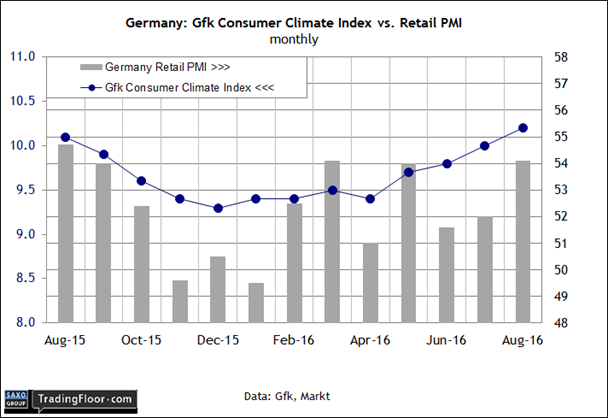

- German consumer sentiment to remain stable in today’s GfK release

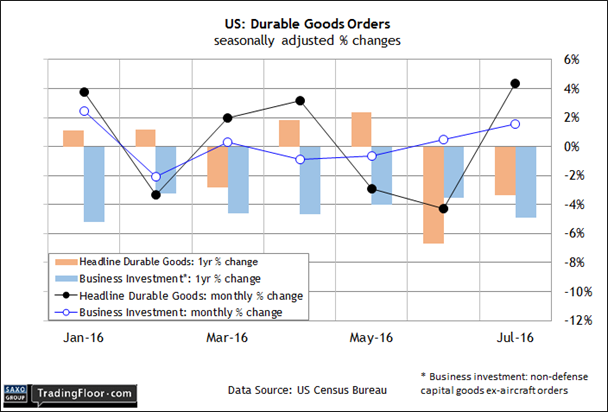

- Economists say US durable goods orders will decline in August update

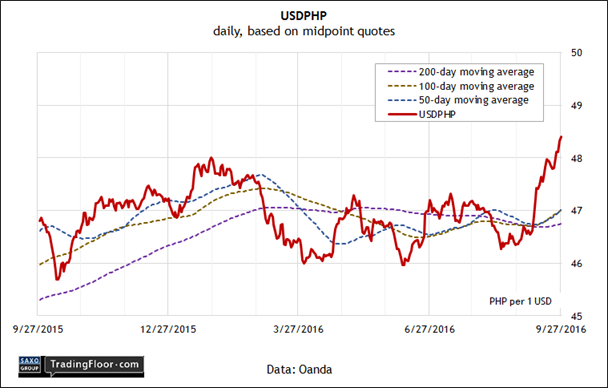

- The Philippine peso has had a rough month against the US dollar

Sentiment in Germany’s consumer sector is in focus today with Gfk’s monthly update. Later, the US government releases durable goods orders for August. Meantime, keep an eye on the Philippine peso, which has tumbled against the US dollar this month in the wake of unsettling comments from the country's president.

Germany: Gfk Consumer Climate Index (0600 GMT): Business sentiment rebounded sharply in September after stumbling in the summer, according to the Ifo Business Climate Index. “Companies are clearly more optimistic about the months ahead,” the president of the Ifo Institute said on Monday. “The German economy is expecting a golden autumn.”

Will consumer sentiment also deliver an upbeat outlook for the remaining months of 2016?

Actually, that’s been the implied forecast in recent history via Gfk’s Consumer Climate Index. The benchmark has posted moderate increases in the past four monthly updates. Although today’s release (billed an estimate for October) is expected to remain unchanged at 10.2, holding steady will echo the previous report, which Gfk said in late-August was a sign that “German consumers’ appetite to buy remains unabated – despite the Brexit decision and terror threat.”

Meantime, recent sentiment data for Germany’s retail industry certainly paints a brighter profile for the near term. The August report for the Markit Germany Retail PMI revealed the strongest increase in retail sales since March.

“The positive PMI results, paired with healthy employment and wage growth, suggest that consumer spending should continue to expand, with the latest IHS Markit forecast predicting growth of 1.6% for 2016 as a whole,” a Markit economist said earlier this month.

US: Durable Goods Orders (1230 GMT): Manufacturing activity remains weak, according to last week’s flash estimate of the US Manufacturing PMI for September. Although the index remains above the no-change 50, the preliminary 51.4 estimate for this month is a reminder that the odds are still low that the sector will soon break out of its slow-growth mode.

“Softer new-order gains are the main concern in the latest PMI survey, and this could act as a drag on production growth into the final quarter,” a senior economist at IHS Markit advised.

The outlook isn't terribly different via regional Fed survey numbers for manufacturing in September: only two of the five benchmarks show a positive reading. The average for these benchmarks inched back into positive territory this month, but only marginally.

Today’s August update on new orders for durable goods, however, is expected to skew negative again after posting a solid gain in the previous month. Econoday.com’s consensus forecast projects a 1.9% monthly slide in orders, which translates into another negative year-over-year comparison.

If the forecast is correct, headline orders are headed for a third straight month of contraction in annual terms — the longest stretch of red ink for the year-over-year change in nearly a year.

USD/PHP: Is Philippines President Rodrigo Duterte’s uninhibited public commentary taking a toll on the country’s currency? No, according to his budget secretary. Rather, the peso’s sharp slide against the US dollar in recent weeks, which has pushed the currency to a seven-year low, is all about the Federal Reserve.

“Why is the dollar strengthening? Because of the impending increase in the interest rate by the Fed,” Benjamin Diokno insisted at a press conference earlier this week.

Perhaps, although an alternative explanation is that the president’s words are promoting uncertainty about the economic outlook for the Philippines, which has been among one of strongest performers in Asia in recent years.

“Unfortunately, Mr Duterte’s love of lynching and his propensity to slander the mothers of foreign dignitaries are making investors nervous,” The Economist recently observed.

Meantime, Standard & Poor's last week said it may downgrade the country's debt due to higher uncertainty.

“It’s political risk that’s impacting investor sentiment,” an economist at Capital Economics told The Wall Street Journal this week. Duterte “is just very unpredictable. The fear that he will suddenly change his mind ... is more heightened now.”

Whatever the source of the peso’s weakness, there’s no doubt that something has changed in September. USD/PHP has been relatively stable for much of the year until the peso began losing ground against the greenback a few weeks ago. USD/PHP has surged more than 4% this month through September 28, leaving the peso at its weakest exchange rate vs the US dollar since 2009.

If the Duterte factor is the main source for the currency’s slide, it’s reasonable to assume that a change in tone by the president could recover the peso's loss. Then again, some conspiracy theorists suggest that a weaker currency is Manila's game plan.

In any case, old habits are hard to break, even for duly elected presidents, which suggests that the peso may tumble further barring an attitude transplant at Malacañang Palace.

Disclosure: Originally published at Saxo Bank TradingFloor.com