You may find something of interest for yourself in this group of filtered dividend stocks.

We quantitatively filtered through David Fish’s Dividend Champions, Contenders, and Challengers list (“CCC list”) of 543 stocks that have paid and increased dividend for at least 5 years (some for several decades) to find those that may be currently most attractive.

Only 9 (less than 2%) passed our filters.

Here are the stocks, and then how we got them:

| Baxter International Inc | BAX | Medical Instruments & Supplies |

| CMS Energy Corp | CMS | Utilities – Regulated Electric |

| DTE Energy Holding Co | DTE | Utilities – Regulated Electric |

| Energy Transfer Equity LP | ETE | Oil & Gas Midstream |

| Genuine Parts Co | GPC | Specialty Retail |

| Microchip Technology Inc | MCHP | Semiconductors |

| ONEOK Partners LP | OKS | Oil & Gas Midstream |

| Simon Property Group Inc | SPG | REIT – Retail |

| Western Gas Partners, LP | WES | Oil & Gas Midstream |

Prior to this review, we owned Baxter International Inc (NYSE:BAX), Genuine Parts Company (NYSE:GPC), Oneok Partn (NYSE:OKS) and Energy Transfer Equity LP (NYSE:ETE). We don’t expect to invest in the others at this time. We find utilities as a category to be overvalued.

We used three different database tools to do the filter.

Filter Level 1 (258 of 543 of CCC stocks passed level 1):

[used yesterday's end-of-day data]

- minimum dollar volume per minute $25,000

- price above 200-day simple moving average

- linear regression slope of 200-day average positive

- current 200-day average above level 10 days ago

- price less than 2 (63-day) standard deviations above 200-day average

Filter Level 2 (showing successive reduction of the 258):

[used today's end-of -day data]

- Yield >= 2.5% (100 passed)

- Consensus target price >= 1.05 times price (42 passed)

- PEG ratio

- 50-day average > 200-day average (15 passed)

Filter Level 3 (showing successive reduction of the 15):

[used today's end-of-day data]

- 1-yr revenue growth rate >zero

- 3-yr revenue growth rate > zero

- 5-yr dividend growth rate >= 3%

Then we checked with the Wright’s ratings for Liquidity, Financial Strength, Profitability and Growth [explanation of rating scale here] and the Moody’s credit rating.

These are important types of data for dividend investors seeking long-term holdings.

We’d like to see investment grade for dividend stocks. For Wright’s we would like to see BBB4 or better, and Baa or better from Moody’s.

| Wright’s | Moody’s | |

| BAX | ABA10 | A3 |

| CMS | ACB7 | Baa2 |

| DTE | ABC2 | A3 |

| ETE | ADNN | Ba2 |

| GPC | AAB10 | n/a |

| MCHP | AAB4 | n/a |

| OKS | ABB5 | Baa2 |

| SPG | ADA5 | A3 |

| WES | BBC7 | Baa3 |

Next we looked up the year ahead rating for price behavior as rendered by ThomsonReuters StarMine through Fidelity (where over 7 is Bullish and 3 or less is Bearish). We don’t put great stock these ratings, but is does feel moderately soothing to know if analysts look favorably.

| StarMine | |

| BAX | 8.5 |

| CMS | 9.1 |

| DTE | 6.8 |

| ETE | 4.7 |

| GPC | 5.8 |

| MCHP | 8.7 |

| OKS | 4.2 |

| SPG | 3.8 |

| WES | 0.8 |

The we looked up the short-term technical rating of the 9 stocks as rendered by BarChart.com and StockCharts.com. The BarChart data is self-evident in its meaning. The StockCharts data is strong technically at 70 and above, and weak at 30 and below.

Technical ratings can be useful when deciding when to enter a position.

| BarChart | StockCharts | |

| BAX | 88% BUY | 59.9 |

| CMS | 8% BUY | 61.9 |

| DTE | 8% SELL | 60.9 |

| ETE | 56% BUY | n/a |

| GPC | 80% BUY | 51.6 |

| MCHP | 88% BUY | 63.4 |

| OKS | 24% BUY | 63.4 |

| SPG | 16% BUY | 70.0 |

| WES | 32% BUY | 86.0 |

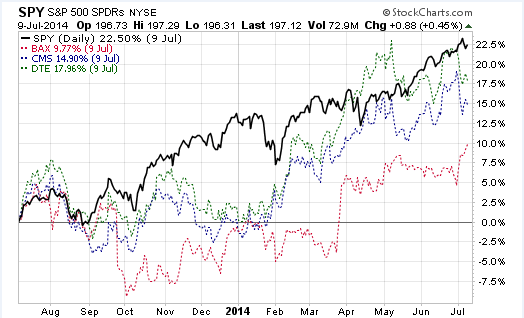

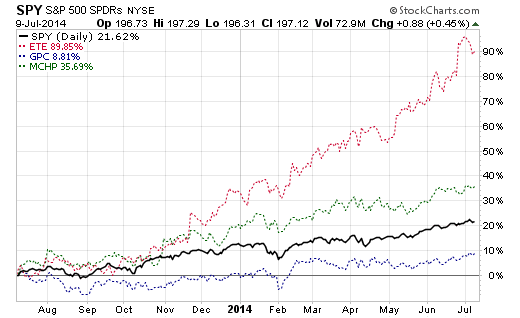

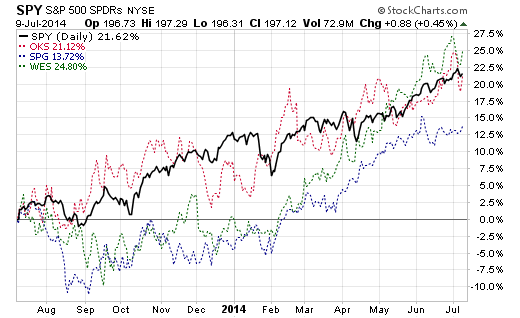

Here is how those 9 stocks did versus the S&P 500 over the trailing 1 year: