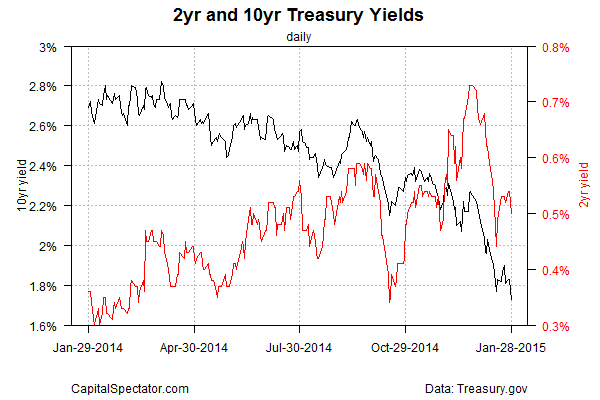

The Federal Reserve continues to signal that it will start raising interest rates later this year, according to yesterday’s FOMC statement. But the Treasury market begs to differ. The benchmark 10-Year yield fell to 1.73% yesterday, the lowest since last May. Notably, the 2-Year yield, considered to be the most sensitive to rate expectations, is also trending lower again, slipping to 0.50% yesterday.

Although the Fed remained vague about the timing of the first rate hike, yesterday’s statement signaled that the economy was strong enough to warrant a change in policy in the near term: “Information received since the Federal Open Market Committee met in December suggests that economic activity has been expanding at a solid pace.” The Treasury market, however, seems to be pricing in a more-nuanced future by way of lower yields.

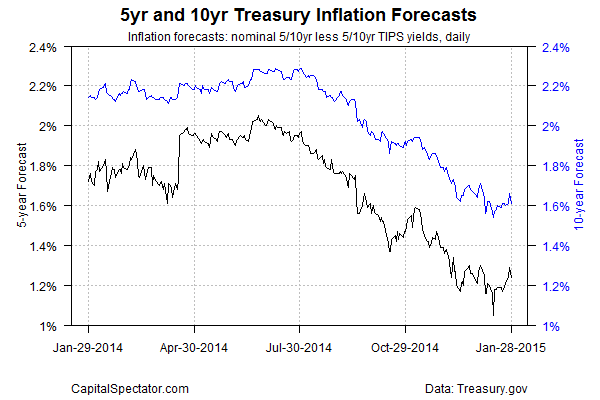

The market’s implied inflation forecast, based on the yield spread between nominal and inflation-indexed Treasuries, have been relatively stable in recent days, but the meager rise from earlier this month reversed course slightly yesterday. As a result, expectations via the 5-Year and 10-year Treasury forecasts dipped on Wednesday, hovering near the lowest levels in several years.

The Fed addressed the recent slide in the Treasury market’s inflation outlook by dismissing it. “Market-based measures of inflation compensation have declined substantially in recent months; survey-based measures of longer-term inflation expectations have remained stable.” Presumably that’s a reference to the University of Michigan’s survey data, which shows that this month’s five-year outlook for inflation among consumers is 2.8%, unchanged from December and near the highest levels over the past year.

But there’s a glitch: consumer expectations for inflation for the next year stumbled in January, falling to 2.4% from 2.8% in the previous month. Is that a sign that consumers will be downsizing expectations on pricing pressure in the months to come? The Treasury market is effectively betting “yes.”

The alternative view, which is also the Fed’s view, is that market-based inflation forecasts suffer from a global perspective on pricing pressure. Because the US dollar is the world’s reserve currency, Treasury prices aren’t solely a reflection of expectations for US inflation. As such, the Fed is inclined to dismiss the market’s view on inflation, or so one can argue. As a result, Janet Yellen and others are telling us that a rate hike is still coming at some point in the near term—anytime from June onwards.

Nonetheless, the Fed statement reminded us that “the Committee judges can be patient in the beginning to normalize the stance of monetary policy.” What does that mean? Perhaps the Treasury market’s forecasts hold a clue after all.