Tired of living in a chronic state of “information overload”? We feel you!

That’s why, each Friday, we cut through the clutter and noise to bring you a handful of charts to sum up the most important investment and economic news.

Since we’re rapidly approaching the end of the year, we’ve got a treat for you. Today and Monday, we’re looking back on the 10 most-defining charts of the year.

Just in case you missed something along the way, you’ll be caught up in a jiffy. Consider it the perfect antidote to Rip Van Winkle Syndrome.

Without further ado…

A Golden Disaster

Back in May, Bank of America’s (BAC) top global economist, Ethan Harris, said, “The big story this year is not the U.S. spending sequester, the China slowdown, or the ongoing European recession. The big story is inflation, or more precisely, the lack thereof.”

His words only ring truer today.

Inflation is non-existent. Or as Fed President, James Bullard, told the CFA Society in St. Louis earlier this month, “Inflation continues to surprise to the downside.”

No inflation spells disaster for gold, which is precisely why Goldman Sachs (GS) called bullion a “slam dunk” sell in October.

Sure enough, while most commodities got socked in 2013, the yellow metal got hit the hardest, dropping nearly 30%.

To all the doom-and-gloomers out there who never sell gold, I’ve got one question, “How’s that inflation hedge working out for you?”

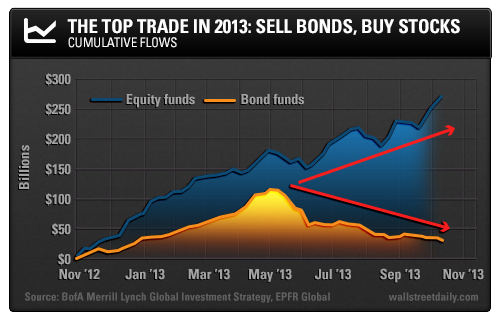

The Great Rotation

As I’m sure you’ll recall, a great debate erupted in the first half of the year over whether or not investors were “rotating” out of bonds and into stocks.

I weighed in twice on the topic, ultimately changing sides because, of course, the data warranted it.

But the debate is pretty much settled now. Investors rotated – in a major way.

U.S. equity funds witnessed their strongest inflows since 2000. Meanwhile, bond funds hemorrhaged assets – and Pimco’s Bill Gross, the largest bond fund manager, wept.

He’s still a billionaire, though. No sympathy necessary.

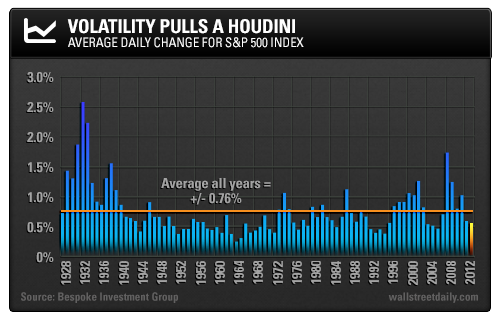

Rough Riders, Mount Up… or Not!

As it turns out, all those new stock buyers were in for a treat, too.

Instead of enduring neck-snapping volatility, they enjoyed a smooth ride.

The average daily change for the S&P 500 Index checked in at a measly 0.55% this year.

To put that into perspective, during the throes of the financial crisis, single-day swings of roughly 2% were the norm.

“This has been the least-volatile year we’ve seen since the bull market began,” explains Bespoke Investment Group. Here’s to 2014 bringing much of the same…

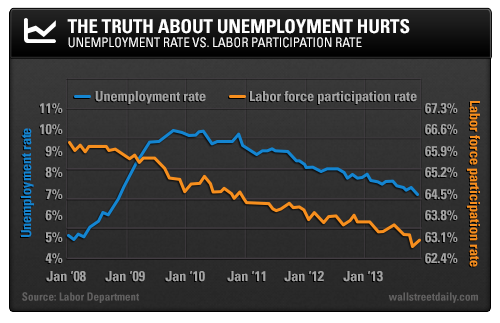

Out of Work and Out of Hope

Not everything is rosy in the market, of course. Especially in the labor market.

As The Wall Street Journal’s Victoria McGrane notes, “We are in the fifth year of economic recovery since the Great Recession, yet Americans are still fleeing the labor force.”

We’ve chronicled this troubling situation before. But it warrants mentioning again.

Although the official unemployment rate keeps dropping, it’s largely because the labor force participation rate (the percentage of Americans who are working or actively seeking work) keeps plummeting.

No doubt, we’ll be tracking this situation in 2014…

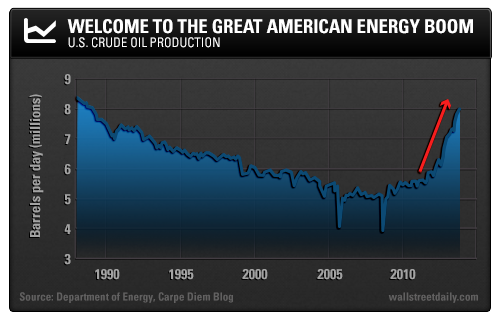

Peak Oil? Try Again!

In the equity market we witnessed the “Great Rotation.” Over in the energy markets, though, we witnessed the “Great Revolution.”

Thanks to technological advances, U.S. oil production enjoyed its largest annual increase in over 100 years.

Here’s a fun trivia fact for you…

There are only seven oilfields in the world that produce one million barrels per day (bpd) or more of oil. Three of them are now in the United States – the Permian Basin, the Eagle Ford and the Bakken.

And the response from everyone in the Peak Oil camp? Nothing but crickets.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

2013: 10 Shocking Charts

Published 12/20/2013, 10:50 AM

Updated 05/14/2017, 06:45 AM

2013: 10 Shocking Charts

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.