Trump’s victory in the presidential election has been a game changer for the stock market as hopes for a massive fiscal stimulus, deregulation and tax cuts sent stocks soaring and bonds tumbling.

The stock market is now entering a new era. For the past eight years, market gains were driven mainly by the Fed’s ultra-accommodative monetary policy. Now, fiscal stimulus is expected to drive stocks higher while the Fed begins normalization of the monetary policy.

Certain sectors of the market--like financials, industrials and materials--are expected to benefit more than others from Trump’s polices. Further, smaller-cap stocks look much better positioned than their larger-cap counterparts. (Read: Dow ETFs—More Rally Ahead or You Have Missed the Boat)

US economic growth continues to improve and will get further boost from stimulus spending. The dollar has been surging of late on expectation of rising rates in the US. A rising dollar hurts larger companies with significant overseas operations. Trump’s proposed protectionist trade policies may also hurt multinationals.

On the other hand, smaller, domestically focused companies are rather immune to currency and trade policy related headwinds. Per FT, the effective corporate tax rate for small-cap US companies is about 32%, compared with 26% for large companies. Thus, lower corporate taxes will be a boon for this group. (Read: Forget Growth, Buy These Value ETFs Instead)

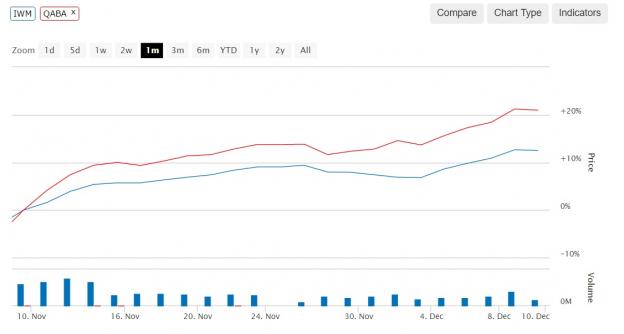

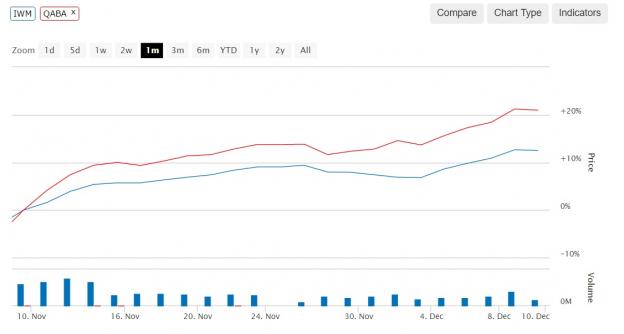

As a result, some ETFs that focus on smaller-cap stocks within the sectors that are best positioned in the current environment have soared after the presidential election. Below, we have highlighted four such small cap ETFs that have been the biggest beneficiaries of the Trump bump and have handily beaten the broader small-cap ETF-- the iShares Russell 2000 (IWM).

PowerShares S&P Small-Cap Materials ETF (PSCM)

This product focuses on small cap companies principally engaged in the business of producing raw materials, including paper or wood products, chemicals, construction materials, and mining and metals.

It is currently ranked Zacks #1 (Strong Buy) and is up about 21% in the past one month.

First Trust NASDAQ ABA Community Bank ETF (QABA)

This product holds NASDAQ-listed US banks and thrifts, but excludes the 50 largest firms from its portfolio. This Zacks Rank #2 (Buy) ETF is up about 21% in the past one month, significant ahead of IWM.

Guggenheim S&P SmallCap 600 Pure Value ETF (RZV)

Earlier beaten-down value stocks have been outperforming growth stocks for the past few weeks. RZV tracks a fundamentally weighted index of small- and micro-cap value companies listed in the US.

It has returned about 21% in the last one month.

First Trust RBA American Industrial Renaissance ETF (AIRR)

This fund focuses on small- and mid-cap industrial service and support companies and local banks that would benefit from a US industrial revival. Trump’s plans to bring manufacturing back to the US would be great for this product.

AIRR is up about 17% in the past one month. It is currently ranked Zacks Rank #2 (Buy).

The Bottom-Line

Investors should remember that small-cap companies are usually much more volatile than their larger-cap counterparts. Further, most ETFs that offer unique exposure usually trade in low volumes, resulting in high bid-ask spreads. These products are more suitable for investors that have higher risk tolerance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

FT-RBA AMER IND (AIRR): ETF Research Reports

FT-NDQ ABA CBIF (QABA): ETF Research Reports

GUGG-SP 600 PV (RZV): ETF Research Reports

ISHARS-R 2000 (IWM): ETF Research Reports

PWRSH-SP SC MAT (PSCM): ETF Research Reports

Original post

Zacks Investment Research

The stock market is now entering a new era. For the past eight years, market gains were driven mainly by the Fed’s ultra-accommodative monetary policy. Now, fiscal stimulus is expected to drive stocks higher while the Fed begins normalization of the monetary policy.

Certain sectors of the market--like financials, industrials and materials--are expected to benefit more than others from Trump’s polices. Further, smaller-cap stocks look much better positioned than their larger-cap counterparts. (Read: Dow ETFs—More Rally Ahead or You Have Missed the Boat)

US economic growth continues to improve and will get further boost from stimulus spending. The dollar has been surging of late on expectation of rising rates in the US. A rising dollar hurts larger companies with significant overseas operations. Trump’s proposed protectionist trade policies may also hurt multinationals.

On the other hand, smaller, domestically focused companies are rather immune to currency and trade policy related headwinds. Per FT, the effective corporate tax rate for small-cap US companies is about 32%, compared with 26% for large companies. Thus, lower corporate taxes will be a boon for this group. (Read: Forget Growth, Buy These Value ETFs Instead)

As a result, some ETFs that focus on smaller-cap stocks within the sectors that are best positioned in the current environment have soared after the presidential election. Below, we have highlighted four such small cap ETFs that have been the biggest beneficiaries of the Trump bump and have handily beaten the broader small-cap ETF-- the iShares Russell 2000 (IWM).

PowerShares S&P Small-Cap Materials ETF (PSCM)

This product focuses on small cap companies principally engaged in the business of producing raw materials, including paper or wood products, chemicals, construction materials, and mining and metals.

It is currently ranked Zacks #1 (Strong Buy) and is up about 21% in the past one month.

First Trust NASDAQ ABA Community Bank ETF (QABA)

This product holds NASDAQ-listed US banks and thrifts, but excludes the 50 largest firms from its portfolio. This Zacks Rank #2 (Buy) ETF is up about 21% in the past one month, significant ahead of IWM.

Guggenheim S&P SmallCap 600 Pure Value ETF (RZV)

Earlier beaten-down value stocks have been outperforming growth stocks for the past few weeks. RZV tracks a fundamentally weighted index of small- and micro-cap value companies listed in the US.

It has returned about 21% in the last one month.

First Trust RBA American Industrial Renaissance ETF (AIRR)

This fund focuses on small- and mid-cap industrial service and support companies and local banks that would benefit from a US industrial revival. Trump’s plans to bring manufacturing back to the US would be great for this product.

AIRR is up about 17% in the past one month. It is currently ranked Zacks Rank #2 (Buy).

The Bottom-Line

Investors should remember that small-cap companies are usually much more volatile than their larger-cap counterparts. Further, most ETFs that offer unique exposure usually trade in low volumes, resulting in high bid-ask spreads. These products are more suitable for investors that have higher risk tolerance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

FT-RBA AMER IND (AIRR): ETF Research Reports

FT-NDQ ABA CBIF (QABA): ETF Research Reports

GUGG-SP 600 PV (RZV): ETF Research Reports

ISHARS-R 2000 (IWM): ETF Research Reports

PWRSH-SP SC MAT (PSCM): ETF Research Reports

Original post

Zacks Investment Research