Committee members of the U.S. Federal Reserve forecast economic growth every year. Not surprisingly, investors place a great deal of faith in those projections. After all, Fed estimates may impact monetary policy.

Estimates for each of the last five years turned out to be exceedingly rosy. Time and again, the “recovery” turned out to be sluggish rather than robust. Granted, the Federal Reserve’s actions succeeded in suppressing interest rates, and ultra-low rates have contributed handsomely to corporate refinancing. Some might even argue that employment gains are directly attributable to Fed policy.

Still, Federal Reserve encouragement of borrowing and subsequent spending has resulted in the weakest post-recession period of growth since World War II. What’s more, blaming all of the economic contraction in the first quarter of 2014 on adverse weather conditions is irrational, if not disingenuous. The truth? Labor force participation is at levels reminiscent of late 70s stagflation, while advances in after-tax household income have been anemic.

In a world of peculiar logic, though, substandard economic progress suggests that the Fed will do everything in its powers to persevere with the suppression of interest rates. Contained rates have been pushing people into riskier assets for years. Therefore, the wonderful vibrations should carry on, right?

Maybe not.

Profits at S&P 500 companies in the quarter rose a paltry 2% from a year ago, in spite of forecasts for an 8.5% rise. Overall sales have also been soft. The fact that stocks keep right on climbing alarms those of us who believe stock prices cannot outshine actual sales and profits indefinitely. Either corporations will need to start selling a whole lot of products and services in the months ahead, or the smart money is going to take a breather in assets perceived to be safer.

Here are a number of warning signs that ETF investors may wish to follow:

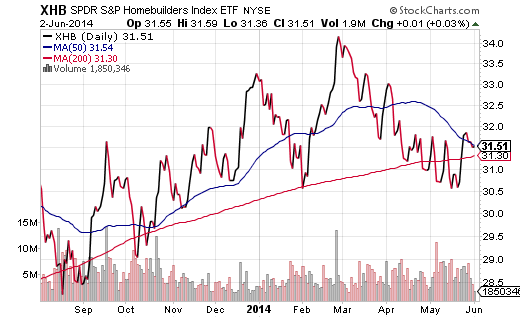

1. Falling Rates Have Not Been Helping Homebuilders. Throughout the current bull market, rate-sensitive home construction shares have been beneficiaries of declining mortgage costs. Until now. A “30-year fixed” has dropped 30 basis points in 2014, yet shares of SPDR S&P Homebuilders (NYSE:XHB) have given up roughly 5% so far. In fact, the average “30-year fixed” today (4.2%) is less expensive than the average from ten months ago (4.5%), but XHB has made precious little progress.

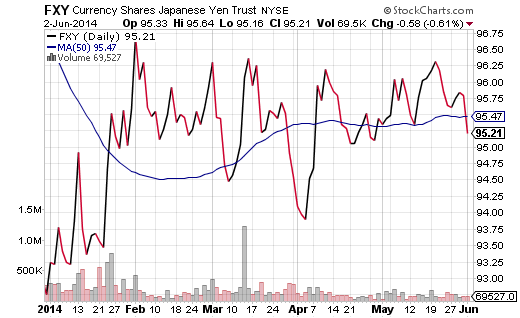

2. A Yen For Your Thoughts? The yen carry trade has been a significant feature of global financing for the better part of 15 years. Investors borrow (or short) the low-yielding yen to invest in higher yielding currencies or higher appreciating assets. Indeed, it is a popular method for institutional traders to raise capital. On the flip side, however, the carry trade can have an unusually harsh side effect if the yen begins to rise in value. Institutions and hedge funds may quickly dump higher-yielding currencies and riskier assets to avoid paying back loans in the more expensive yen. If RYDEX CurrencyShares Yen Trust (ARCA:FXY) picks up more momentum in the months ahead, it is difficult to imagine the S&P 500 escaping unscathed.

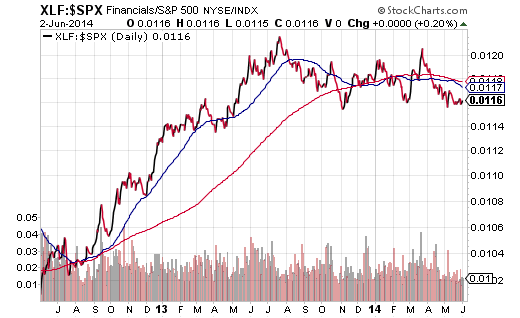

3. Weakness In Financial Stocks. The last time that financial stocks dramatically underperformed the broader S&P 500 occurred in the summer of 2011. Not only was the eurozone coming apart at the seams, not only were global financial institutions holding country debt that nobody wanted, but investors began doubting the viability of the financial sector as if it were 2008. U.S. banks may not be on the verge of collapse here in 2014. On the other hand, corporations in SPDR Select Sector Financials (ARCA:XLF) have been relative losers for 10 months. (See the price ratio below.) Simply put, U.S. commercial banks would rather leave their excess dollars at the Fed at an interest rate of 0.25% than lend to households at 4%-10%. What might this be telling us about the well-being of the overall economy or the management of investment risk or both?

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.