Europe - Well TMM read that one wrong and regret our move against our big trend thoughts in trying to finesse the thinking that the market had got a little ahead of itself on its path back to a new normal from one of abject doom. Nevertheless, for those with ammo, adding to existing Euribor longs (or if lucky enough not to already have them, adding one) doesn't seem like a terrible idea. Either way, it appears that together with the market, we a can add someone else to the "getting a bit cocky" box. Dr. Aghi's performance was verging on the valedictory and though we detested the blinkered old bureaucracy that was the Trichet/Duisenberg ECB, the cult of personality appears to be infecting Mario. First symptom? Casting opinion on matters that aren't his to cast opinion on. Don't go all Greenspan on us now Dottore!

TMM like to think that we have seen a 3 stage capitulation on short risk positions over the last couple of weeks. First came the improving Chinese data (though many are again questioning its validity), then came the ironing out of the cliff to a hump and finally Draghi announces Europe cured (well not quite, but that appears to be the market response). With such a huge collective sigh of relief and resurgence of media coverage of upside even TMM (with their view of recovery) are wondering if in the short term things are a little ahead of themselves to the point of having bought puts in SPX on Friday looking for a turn lower in direction and higher in VIX. Much like our languishing USD/JPY puts, this is a shorter term hedge against our longer term trend expectations.

But on to more pressing things - TMM's third Non-Prediction of 2013:

3) EM equities will NOT be able to resist the improving domestic growth and inflation mix as well as the lift in the global manufacturing cycle and should handily outperform their DM counterparts.

Continuing the theme of the past few months, TMM reckon EM Equities have a lot further to go, based upon a combination of:

1. The turn in the global manufacturing cycle driven by a combination of the US consumer and pent-up CapEx-related demand from corporates.

2. Monetary and fiscal stimulus in China.

3. Reduced drag from Europe after the recent stabilisation of the PMIs (last month's dire IP numbers notwithstanding).

4. Food inflation risks overstated, particularly given upcoming reweighting in the Chinese CPI basket, meaning that the easing cycle of the past 12-18months should still be supportive of both liquidity conditions & growth.

5. A return of capital flows into EM (and Asia in particular) as real money underweights enacted in early/mid-2011 on the back of EMU-break up fears are reversed.

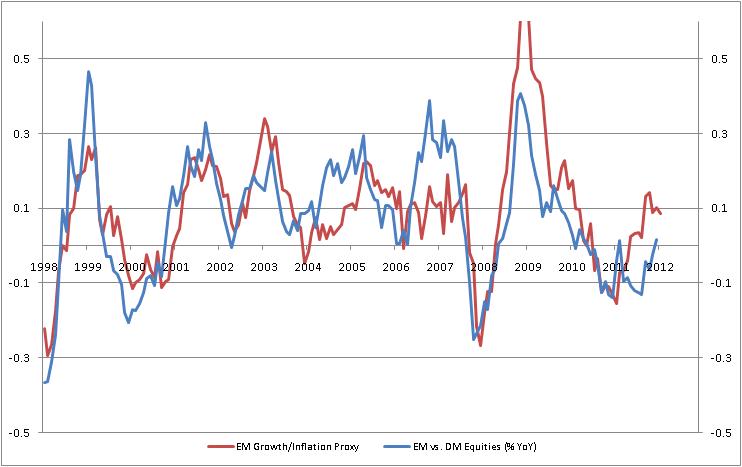

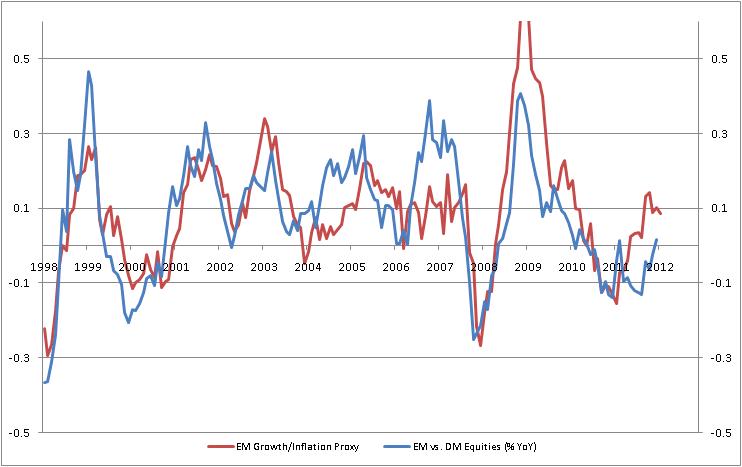

The below chart shows the YoY change in MSCI EM vs. DM vs. a proxy for the growth & inflation mix based upon a bunch of PMIs, export figures, money supply & inflation prints and is showing a reasonable divergence right now. TMM would argue that the divergence in 2006-8 can be explained by the BRIC-lovefest which subsequently unwound, and that of 2009 by non-linearities uncaptured by the model. The current gap looks to be around 15-17%, and as discussed above, likely a function of the very strong risk aversion of summer/autumn 2011.

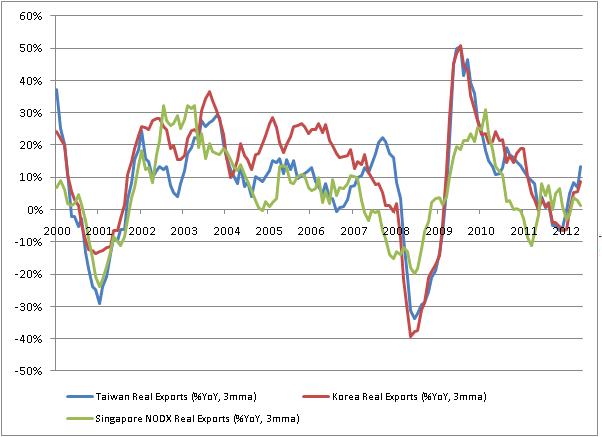

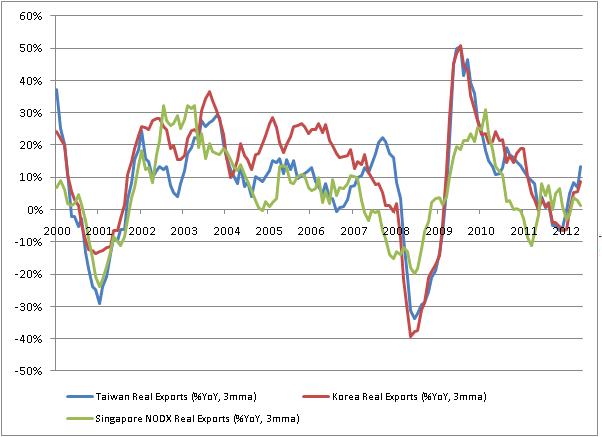

Real exports from the big-3 in Asia (ex-China, ex-Japan) have picked up momentum over the past few months, driven presumably by robust US consumer demand. Post the fiscal cliff agreement, the CapEx rebound TMM have been talking about for a while should provide further gains here as pent up demand is released (though, admittedly, the debt ceiling deadline next month may postpone some of this).

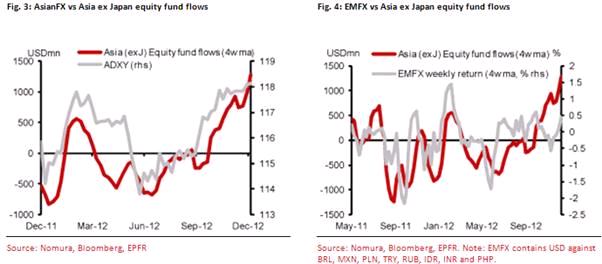

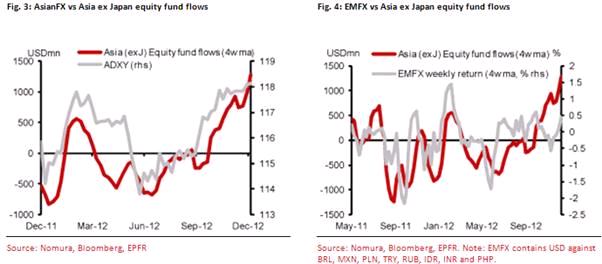

Since late summer, fund flows (see below chart, courtesy of TMM's mates at Nomura) have picked up significantly, powered by the turn in exports, a resumption of appreciation pressures on the CNY - partially due to the PBoC calming market fears of capital outflows & partly due to China's soft landing. Given the real money underweight, above valuation & signs of fundamental strength these should continue to pick up pace.

Given the policy stimulus in China, TMM believe the best place to be is Asia, and within that region, their favourite pick is Korea (but also have the usual MSCI EM vs. DM). Obviously, the recent move in Samsung vs. Apple has been large, but more broadly, Korea seems best place in Asia to pick up inflows (given the currency has become dominated by sticky bond flow it is now far less volatile and thus less risky for equity investors). Moreover, its strong manufacturing & electronics bias make it the perfect candidate for the turn in the manufacturing/services cycle and the coming CapEx ramp up in the US. The one fly in the ointment is, of course, KRW/JPY which has had quite a large move. But as per TMM's first Non-Prediction, we reckon that Japan has permanently lost market share, so 15% on the exchange rate is certainly not going to help them (or hurt Korea) too much - at least not in the coming year.

Trading at just 9.6x 2013's earnings, it is amongst the cheapest of the liquid EM markets (H-Shares only beating it at 9x). In terms of price targets, TMM think the trade has about 15%-20% in it, which corresponds to the overall EM/DM mismatch in the first model chart & the underperformance vs. the S&P 500 since summer 2011:

We will be following up soon with a couple more predictions but for now we really have to add Non-Prediction No.4:

4) The UK media will NOT recognise the difference between Captain Oates' famous walk to oblivion in the South Pole and the minor inconvenience of having to commute to work in a light dusting of snow.

TMM like to think that we have seen a 3 stage capitulation on short risk positions over the last couple of weeks. First came the improving Chinese data (though many are again questioning its validity), then came the ironing out of the cliff to a hump and finally Draghi announces Europe cured (well not quite, but that appears to be the market response). With such a huge collective sigh of relief and resurgence of media coverage of upside even TMM (with their view of recovery) are wondering if in the short term things are a little ahead of themselves to the point of having bought puts in SPX on Friday looking for a turn lower in direction and higher in VIX. Much like our languishing USD/JPY puts, this is a shorter term hedge against our longer term trend expectations.

But on to more pressing things - TMM's third Non-Prediction of 2013:

3) EM equities will NOT be able to resist the improving domestic growth and inflation mix as well as the lift in the global manufacturing cycle and should handily outperform their DM counterparts.

Continuing the theme of the past few months, TMM reckon EM Equities have a lot further to go, based upon a combination of:

1. The turn in the global manufacturing cycle driven by a combination of the US consumer and pent-up CapEx-related demand from corporates.

2. Monetary and fiscal stimulus in China.

3. Reduced drag from Europe after the recent stabilisation of the PMIs (last month's dire IP numbers notwithstanding).

4. Food inflation risks overstated, particularly given upcoming reweighting in the Chinese CPI basket, meaning that the easing cycle of the past 12-18months should still be supportive of both liquidity conditions & growth.

5. A return of capital flows into EM (and Asia in particular) as real money underweights enacted in early/mid-2011 on the back of EMU-break up fears are reversed.

The below chart shows the YoY change in MSCI EM vs. DM vs. a proxy for the growth & inflation mix based upon a bunch of PMIs, export figures, money supply & inflation prints and is showing a reasonable divergence right now. TMM would argue that the divergence in 2006-8 can be explained by the BRIC-lovefest which subsequently unwound, and that of 2009 by non-linearities uncaptured by the model. The current gap looks to be around 15-17%, and as discussed above, likely a function of the very strong risk aversion of summer/autumn 2011.

Real exports from the big-3 in Asia (ex-China, ex-Japan) have picked up momentum over the past few months, driven presumably by robust US consumer demand. Post the fiscal cliff agreement, the CapEx rebound TMM have been talking about for a while should provide further gains here as pent up demand is released (though, admittedly, the debt ceiling deadline next month may postpone some of this).

Since late summer, fund flows (see below chart, courtesy of TMM's mates at Nomura) have picked up significantly, powered by the turn in exports, a resumption of appreciation pressures on the CNY - partially due to the PBoC calming market fears of capital outflows & partly due to China's soft landing. Given the real money underweight, above valuation & signs of fundamental strength these should continue to pick up pace.

Given the policy stimulus in China, TMM believe the best place to be is Asia, and within that region, their favourite pick is Korea (but also have the usual MSCI EM vs. DM). Obviously, the recent move in Samsung vs. Apple has been large, but more broadly, Korea seems best place in Asia to pick up inflows (given the currency has become dominated by sticky bond flow it is now far less volatile and thus less risky for equity investors). Moreover, its strong manufacturing & electronics bias make it the perfect candidate for the turn in the manufacturing/services cycle and the coming CapEx ramp up in the US. The one fly in the ointment is, of course, KRW/JPY which has had quite a large move. But as per TMM's first Non-Prediction, we reckon that Japan has permanently lost market share, so 15% on the exchange rate is certainly not going to help them (or hurt Korea) too much - at least not in the coming year.

Trading at just 9.6x 2013's earnings, it is amongst the cheapest of the liquid EM markets (H-Shares only beating it at 9x). In terms of price targets, TMM think the trade has about 15%-20% in it, which corresponds to the overall EM/DM mismatch in the first model chart & the underperformance vs. the S&P 500 since summer 2011:

We will be following up soon with a couple more predictions but for now we really have to add Non-Prediction No.4:

4) The UK media will NOT recognise the difference between Captain Oates' famous walk to oblivion in the South Pole and the minor inconvenience of having to commute to work in a light dusting of snow.