shares declining 14.6% in the period. However, over the last 6 months, most carriers have traded in the green. Hawaiian Holdings, Inc. (NASDAQ:HA) witnessed the highest upside (62.62%) over the last six months compared to its peers.

What’s Next in the Airline Biz?

With nothing specific lined up in the coming days, stay tuned for the usual news releases. Moreover, it will be interesting to see whether there is any further update on senator Charles Schumer’s call to investigate the cause behind expensive air tickets despite falling oil prices.