Back in the Spring of 1980, when I was taking my first Money & Banking class, the Fed Funds rate was gyrating from 14% to 20% to 8.5% all in a period of about 6 months, under Paul Volcker’s supervision.

What was happening within the economy and the Fed made headlines nearly every day, so much so that – according to one Wall Street Journal article at the time – union meetings started with a discussion of expected monetary policy, and what the Fed and FOMC might do in the near future.

At that time the Prime Rate was near 20% and the 30-year Treasury traded near 15%.

That’s a long time ago…

When Paul Volcker abandoned the “monetarist experiment” in August, 1982, and returned to targeting interest rates, which the FOMC continue to do today, the S&P 500 took off on an 18-year bull-market run that saw it increase from 109.70 on August 1, 1982, to 1,552 in March of 2000, for a total percentage gain of roughly 1300%.

The bull market of the 1980’s and 1990’s was led primarily by two sectors: Financial’s and Technology.

By the Spring of 2000, Technology comprised more than 33% of the S&P 500 by market cap, a huge figure, which in and of itself should have been a major red flag.

Some quick stats for you on the 1990’s:

- Per the Morningstar Ibbotson data, the “average’ return on the S&P 500, from 1982 to 1999 was 21%.

- For the 5 years from 1995 – 1999, the cumulative return on the S&P 500 was 143.5% and the “average” return for those 5 years for the S&P 500 was 28.7%. (The point being that as the bull market went on from the 1980’s to the 1990’s, the returns got stronger, and more frequent.)

- There was one year with a negative return for the S&P 500 in that 18 years time frame, i.e. 1990, with a decline of 3.10%. (August, 1990 was the start of Gulf War I, and the start of the commercial real estate and high yield debt crisis.)

- Per the same data, the “average return” on the 30-year Treasury was 12.88% from 1982, through 1999.

- Although the Thomson Reuters S&P 500 earnings data starts in 1985 when the S&P 500’s earned $16.66 in EPS, while 1999’s actual S&P 500 EPS was $50.82, needless to say the 1980’s and 1990’s were two decades of :P.E expansion”.

Think about those numbers.

The Decade from 2000 through 2009:

There is an old saying in the business that “you’re never really an investor until you’ve come out the other side of a bear market”.

I have to agree – the decade from 2000 to 2009 taught me more about investing than the 1982 – 2000 bull run. Graduating from college in May, 1982, and seeing nothing but a bull market from August, 1982, to March of 2000, one-way thinking tends to dominate the thought process.

Imagine the reaction if client’s were told in early 2000, let’s sell all the large-cap Technology and buy Gold, which had been in a bear market since 1980. Gold ran from $200 in the late 1999, to $1,850 an ounce in September, 2011.

Emerging Markets and commodities, which represented “deep value” sectors in the late 1990’s and dramatically under-performed the S&P 500, suddenly caught fire and dramatically outperformed the S&P 500 for an entire decade from early 2000 through 2009. US Steel (X) went from $9 per share in early 2003, to $196 per share by July, 2008. Potash (NYSE:POT) a fertilizer company went from $3 per share in early, 2003 to $70 by July, 2008.

The “deep value” of the 1990’s became the “growth stocks” of the decade from 2000 to 2009, and the growth stocks of the 1990’s became the value stocks of 2000 – 2009.

Fortunes change.

Some 2000 – 2009 market stats for you:

- Per the Morningstar data, the “average” return on the S&P 500 for the decade from 2000 through 2009 was +1.21%.

- Four of the ten years of 2000 – 2009 saw negative returns on the S&P 500.

- Two brutal bear markets for the S&P 500 – the cumulative 43% drop in the S&P 500 from March of 2000, through 2002, and the 37% decline in 2008 – were more reminiscent of the 1930’s and probably (in my opinion) discouraged an entire generation of investors.

- The S&P 500 earned $55 per share (EPS) in 2000 and $60 in 2009, so the decade of 2000 – 2009 the S&P 500 grew roughly 1% a year, right inline with the average return for the S&P 500. technically, you couldn’t even call the 2000’s decade a decade of “P.E contraction”.

From 2010 Forward to Today:

- S&P 500 earnings have increased 100% or roughly doubled from 2009’s $60 to today’s expected 2016 EPS estimate of $117, while the S&P 500 has risen cumulatively about 80% from 2010 through 2015, so in fact there is a little bit of P.E compression still occurring in the aftermath of the last decade.

- From 2010 through 2015, the average return on the S&P 500 has been roughly 13%, ahead of the long-term average.

- From 2000 through 2015 inclusive, the “average” return on the S&P 500 is 5.98%, not even 6%.

- The average return from 1971 through 2015 for the S&P 500 is 11.73%. (Again, all of this courtesy of Morningstar Ibbotson).

Conclusion: When you think of the S&P 500 in terms of “decades” and the performance therein, the bigger picture becomes clearer. After the go-go 80’s and 90’s came two brutal bear markets in the 2000 – 2009 decade, and since then, investors have seen quieter markets, with much worse sentiment, and (somewhat) reasonable valuations. The big stat that is emblematic of this market which is available weekly comes from Bespoke Research: the AAII (American Association of Individual Investors) notes that – as of the week prior to the August nonfarm payroll report release, “bullish sentiment saw the largest weekly decline since March, falling from 35.56% to 29.42%. That is the lowest weekly reading since the Brexit vote and now makes 43 straight weeks where bullish sentiment has been below 40% and the 77th week in the last 78.”

Are you kidding me ? In August ’16 the S&P 500 was basically (the rally gave up the ghost towards the end of the month) and the S&P 500 is up 6% – 7% this year, and bullish sentiment cant manage to get over 40% ?

There is very little optimism about expected stock returns and very little enthusiasm on the part of the retail investor for this post-2008 stock market rally, and personally that is very good news.

Also this is simply an opinion, I do think several asset classes are on the verge of longer-term turns:

1.) Interest rates:

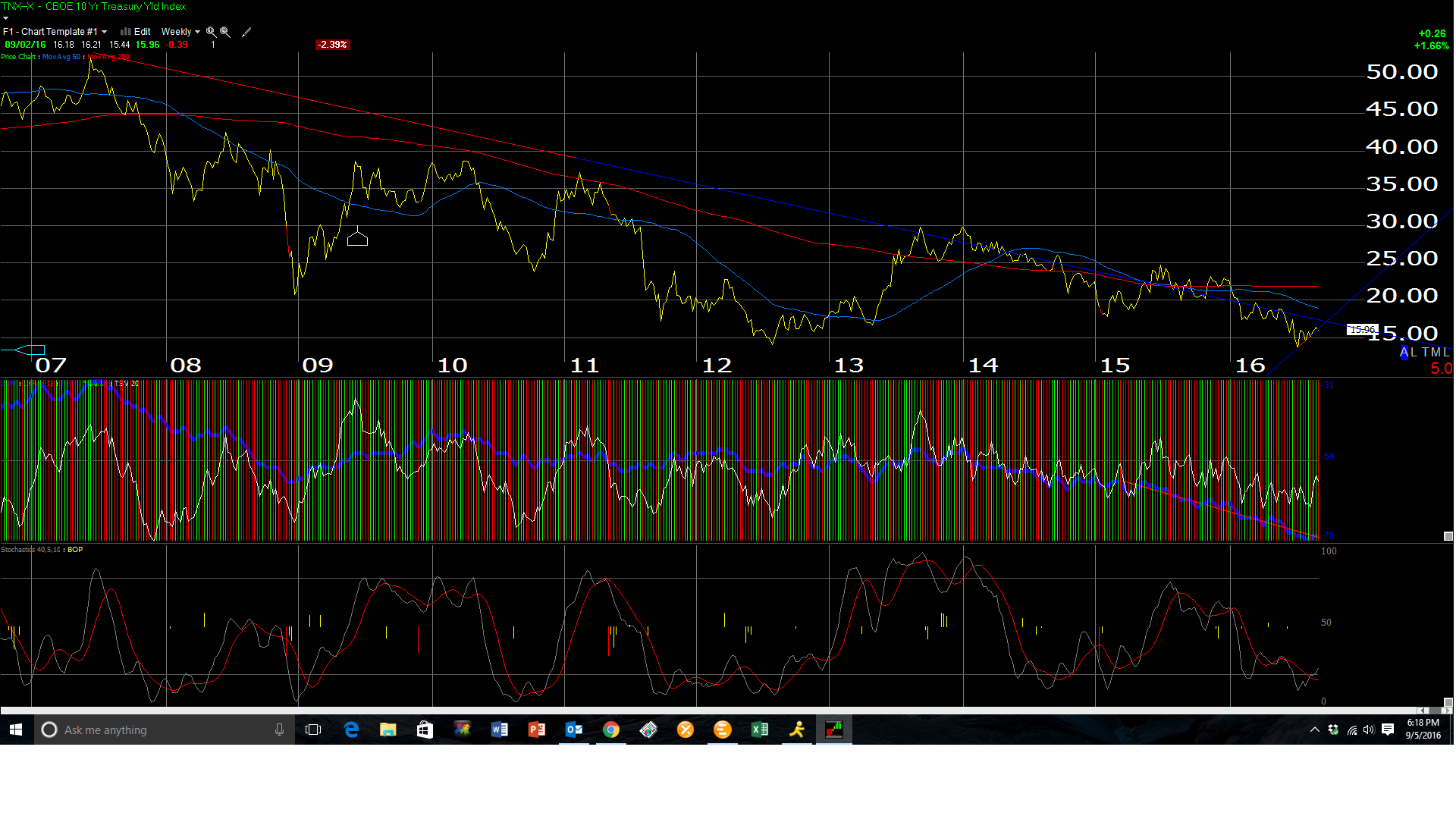

The forecast with my lowest degree of confidence, but the one central to the others, is the “double-bottom” in the 10-year Treasury yield in July ’16 and July ’12, both in the 1.39% – 1.40% area. Since the March, 2009 low. So far it looks like – despite weaker data, Brexit, etc. the 10-year Treasury yield can’t go lower. What I tell clients is that every long-term capital markets trend eventually changes – it is just the nature of the beast. if we looked at “real” Treasury yields relative to wage inflation, basically all of the Treasury curve is under water, with negative “real” returns. Even with the core PCE, which is 1.2% – 1.5%, the 10-year Treasury yield is breakeven on an inflation-adjusted basis. It makes zero sense to me how mutual fund flows can see continues inflows into high-grade (corporate investment-grade) funds, with credit spreads near record “tights”.

2.) Financials:

Bespoke posted this chart last week to their subscriber website. I suspect this is also tied into the above chart on interest rates. Financials, like the US Banks have underperformed now for a few years, since 2013, which coincidentally, we saw the 10-Year Treasury yield rise from 2% to 3% that year, and the yield curve steepened. Client accounts are overweight the Financial sector, since I think the US banks, brokers and exchanges represent good value. As an added bonus, it is a very unloved sector too.

3.) Emerging Markets:

Having never owned Emerging Markets until last fall, 2015, it was a Josh Brown article on TheReformedBroker which caught my attention during the later stages of the China-induced sell-off in September and early October ’15. Josh noted that Emerging Market outflows had hit record highs, and the 10-year returns on the asset class had gone negative, dramatically under-performing the S&P 500 since 2011.

The biggest additions to client accounts in the iShares MSCI Emerging Markets ETF (NYSE:EEM) and the Vanguard FTSE Emerging Markets Fund (NYSE:VWO) came late in Q1 ’16, after the seeming bottom in the commodity complex. The EM’s seem to be very closely correlated to the commodity cycle and a flat to weaker dollar, and it looked like some of the conditions were going to unfold in 2016, as they have for the last 5 – 6 months.

As just one example, since September, 2011 when the EEM and the VWO peaked, the S&P 500 has increased roughly 83% (using 1,200 for the S&P 500’s value as of late September, 2012, versus Friday’s close) versus the roughly 25% decline in the EEM/VWO, the performance differential is notable. In addition, looking at Morningstar data, the 10-year return on the EEM/VWO is just 3.5% total return.

These asset class recoveries become jeopardized in my opinion of interest rates rise too sharply, and the dollar strengthens notably in a short period of time like it did from October ’14 through March ’15.

In that case, the EM’s and the commodity trades probably do not work.

There is no saying these asset classes will work at all. The lesson for readers is simply be aware of crowded, popular trades, (yield chasing today, and inflows into bond funds) and what hasn’t worked for long periods.

Our largest sector overweights for clients remain Technology and Financials, the sectors that suffered the two bear markets of the 2000 – 2009 decade, with plenty of “new tech” thrown in. Both sectors today represent about 35% – 36% of the S&P 500 and still offer very good value in my opinion. Technology ex-Apple, looks to offer healthy earnings growth over the next few quarters.