Recent Performance of the Stocks Mentioned Below:

Average 1-Week Return: -1.03%

Average 1-Month Return: -4.44%

Average 1-Year Return: -19.98%

1. Abiomed Inc. (ABMD). Engages in the research, development, and sale of medical devices that provide circulatory support to acute heart failure patients across the continuum of care in heart recovery. Price-to-Earnings-Growth ratio at 0.84. SMA50 at $17.32 vs. SMA200 at $20.87.

2. Acacia Research Corporation (ACTG). Develops, licenses, and enforces patented technologies in the United States. Price-to-Earnings-Growth ratio at 0.65. SMA50 at $24.26 vs. SMA200 at $32.41.

3. Amedisys Inc. (AMED). Provides home health and hospice services including practical nursing services and physical and occupational therapy. Price-to-Earnings-Growth ratio at 0.74. SMA50 at $11.76 vs. SMA200 at $12.74.

4. Apollo Group Inc. (APOL). Provides educational programs and services at the undergraduate, master’s, and doctoral levels. Price-to-Earnings-Growth ratio at 0.87. SMA50 at $22.92 vs. SMA200 at $31.46.

5. Atmel Corporation (ATML). Designs, develops, manufactures, and markets a range of semiconductor integrated circuit (IC) products. Price-to-Earnings-Growth ratio at 0.55. SMA50 at $5.01 vs. SMA200 at $6.95.

6. Baidu, Inc. (BIDU). Provides Internet search services. Price-to-Earnings-Growth ratio at 0.47. SMA50 at $105.99 vs. SMA200 at $120.94.

7. Brooks Automation Inc. (BRKS). Provides automation, vacuum, and instrumentation solutions primarily to the semiconductor manufacturing industry worldwide. Price-to-Earnings-Growth ratio at 0.21. SMA50 at $7.46 vs. SMA200 at $9.33.

8. magicJack VocalTec Ltd. (CALL). Price-to-Earnings-Growth ratio at 0.8. SMA50 at $20.49 vs. SMA200 at $21.18.

9. CEVA Inc. (CEVA). CEVA, Inc. and its subsidiaries engage in designing and licensing silicon intellectual property (SIP) for the handsets, portable multimedia, and consumer electronics markets. Price-to-Earnings-Growth ratio at 0.61. SMA50 at $14.59 vs. SMA200 at $17.71.

10. Crocs, Inc. (CROX). Crocs, Inc. and its subsidiaries engage in the design, development, manufacture, marketing, and distribution of footwear, apparel, and accessories for men, women, and children. Price-to-Earnings-Growth ratio at 0.86. SMA50 at $14.41 vs. SMA200 at $16.97.

11. Carrizo Oil & Gas Inc. (CRZO). Engages in the exploration, development, and production of oil and gas in the United States and United Kingdom. Price-to-Earnings-Growth ratio at 0.68. SMA50 at $23.89 vs. SMA200 at $25.31.

12. Coinstar, Inc. (CSTR). Provides automated retail solutions primarily in the United States, Canada, Puerto Rico, the United Kingdom, and Ireland. Price-to-Earnings-Growth ratio at 0.61. SMA50 at $45.57 vs. SMA200 at $55.97.

13. Constant Contact, Inc. (CTCT). Provides on-demand email marketing, social media marketing, event marketing, and online survey solutions primarily in the United States. Price-to-Earnings-Growth ratio at 0.67. SMA50 at $14.96 vs. SMA200 at $20.71.

14. Deckers Outdoor Corp. (DECK). Engages in the design, production, marketing, and brand management of footwear and accessories for outdoor activities and everyday casual lifestyle use. Price-to-Earnings-Growth ratio at 0.64. SMA50 at $35.04 vs. SMA200 at $50.15.

15. Dollar Tree, Inc. (DLTR). Operates discount variety stores in the United States and Canada. Price-to-Earnings-Growth ratio at 0.97. SMA50 at $42.27 vs. SMA200 at $47.79.

16. Ebix Inc. (EBIX). Provides on-demand software and e-commerce solutions to the insurance industry. Price-to-Earnings-Growth ratio at 0.46. SMA50 at $20.49 vs. SMA200 at $21.17.

17. EZCORP, Inc. (EZPW). Provides credit services to people who lack the cash or access to credit to meet short-term needs. Price-to-Earnings-Growth ratio at 0.51. SMA50 at $19.78 vs. SMA200 at $24.39.

18. Finisar Corp. (FNSR). Designs, develops, manufactures, and markets optical subsystems and components that are used to interconnect equipment in short-distance local area networks (LANs), storage area networks (SANs), longer distance metropolitan area networks (MANs), fiber-to-the-home networks, cable television networks, and wide area networks. Price-to-Earnings-Growth ratio at 0.9. SMA50 at $12.81 vs. SMA200 at $15.05.

19. Shanda Games Limited (GAME). Engages in the development and operation of online games in the People’s Republic of China. Price-to-Earnings-Growth ratio at 0.35. SMA50 at $3.49 vs. SMA200 at $4.05.

20. GT Advanced Technologies Inc. (GTAT). Provides polysilicon production technology and multicrystalline ingot growth systems, and related photovoltaic (PV) manufacturing services for the solar industry worldwide. Price-to-Earnings-Growth ratio at 0.33. SMA50 at $4.41 vs. SMA200 at $5.74.

21. Intel Corporation (INTC). Engages in the design, manufacture, and sale of integrated circuits for computing and communications industries worldwide. Price-to-Earnings-Growth ratio at 0.82. SMA50 at $21.21 vs. SMA200 at $24.76.

22. Iridium Communications Inc. (IRDM). Provides mobile voice and data communications services through satellites to businesses, the U. Price-to-Earnings-Growth ratio at 0.83. SMA50 at $6.84 vs. SMA200 at $8.04.

23. Logitech International SA (LOGI). Designs, manufactures, and markets hardware and software products that enable digital navigation, music and video entertainment, gaming, social networking, audio, and video communication over the Internet, video security, and home-entertainment control. Price-to-Earnings-Growth ratio at 0.97. SMA50 at $7.92 vs. SMA200 at $8.3.

24. Liquidity Services, Inc. (LQDT). Operates an online auction marketplace for wholesale, surplus, and salvage assets primarily in the U. Price-to-Earnings-Growth ratio at 0.97. SMA50 at $42.08 vs. SMA200 at $48.19.

25. Mattress Firm Holding Corp. (MFRM). Price-to-Earnings-Growth ratio at 0.62. SMA50 at $30.17 vs. SMA200 at $32.52.

26. NetEase.com, Inc. (NTES). Engages in the development of applications, services, and other technologies for the Internet in China. Price-to-Earnings-Growth ratio at 0.58. SMA50 at $51.08 vs. SMA200 at $54.71.

27. Questcor Pharmaceuticals, Inc. (QCOR). Provides prescription drugs for central nervous system and inflammatory disorders. Price-to-Earnings-Growth ratio at 0.29. SMA50 at $23.85 vs. SMA200 at $37.39.

28. Spirit Airlines, Inc. (SAVE). Provides passenger airline service primarily to leisure travelers and travelers visiting friends and relatives. Price-to-Earnings-Growth ratio at 0.56. SMA50 at $17.16 vs. SMA200 at $19.55.

29. Silicon Motion Technology Corp. (SIMO). Operates as a fabless semiconductor company. Price-to-Earnings-Growth ratio at 0.56. SMA50 at $13.91 vs. SMA200 at $15.55.

30. Titan Machinery, Inc. (TITN). Operates a network of full service agricultural and construction equipment stores in the United States. Price-to-Earnings-Growth ratio at 0.58. SMA50 at $21.54 vs. SMA200 at $26.68.

31. Tower Group Inc. (TWGP). Provides a range of commercial, personal, and specialty property and casualty insurance products and services to businesses in various industries and to individuals in the United States. Price-to-Earnings-Growth ratio at 0.7. SMA50 at $18.46 vs. SMA200 at $19.86.

32. Ubiquiti Networks, Inc. (UBNT). Price-to-Earnings-Growth ratio at 0.52. SMA50 at $11.86 vs. SMA200 at $17.75.

33. Volterra Semiconductor Corporation (VLTR). Engages in the design, development, and marketing of analog and mixed-signal power management semiconductors for the computing, storage, networking, and consumer markets. Price-to-Earnings-Growth ratio at 0.94. SMA50 at $18.82 vs. SMA200 at $25.53.

34. Vertex Pharmaceuticals Incorporated (VRTX). Engages in the discovery, development, and commercialization of small molecule drugs for the treatment of serious diseases worldwide. Price-to-Earnings-Growth ratio at 0.92. SMA50 at $49.1 vs. SMA200 at $49.7.

35. Zumiez, Inc. (ZUMZ). Zumiez Inc., founded in 1978, is a mall-based specialty retailer providing sports-related apparel, footwear, equipment, and accessories. Price-to-Earnings-Growth ratio at 0.89. SMA50 at $23.73 vs. SMA200 at $32. (To view Contextuall’s current predictions for the Nasdaq index, click here).

(To view Contextuall’s current predictions for the Nasdaq index, click here).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

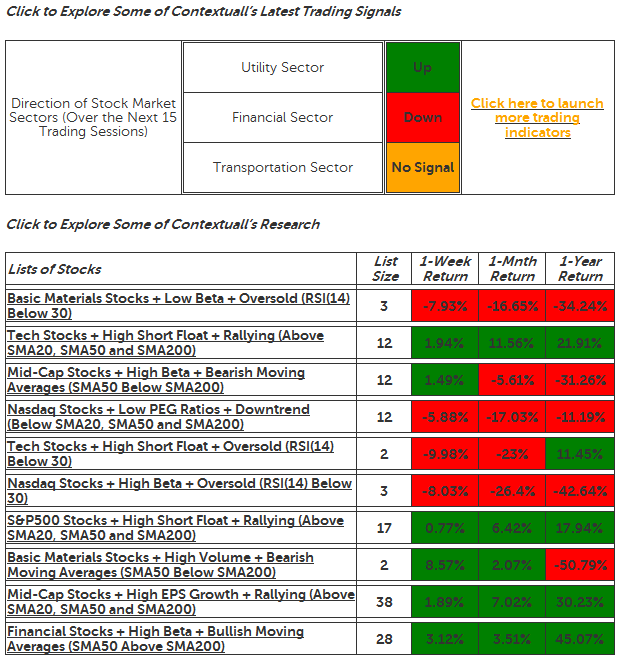

35 Nasdaq Stocks With Low Valuations And Bearish Moving Averages

Published 12/06/2012, 02:38 AM

Updated 07/09/2023, 06:31 AM

35 Nasdaq Stocks With Low Valuations And Bearish Moving Averages

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.