Agilent Technologies Inc. (NYSE:A) recently announced the public offering of $300 million aggregate principal amount of senior notes. The notes carry an interest rate of 3.050% and are slated for maturity in 2026. The offering will be closed on Sep 22, 2016 on compliance with customary closing conditions.

Agilent plans to use the proceeds from this offering to initially repay all amounts outstanding under its revolving credit facility. The remaining proceeds will thereafter be used for general corporate purposes.

BNP Paribas (PA:BNPP) Securities Corp., Citigroup (NYSE:C) Global Markets Inc. and Credit Suisse (SIX:CSGN) Securities (USA) LLC will act as joint book-running managers for the offering.

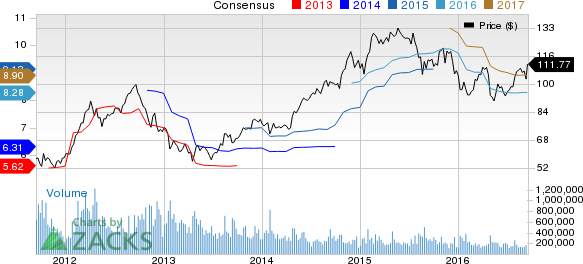

Agilent Technologies is a broad-based OEM of test and measurement equipment. The company reported decent fiscal third-quarter 2016 results, with the bottom line surpassing the Zacks Consensus Estimate while the top line matching the same.

Exiting the fiscal third quarter, Agilent had cash and short-term investments of approximately $2.20 billion against $2.14 billion in the previous quarter. The company’s long-term debt was $1.65 billion at the end of the quarter. Cash flow from operations was roughly $194 million and capex was $24 million.

We believe that the company has a strong balance sheet, which will help it to capitalize on investment opportunities and pursue strategic acquisitions, further improving its growth prospects. Moreover, we believe that the senior notes offering will bring down the company’s cost of capital, thus strengthening its balance sheet and supporting growth.

Currently, Agilent has a Zacks Rank #3 (Hold). Some better-ranked stocks in the same space are Cognex Corporation (NASDAQ:CGNX) , Itron, Inc. (NASDAQ:ITRI) and Stamps.com Inc. (NASDAQ:STMP) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

STAMPS.COM INC (STMP): Free Stock Analysis Report

AGILENT TECH (A): Free Stock Analysis Report

ITRON INC (ITRI): Free Stock Analysis Report

COGNEX CORP (CGNX): Free Stock Analysis Report

Original post

Zacks Investment Research