The social media giant Facebook (FB) has made an impressive comeback following its stellar second quarter results. In fact, FB shares have nearly doubled over the past three months, suggesting that the worst might be over for the company that had been seeing weak mobile advertising revenues since its IPO.

After all, mobile advertising revenues now account for 41% of the total revenue in the second quarter, up from 30% in the first quarter. This increasing advertising trend is expected to continue, as mobile revenue would soon exceed revenues from desktop advertisements, as per management.

This fast-growing mobile advertising market is boosting investors’ confidence in the company’s growth outlook. Additionally, Facebook recently launched a number of products, such as Twitter-like hashtags (#), Facebook Home and Instagram’s video application to attract advertisers.

These offerings have definitely spurred FB’s customer base, leading to a 51% spike in the monthly mobile active users during the second quarter. The lined-up products such as the Reader and television-like spot offerings for advertisers (reportedly for $2.5 million a day) can continue to fuel further growth in the months ahead.

Moreover, Citigroup has a bullish outlook on the company’s growth and the resulting upgrade of the stock to ‘Buy’ has spread optimism across the whole tech sector.

Facebook currently has a Zacks Rank #2 (Buy), suggesting that it will continue to outperform in the remainder of the year. Given the bullish outlook and the impressive run in FB share prices, we have highlighted three ETFs with heavy exposure to this social networking giant, any of which could be great ways to play this booming trend in the space:

Global X Social Media Index ETF (SOCL)

This fund tracks the Solactive Social Media Index, holding 27 securities in the basket. Of these firms, FB takes the top spot, making up roughly 13.01% of assets. In terms of country exposure, U.S. firms take half of the portfolio, closely followed by China (28%) and Japan (13%).

The fund debuted a year and a half ago in the social media space and has amassed $66.7 million in its asset base. The ETF charges 0.65% in fees and expenses and sees light volumes on most days.

The ETF is up 49.1% year-to-date and increased 25.3% in the trailing three-month period. The fund currently has a Zacks ETF Rank of 3 or ‘Hold’ rating with ‘High’ risk outlook.

PowerShares Nasdaq Internet Portfolio (PNQI)

This fund provides broad exposure to the Internet industry by tracking the NASDAQ Internet Index. The ETF holds 81 stocks in its basket with FB at the top position, accounting for 8.76% of total assets.

In addition to information technology, the product also offers exposure to consumer discretionary firms (31%). The fund has accumulated AUM of $179.6 million while charges 60 bps in fees per year, though volume is light.

PNQI gained 16.3% in the past three months and 43.1% year-to-date. The fund currently has a Zacks ETF Rank of 3 or ‘Hold’ rating with a ‘High’ risk outlook.

Market Vectors Wide Moat ETF (MOAT)

This ETF follows the Morningstar Wide Moat Focus Index and provides equal-weighted exposure to 21 U.S. securities that have a unique sustainable competitive advantage in their respective industries. The fund has managed assets worth $372.2 million so far and charges 49 bps in expense ratio. The product trades in good volume of roughly 100,000 shares per day.

Here again, Facebook is the top firm with 8.41% allocation. From a sector perspective, information technology takes the largest share with 32.8%, closely followed by industrials (19.4%) and financials (14.1%).

In terms of performance, the ETF added 6.9% in the trailing three months and 20.3% so far this year.

Bottom Line

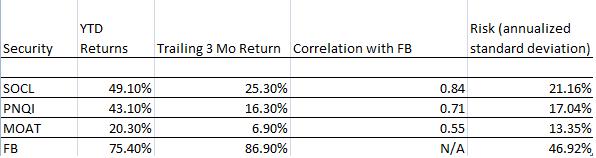

While it is true that Facebook has generated much more returns than the ETFs, the exposure to only FB requires above par risk appetite given its higher volatility (annualized standard deviation is 46.92%). In order to minimize this risk, investors could definitely look to the three ETFs that have a high correlation to that of FB’s share price.

From the above table, it can be concluded that SOCL, with correlation of 0.84, could be a good choice to play FB directly. It also represents a moderate risk choice for those seeking a pure play in the social media space to ride the most of the recent surge in Facebook, while also gaining exposure to a host of other firms in the sector.

The other two products – PNQI and MOAT – require lower risk tolerance levels and provide diversified exposure to other sectors. However, they have both clearly benefited from the jump in Facebook shares, and could continue to do well if this social giant remains a strong performer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 ETFs With The Most Facebook Exposure

Published 10/15/2013, 12:34 AM

Updated 07/09/2023, 06:31 AM

3 ETFs With The Most Facebook Exposure

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.