If corporate profits decline, what will hold up the market's lofty valuations other than the tapering flood of liquidity from the Federal Reserve?

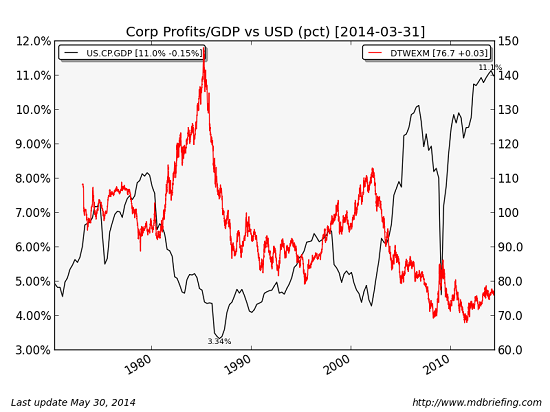

I have often noted that profits of global U.S. corporations have been boosted by the weak US Dollar. In a weak-dollar environment, a company need not sell more goods or services or expand margins to book more profit: all a corporation needs to do is book profits earned in other currencies in dollars.

When the euro and the dollar (EUR/USD) were 1-to-1 back in the early 2000s, 100 euros of profit converted to $100 when stated in dollars. With the euro around $1.36, the same 100 euros of profit earned by the U.S. corporation in Europe converted to a $136 in profit when stated in dollars--a hefty 36% premium gained entirely as a result of the weak dollar.

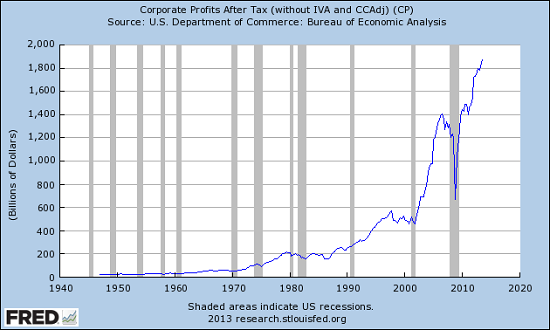

This explains why the Fed has been so keen to trash the dollar: it magically increases corporate profits and thus drives stocks higher. The mainstream financial media's explanation for the weak-dollar policy is that the Fed is anxious to increase exports, but this is a sideshow; exports make up less than 9% of the U.S. GDP. The real action is in corporate profits, which thanks to the weak dollar are near all-time highs of $2 trillion, about 12% of the nation's entire GDP.

Courtesy of our friends at Market Daily Briefing, here is a chart of the USD and the S&P 500 stock index. Note that when the USD is strong, profits decline, and when the dollar is weak, profits soar:

For a variety of reasons, the dollar is in a long-term uptrend. These reasons include global capital flows, Triffin's Paradox and the need to defend the dollar to prop up the U.S. Treasury bond market and fund the U.S. deficit. I have covered these topics in depth over the past few years:

- What Will Benefit from Global Recession? The U.S. Dollar (October 9, 2012)

- Understanding the "Exorbitant Privilege" of the U.S. Dollar (November 19, 2012)

- Why the Shrinking Trade Deficit Will Choke U.S. Corporate Profits (August 8, 2013)

We can see the uptrend in a chart of the U.S. dollar. There's nothing fancy here; the USD bottomed in late 2011 and advanced into a trading range that has lasted two years. A year-long triangle pattern has been broken to the upside, a move that can be viewed as a continuation of the uptrend from 2011.

Many observers focus on the eventual consequences of large-scale credit/money-printing, i.e. debasement of paper (fiat) currencies. While this may yet occur, the credit issuance/money printing of the Fed is actually modest compared to other issuances of credit/currency, and is tapering as the Fed is forced to defend other parts of the global Empire, for example, the Treasury bond market.

The dynamics and consequences of the various currency players' actions are not linear, and so predictions based on linear projections are often wrong. But I think these two dynamics--the correlation of the weak dollar to global U.S. corporate profits and the dollar strengthening as other players' fundamentals unravel -- will be dominant, and the ones to watch in terms of explaining why U.S. corporate profits will weaken, regardless of sales and margins.

And if corporate profits decline, what will hold up the market's lofty valuations other than the tapering flood of liquidity from the Federal Reserve? Answer: nothing.

Complacent punters will discover to their great dismay that liquidity is only one dynamic of many.