Hidden Motives

It is well-known that India’s government wants to coerce its population into “modernizing” its financial behavior and abandoning its traditions. The recent ban on large-denomination banknotes was not only meant to fight corruption.

In fact, as our friend Jayant Bhandari has pointed out, fresh avenues for corruption immediately opened up upon enactment of the ban (see “Gold Price Skyrockets in India After Currency Ban” – Part 1, Part 2 and Part 3).

It is a nigh apodictic certainty that governments are lying – whether outright or by omission – when they impose such drastic measures. It should be clear how the State operates once one recognizes its true nature and realizes that “we” are definitely not the State.

Thus there are several reasons for the currency ban that have nothing to do with the official justification forwarded by the government. One is of course that the government hopes to be able to confiscate a sizable proportion of the citizenry’s – allegedly “ill-gotten” – wealth.

A special one-off tax penalty will be imposed on deposits government officials arbitrarily deem “too large” – under the cover that only criminals will be deprived of their possessions, for the benefit of public at large (meaning: Modi’s supporters. As an aside, this may well turn out to be a major miscalculation).

Another reason is that the government wants to coerce people into transferring much of the cash they currently hold into the banking system. This will transform their cash into digital money substitutes.

This increase in deposit money will be a great boon for India’s fractionally reserved banks. It represents extremely cheap funding for them and will enable them to vastly expand credit creation ex nihilo. At the same time, the government will achieve far greater control over the economic life of its citizens.

Indians and Gold- A Rational Love Affair

In the recent past, India’s government has also launched several initiatives aimed at reducing gold purchases by Indian citizens. For one thing, it is asserted that the gold hoards held by citizens are “unproductive” and a sign of India’s backwardness that needs to be eradicated in the name of modernization.

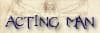

Another official reason is that government wants to lower the country’s trade deficit. Since India isn’t producing much gold, it is importing quite a lot; in recent years gold imports oscillated around 700 tons per year.

The world’s governments are almost without exception comprised of economically ignorant mercantilists who believe that a trade deficit is a symptom of declining wealth. Naturally, India’s government is no different in this respect.

This mercantilist view of trade is one of the most “sticky” and widespread economic errors in history (evidently, not only prices and wages are “sticky”…). It is a direct result of viewing the economy through a collectivist lens instead of through the lens of methodological individualism.

The government’s efforts included raising a tariff on gold imports (ever since, India’s gold import statistics are no longer reliable, as a lot of gold is smuggled in), as well as urging the creation of assorted “paper gold” products by commercial banks.

The latter were supposed to entice citizens to deposit their gold with banks in exchange for paper receipts. You have one guess why the government would be eager to see that happen.

India’s citizens have a traditional affinity for gold. Gold is not only a “love trade” for Indians though, as our friend Ronnie Stoeferle puts it. They also buy gold because they don’t trust their government and its economic policies.

As has just been demonstrated again, this is quite a healthy attitude – even if the government of the day is widely considered to be “good for the economy” (Mr. Modi’s government has indeed adopted a number of positive economic reforms as well in the past).

Not only can it be very costly to trust the government, there is obviously also a big difference between looking at and fondling actual metal, as opposed to a bank receipt for a gold deposit. If you try it, you will see it is just not the same.

Indian women love gold adornments and gold jewelry plays a major role as a wedding present that concurrently serves as a store of wealth. Hence the government’s efforts to “wean the citizenry off gold” have completely failed to gain traction.

What If India Bans Gold Imports?

It remains to be seen if the government will get away unscathed with the recent demonetization of large denomination banknotes. As Jayant has pointed out, Mr. Modi has actually enjoyed widespread popular support for the measure – at least initially. Certain segments of society continue to be supportive, depending on the degree to which they are actually affected by the ban.

After two weeks of increasing chaos and ample demonstrations of government ineptitude, the political opposition has finally decided to join the fray and is now beginning to forcefully denounce the measure.

Parliament was adjourned after an “uproar” over the currency ban, the opposition is organizing an “all India protest” for November 28, as it is now united in opposing the ban. Moreover, allegations that the plan was leaked to certain people in advance have surfaced (that wouldn’t surprise us one bit).

As Jayant has rightly pointed out in the third part of his articles on the currency ban, the evolving situation is forcing the government to continually issue new ad hoc decrees in order to stop people from successfully fighting the edict.

Similar to the attempts of the post-revolutionary assembly of France to defend the assignat in the late 18th century, it is resorting to increasingly repressive steps (the most recent one is that it has apparently suddenly shortened the grace period for banknote exchanges, concurrently with announcing that it will impose a tax penalty on “too large” deposits).

This has led to speculation that gold may be in the government’s cross hairs next. As the thinking goes, if it can ban certain banknotes, surely it can also enact a ban on gold imports? As an aside, an outright ban on gold ownership seems highly unlikely, as that would probably cause more than just an “uproar”.

Also, some of the largest gold hoards are held by temples – in other words, the country’s religious establishment would undoubtedly be less than amused. Gold imports are a different matter though.

A recent article posted at Zerohedge discusses the possibility and attempts to estimate what the potential impact on gold prices might be. First let us consider the question whether the recent decline in gold prices may have had anything to do with rumors about India imposing a ban on gold imports. We would argue this is extremely unlikely.

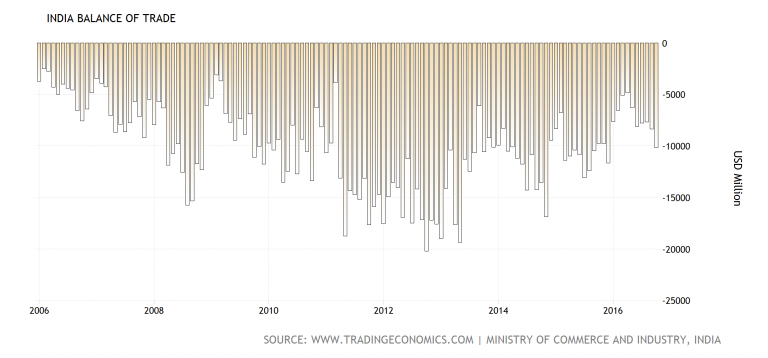

First of all, at the recent peak in gold prices, the net speculative position in gold futures had reached a record high. Even though one needs to interpret the commitments of traders in gold futures in a more nuanced manner than many observers are wont to do, we have pointed out on several occasions that this made the market very vulnerable to a shake-out. The only question was when it would start and how extensive it would be.

Net and gross positions of speculators in COMEX gold futures – note that these data refer to the CoT report of November 15, which in turn is a snapshot of the actual situation as of November 12. Due to the holiday schedule, new data will only become available on Monday. As of November 12, the total net speculative position had declined from a 340,000 contract peak in early July to less than 200,000 contracts – it has probably decreased further in the meantime .

The correction has in fact turned out to be a lot more extensive than we thought it would be, partly driven by the market reaction to the Republican clean sweep of the election. At least we didn’t neglect to mention that the large speculative position was likely to “require more work” (this has probably been achieved by now).

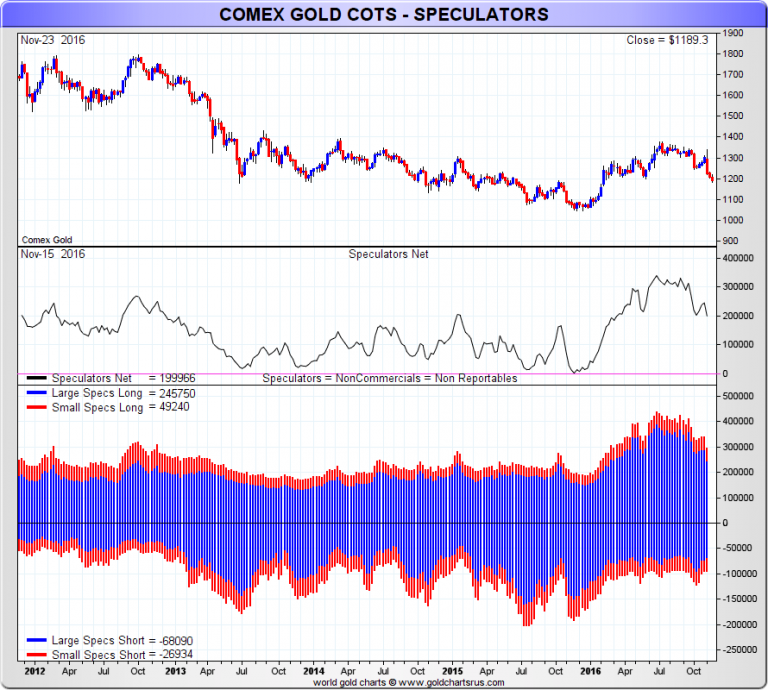

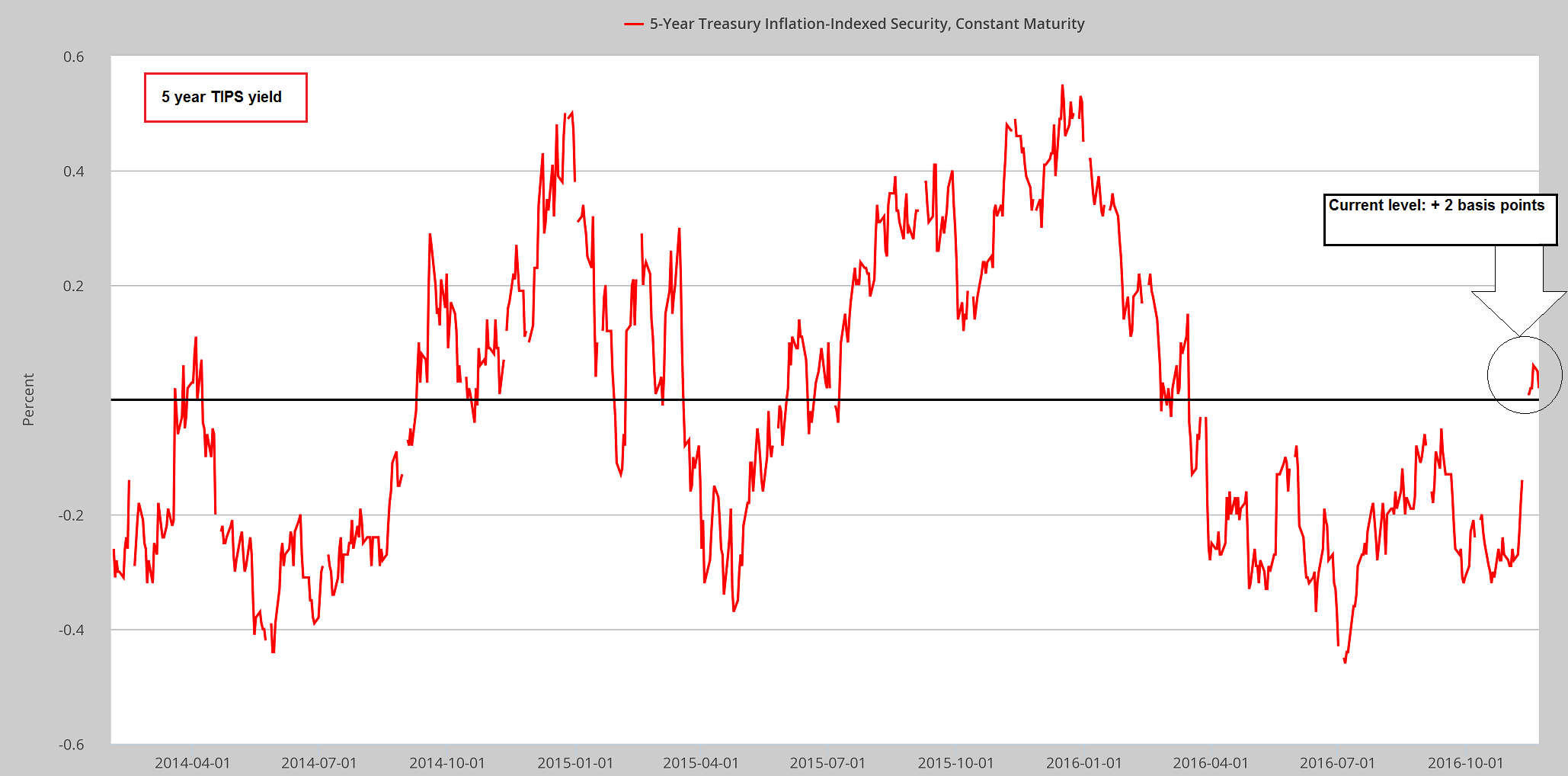

The proximate driver of the decline in gold prices was the surge in the US dollar, which in turn appears to have been egged on by rising bond yields – particularly a reversal in real interest rates as reflected by TIPS yields. These have in the meantime reached positive territory again, if only by a few basis points. It is the trend that counts though, and perceptions about the future trend.

DXY daily: relative to this move, gold has held up quite well actually

5 year TIPS yield: real US interest rates were in negative for most of 2016, but have now returned above the zero line – if barely

Fundamental Drivers of the Gold Price

In the above mentioned article it is also mentioned that a gold import ban by India is likely provoke a “$200 one day crash” in gold prices. We don’t know how this estimate was arrived at.

We concede that such news would likely have a negative effect on market psychology, but we cannot really estimate the size effect. We only know that in the long term it would merely amount to short term variance.

Many market participants and observers continue to be blissfully unaware of how to properly analyze the gold market and continue to look at gold supply and demand as though the metal were an industrial commodity.

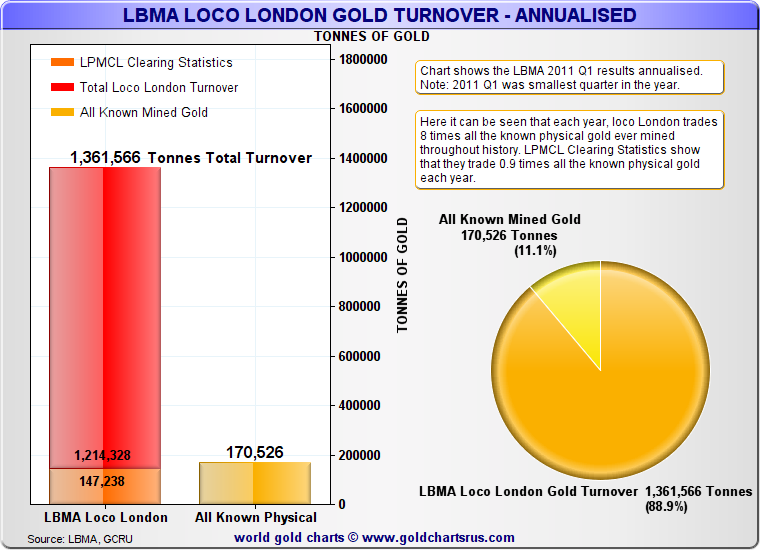

This is not the case though – in reality, the markets treat gold as though it were money (even though it currently does not serve as an official medium of exchange), and it is in fact the world’s fourth-most liquid currency in terms of average daily trading volume.

LBMA turnover, Q1 2011 annualized. Note that this does not only represent physical trades, and certain transactions are actually not included. We will discuss these figures in more detail on another occasion – the point here is merely to show that an enormous amount of gold is traded every day.

India imports 700 tons of gold per year – but in London alone, nearly 600 tons are changing hands every single trading day. Quite a bit of gold is already smuggled into India in order to sidestep the import surcharge. An import ban would no doubt intensify these smuggling activities and gold would continue to enter India below the authorities’ radar.

This not really important though – one has to consider the true supply-demand situation when analyzing gold. Since gold is not “used up”, nearly every single ounce ever mined continues to be part of the global supply.

It is precisely because gold has such a huge ratio of stocks to flows that it is useful as a money commodity. At a minimum, the total supply consists of 180,000 tons, and very likely it is actually greater (around 3,000 tons, or 1.4%, are added to the total supply every year by mine production).

Let us assume that the 180,000 tons figure is correct. Obviously, this means that the total demand for gold (including reservation demand) is also 180,000 tons, since supply and demand have to be equal. India’s annual imports therefore amount to about 0.39% of the world’s total gold supply and demand, which is basically a rounding error.

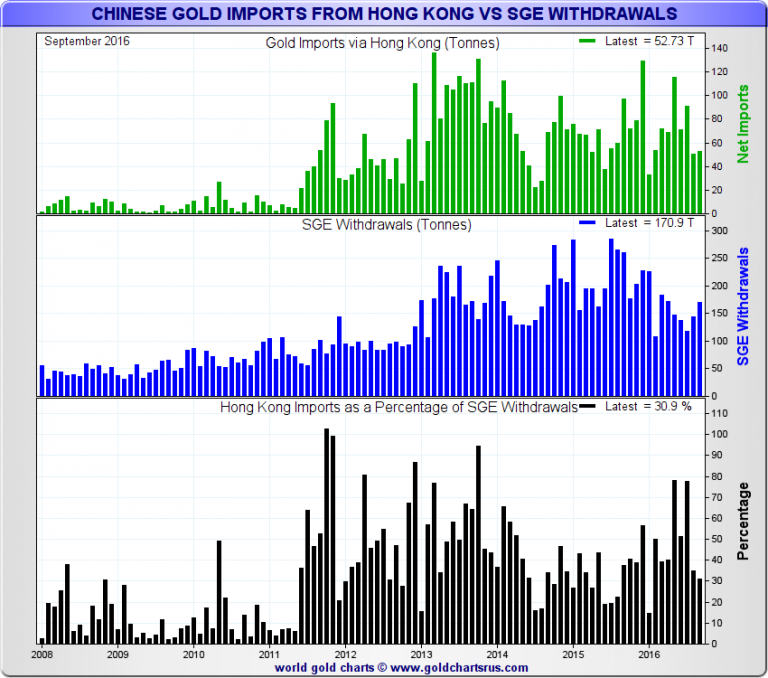

Gold imports to China and withdrawals from the Shanghai Gold Exchange. This shows that there is growing interest in gold by Chinese buyers, which is of course positive in principle. But it cannot alter what the major forces driving prices consist of – click to enlarge.

Readers may recall the many stories about surging Chinese gold imports, which regularly made the rounds while the gold price fell by nearly 46% between late 2011 and late 2015. The vast majority of these reports implied that surging Chinese imports should lead to rising prices, but the exact opposite has in fact happened.

It should be clear that prices don’t rise just because gold is moved from A to B After all, someone had to sell and export what Chinese buyers bought and imported. Prices merely reflect the relative urgency with which buyers and sellers act.

Also, while the amounts involved looked quite large relative to e.g. the WGC’s supply-demand statistics – which analyze only the estimated annual flow of gold, and completely ignore the much larger stock – they were really tiny compared to total global gold supply and demand. India’s annual imports are even smaller.

Conclusion

Readers who have not yet seen the articles on the topic of gold market analysis which have preciously appeared in these pages, are advised to review the following:

- Misconceptions About Gold (by yours truly)

- What Determines the Price of Gold? (an excellent article by Robert Bumen that inter alia discusses the concept of reservation demand in detail).

The upshot of all this is that for psychological reasons it is reasonable to expect a short term negative reaction if India were to ban gold imports, but the trend will continue to be determined by the true fundamental drivers of the gold price. How many tons of gold are moved from one place of the world to another in the course of a year is not really relevant in this context.

Gold demand is driven by macroeconomic factors, some of which are overlapping. They include:

- market-derived real interest rates,

- the trend of the US dollar,

- credit spreads,

- the steepness of the yield curve,

- faith in the monetary authorities,

- faith in the solvency of the banking system,

- faith in government and particularly its fiscal policy,

- money supply growth rates,

- the general trend in commodity prices,

- the trend in risk asset prices,

- the demand for money (i.e., the desire to increase precautionary cash balances), the trend in economic confidence in general

What can be safely excluded – apart from short term psychological considerations – are things like mine supply, scrap supply, imports to certain countries, the amount of gold held by bullion ETFs (which is a useful sentiment indicator though) and similar exercises involving the addition and subtraction to and from annual gold flows.

These marginal changes may exacerbate or mitigate short term price trends, but they can never be the major determinants of the gold price.