I used to half joke with some of my investing friends that the best time to buy stocks is during or right after a crash. Think 1987, 2000-2002, 2008-09, and now perhaps Gold Miners?? Before we get too far ahead of ourselves, lets examine evidence of a “Crash” - I like to use crowd behavioral, empirical, and technical evidence in combination:

1. In a recent money managers' poll, virtually no one was bullish on Gold or Gold stocks, and over 80% of those polled were bullish on the S&P 500 and US stocks.

2. The percentage of Dumb Money traders (non-reportable traders) in the futures markets with short positions on Gold is at all time highs, they tend to be very long at the highs and very short at the lows.

3. The insider buying ratio of Gold Mining stocks to sellers is running over 10 to 1, the highest since October 2008 when Gold bottomed out at $685 per ounce from $1030 highs. Quoting Ted Dixon, CEO of Ink Research: “...such a high level of buying interest among officers and directors within their own businesses in the resource sector has correctly foreshadowed a recovery in share prices in the past: That high point of nearly five years ago came about six weeks before the Venture market bottomed on Dec. 5, 2008…While the excitement that surrounded mining stocks as recently as two years ago has waned, experienced value investors recognize that such periods of investor neglect often give rise to the best deals” Source: Theglobeandmail.com

4. The ratio of the HUI Gold Bugs Index to the S&P 500 is at multi year lows and in near crash mode on the charts. The RSI Index (Relative strength) on the weekly charts is at 10 year lows at -13.71, which is off the charts low.

5. Most trading message boards I view at Stocktwits and other sites are universally bearish on Gold and Gold stocks.

6. Gold is in a wave B or Wave 5 down, re-testing the 1322 lows which we have discussed here for weeks as very likely if 1470 was not taken out on the upside…this is a normal sentiment pattern and re-test.

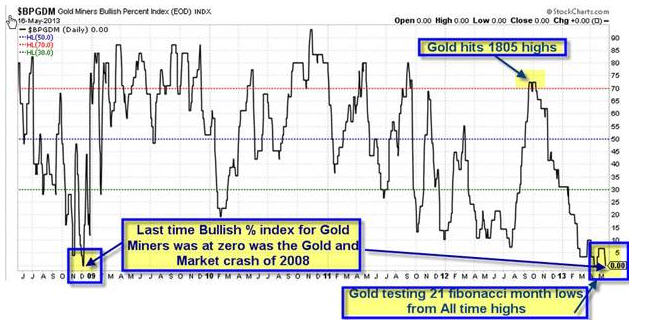

7. Gold has been in a 21 Fibonacci month correction pattern off a 34 Fibonacci month rally from 686-1923. In August of 2011 I penned articles from 1805 right up to 1900 warning of a massive wave 3 top forming. The, everyone was bullish, now it’s the complete opposite.

8. Currency debasement continues around the world with negative real interest rates. This is bullish for Gold once this correction has run its course.

9. Hulbert Digest Gold Sentiment index is at an all time low (gold newsletters at -35 sentiment readings!!)

10. Gold-Silver put to call ratios are at all time highs

I could go on and on with headlines and such, but you get the idea. This is the same type of sentiment I wrote about on the stock market on Feb 25th 2009, here... and nobody on the planet was bullish.

Below is a chart showing the Bullish % index for Gold Miners. As you can see, the last time we were at 0% was late 2008 when Gold had bottomed out and insiders were also buying like crazy. Much like now:

The Gold ETF (GLD) chart also shows a likely re-test or slightly lower of the 1322 futures lows of April, when Insider buying hit 10 year record levels:

Obviously Gold could end up going a lot lower than we think, and the Gold Mining stocks could sink further yet. But for those with a 3-6 month horizon, we expect the 21-24 month Gold correction to complete by no later than October 2013. During the next several months the opportunities to buy some miners on the cheap will potentially make some investors a lot of money in the coming few years.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

10 Reasons It's Time To Consider Gold Miners

Published 05/21/2013, 01:37 AM

Updated 07/09/2023, 06:31 AM

10 Reasons It's Time To Consider Gold Miners

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.