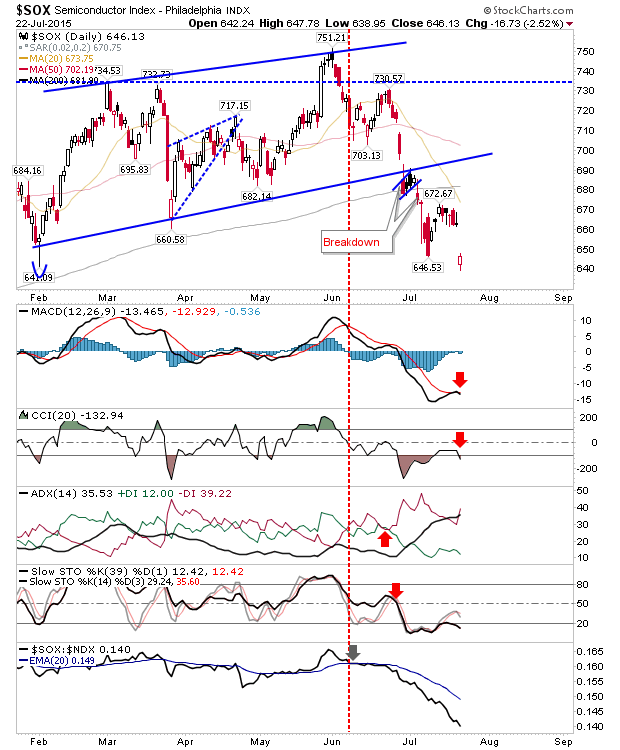

There was some spill over from yesterday's after hours disappointment in Apple (NASDAQ:AAPL), but after a weak open, bulls were able to mount some challenge by close of business. However, today's close was still below that of yesterday and registered as distribution. Hardest hit was the Philadelphia Semiconductor Index. It experienced a gap down, shedding 2.5%, as it continues to trend lower. Given the extent of the decline it's hard to see how the Nasdaq and Nasdaq 100 can continue to trade near yearly highs.

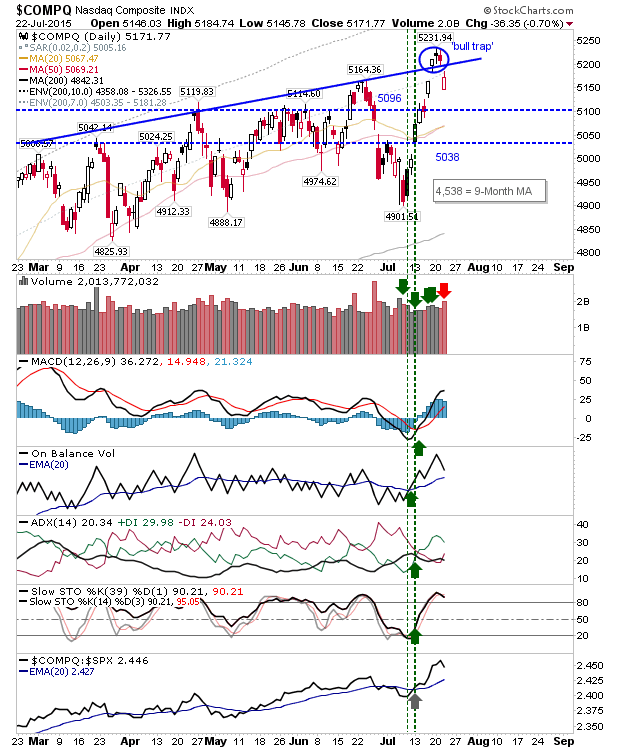

The late recovery in the NASDAQ wasn't enough to stop confirmation of the 'bull trap'. The next challenge will be closing the breakdown gap. Technicals are all bullish, and only the performance of the index relative to the S&P 500 is indicating potential weakness.

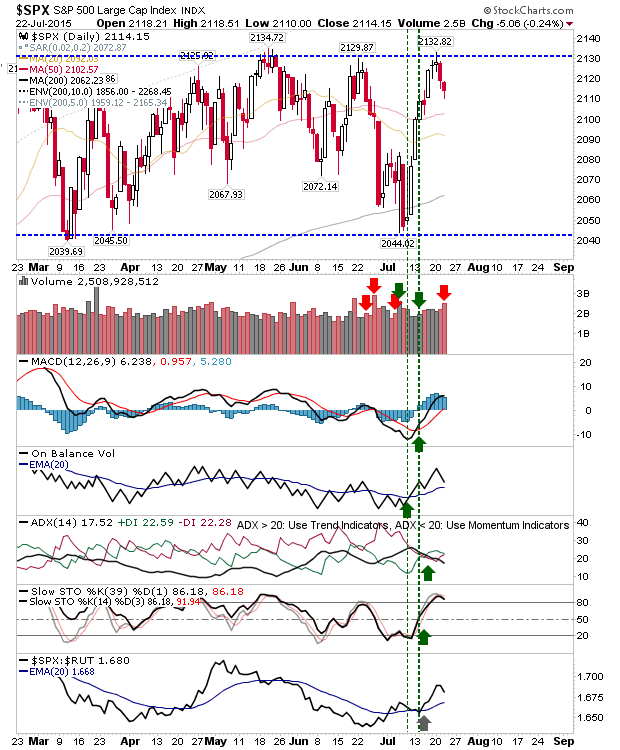

The S&P suffered a further loss as the rejection of 2,132 continues. However, the first support level to look for Thursday or Friday is the 50-day MA (assuming loses continue).

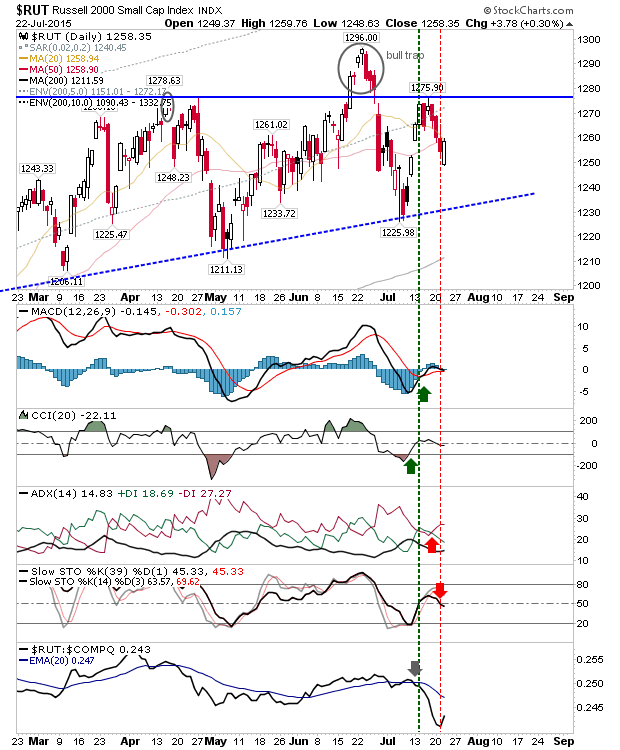

Finally, the Russell 2000 was able to recover some ground. It's range bound, so future price action is likely to remain scrappy. A challenge of the 'Bull Trap' would offer some direction, but bears are probably feeling a little more confident.

Sellers will probably look to take things into a third day. Keep an eye on the Russell 2000. If this can push towards 1,278 it would offer buyers something to work with for other indices. In the meantime, all indices are back inside trading ranges, and are net neutral. The broader direction has still to be determined, only the prior trend suggests markets will end this by pushing higher.