Mimicking the calendar, Forex price action has experienced a relatively quiet start to the week. But with tonight’s data sure to throw up a few surprises as well as today being the final day of the month/quarter, things aren’t expected to stay quiet for long. End of month/quarter flows are sure to play a role in today’s price action so just remember to be alert, not alarmed.

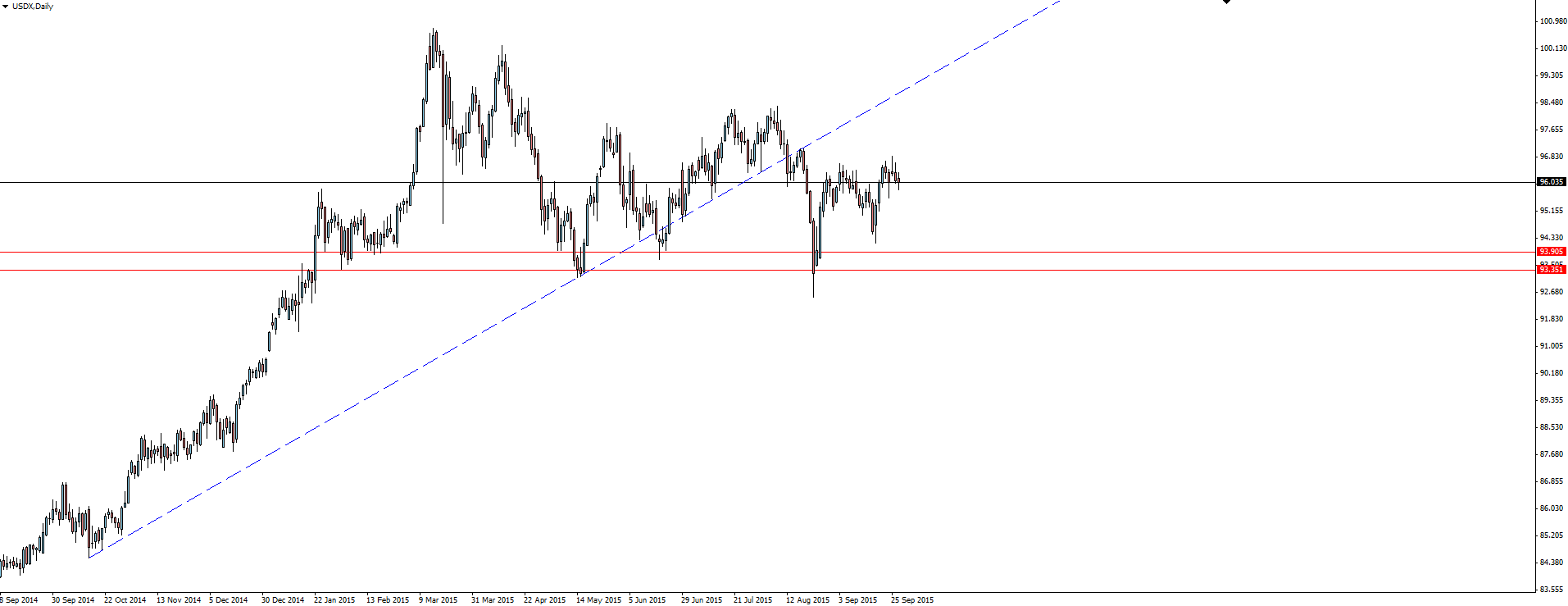

This little lull gives us a chance to take a look at some perceptions and then the actual performance of the US dollar. If you’re only following the majors, you’ve surely seen and read that the USD hasn’t performed that well over the last few weeks. Taking a look at the USDX chart, you can see that while still in a major bullish trend, the trend line has been breached and price has basically traded sideways in consolidation mode.

Nothing special here, this all looks to back up the general view.

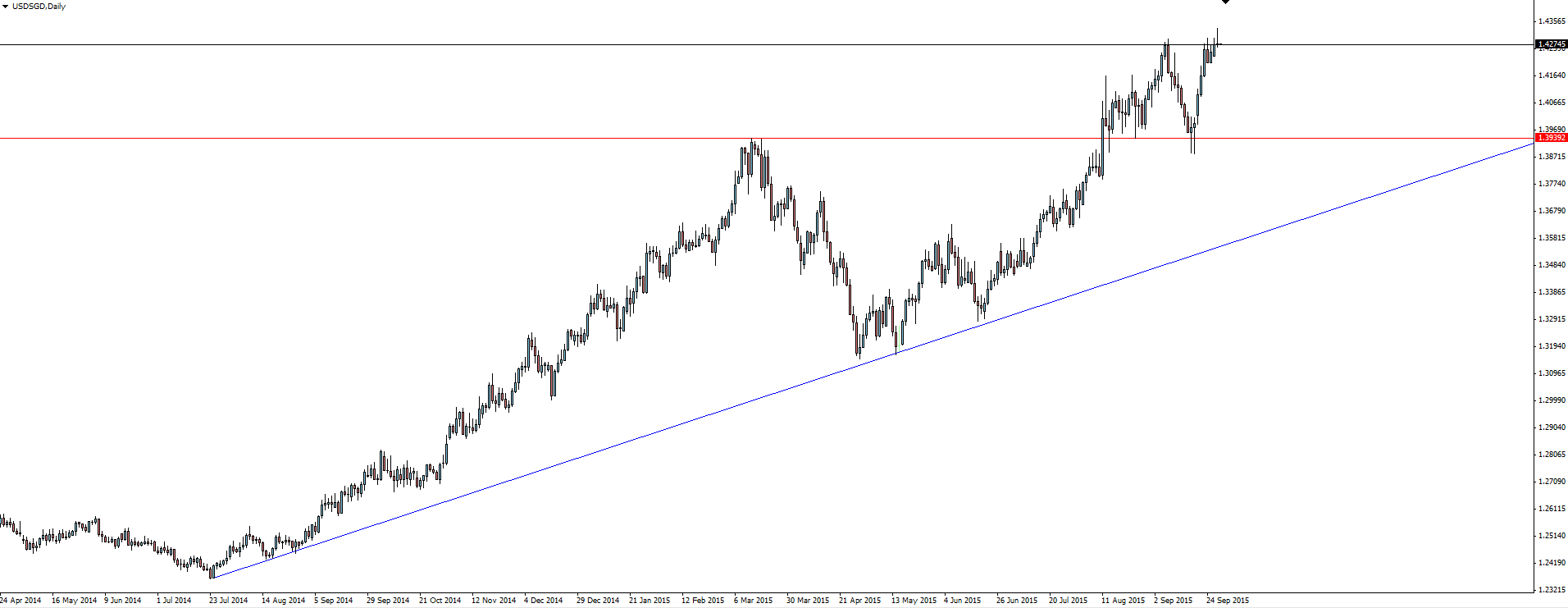

However, if you turn your attention beyond the majors to the exotics, you will find a whole different tale being told. With new milestone highs being reached across the exotics board, we have turned our focus to the Singapore dollar.

USD/SGD Daily:

This chart is vastly different to the heavily weighted US Dollar Index, showing the HUGE bullish trend still well and truly intact while price continues to make new highs all over the place! USD not strong?

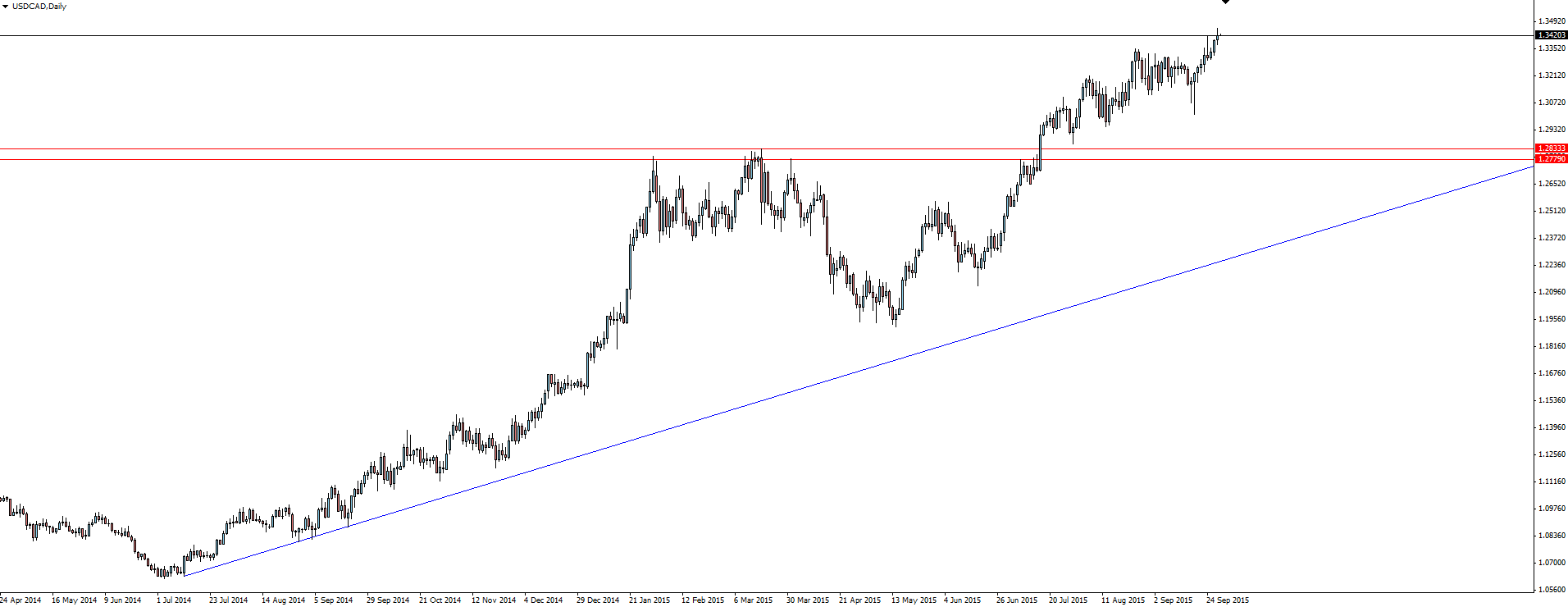

While not so much an exotic, USD/CAD is another USD pair which has bucked perception. Climbing to fresh 11 year highs overnight, the pair has now printed 9 days without a single bearish candle. Its longest streak in 4 years!

USD/CAD Daily:

Most of the better performing USD pairs are due to weaknesses in commodity prices on the back of a slowdown in Chinese demand. This has seen many smaller, less diversified economies hit hard, weakening their own currencies.

Check out some of the exotic /USD pairs that Vantage FX have on their MT4 platform.

“There is no such thing as overbought!”

On the Calendar Wednesday:

- NZD: ANZ Business Confidence

- AUD: Building Approvals

- GBP: Current Account

- USD: ADP Non-Farm Employment Change

- CAD: GDP

- USD: Fed Chair Yellen Speaks

Chart of the Day:

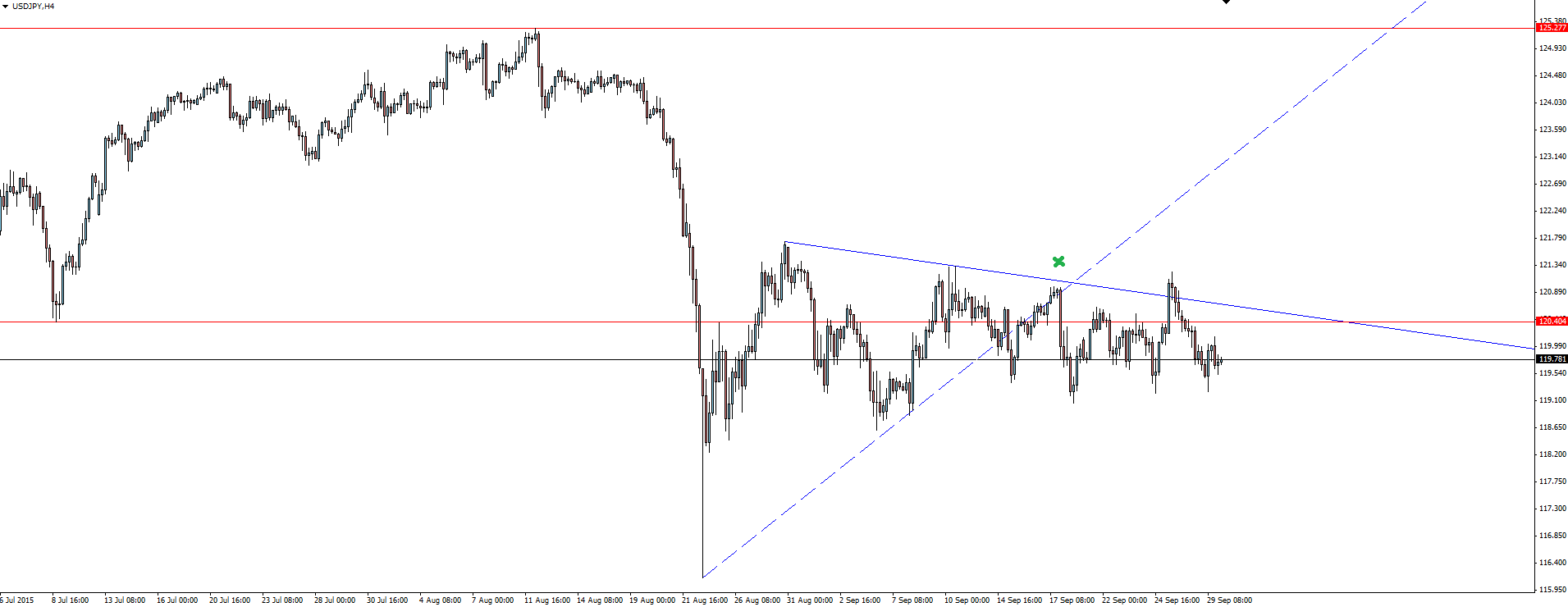

For a few weeks now, social media has been abuzz with the consolidation triangle that USD/JPY has been printing.

We have been watching this USD/JPY triangle for a few weeks ourselves and I must say that the price action has been largely disappointing from a trader’s viewpoint.

Price never really broke down after re-testing the broken trend line as resistance, instead just petering out into more sideways chop. The upper trend line is still being respected, but this is the sort of price action prone to fake outs.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by MT4 Broker Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, Forex analysis, MetaTrader 4 for Mac prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a Forex trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.