Refreshing. Exhilarating, even! But will it last? Our gut feeling is that this is not The Big One – that investors will soon be throwing money at stocks again with the same reckless abandon they’ve shown since 2009. But it never hurts to dream. Imagine what a whole month of days like yesterday would do to clear the fetid, toxic air from Wall Street. The effect would be positively cathartic if the capitulation phase were to lop, say, 2000 points from the Dow in just a few days. From that point forward, even the most churlish permabears would recognize that the stock market was in recovery mode, too devastated to attract the quasi-criminal element that has dominated the markets in recent years. High frequency trading circuitry would be fried, yields on dividend stocks would fatten and interest rates could seek their own level. Who knows? Perhaps even the $3 trillion-plus in dubious assets carried by the Fed would come available at market prices?

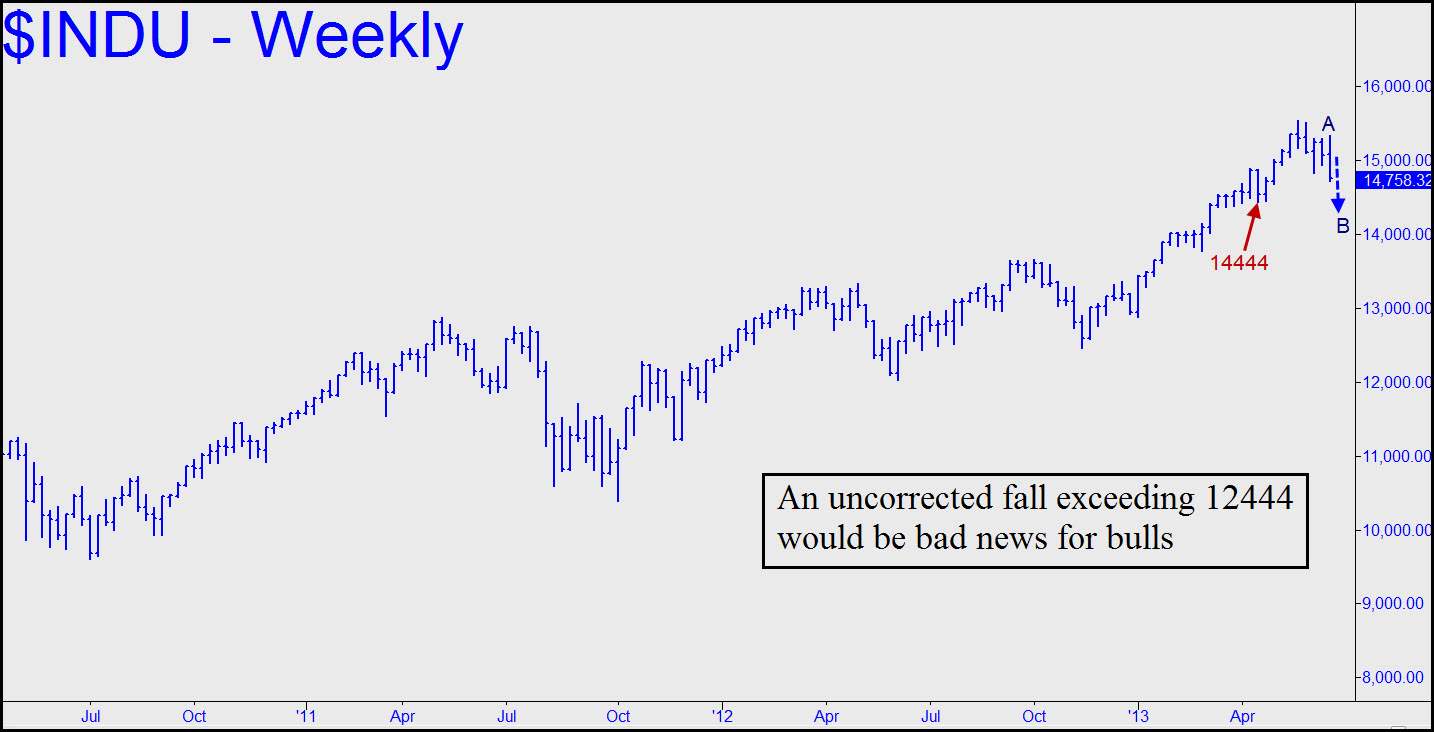

Meanwhile, although our very bullish Dow target at 16800 remains theoretically valid, the burden of proof has shifted to bulls for a rare change. From a technical standpoint, we can see in retrospect that late May’s record high at 15542 was precisely predictable and therefore shortable. The reason is shown in the weekly chart accompanying today’s DJIA tout, which can be accessed by non-subscribers via a free trial subscription. Those familiar with Hidden Pivot Analysis, including your editor, might want to kick themselves for missing the opportunity. Less easy to miss in the days ahead would be the creation of a bearish “impulse leg” on the weekly chart. The last time this occurred was in July 2011, and it signaled the onset of a 2147-point decline, or 17.6%. If a selloff of similar magnitude were to occur now, the Dow would sell for 12807, a 1925-point discount from the current price. What would it take to generate a bearish impulse leg? The chart shows that sellers would need to drive the Dow beneath the 14444 low without an intervening upward correction of significance. Were this to occur, bulls would likely be on the defensive till at least September. What a welcome change that would be!

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Refreshing Change, But Will It Last?

Published 06/21/2013, 04:10 AM

Updated 07/09/2023, 06:31 AM

A Refreshing Change, But Will It Last?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.